WITH the world shifting towards electrification, Malaysia has started to get the ball rolling. Malaysia has strong input industry with many local companies play a part in the global electric vehicle (EV) supply chain such as semiconductors, battery assembly and copper wire manufacturing.

With all of the supportive policy measures in line, we believe that the Malaysia’s EV market will experience exponential growth.

EV entering emerging markets

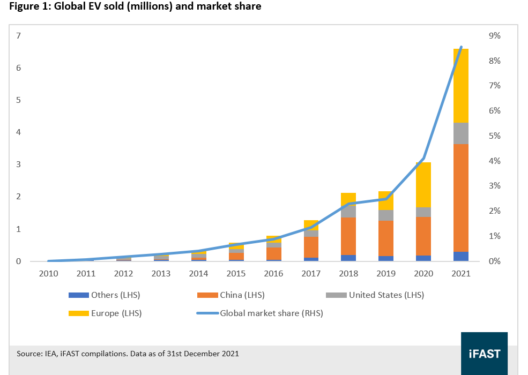

Although the EV industry has experienced a tremendous rise in terms of sales volume and market share in the past few years (see Figure 1), there is still a lot of market share left to capture.

Especially in the emerging markets, where EV penetration rate is lower due to fewer available models and expensive. In addition, the lack of widely accessible charging infrastructure and weaker regulatory push also contribute to slower market uptake in emerging markets.

Therefore, we believe that the decreasing EV prices due to economies of scale and increasing driving ranges in the future years as well as the installation of more charging stations will boost the EV industry in the emerging markets. Overall, we are positive on the global EV market and the valuations are attractive.

Despite a slow start and still lagging behind its Asian peers, Malaysia is on the right track in its auto industry transformation. Malaysia’s auto industry is a significant component of the country’s manufacturing sector. The country is the third-largest automotive market in ASEAN with its automotive industry contributing 4% to gross domestic product (GDP).

The Malaysian EV industry is well-placed to develop due to strong input industry that are needed for EV production such as semiconductors and copper wire manufacturing.

Below are the top seven EV related stocks in Malaysia:1. Greatech Technology Bhd (0208).

- Greatech Technology Bhd is one of the leading providers of production equipment for lithium-ion battery modules and packs. They specialised in key technologies in battery production such as laser, adhesive dispensing and robotic handling, and tests.

Their key technologies can be segregated into EV battery module assembly line and EV battery pack assembly line. The management is expecting to receive order book worth of RM500 mil for FY2022 with a total of RM300 mil or 60% of its order book is filled by EV industry.

- D&O Green Technologies Bhd develops semiconductor application technology, installation, electronic components, electrical equipment for lighting, electronic display screen, and lighting fittings for EVs. We opine that D&O is in a good position to capture the bigger demand from the EV industry as it manufactures smart LED’s for this sector.

While most of D&O’s operation is running at full capacity at the moment, the company is also targeting to grow its capacity by 20% to 30% annually over the next five years in order to cater to the overwhelming LED demand as more new car models are being rolled out, especially in the EV segment.

- Amid the rapidly expanding EV market, Pestech International Bhd has taken further steps to promote green energy initiatives by deploying EV charging infrastructures in various locations. The EV charger is designed to be installed (both indoor and outdoor) at private houses, communal blocks, companies, reserved parking bays and other places where user authentication is not a requirement.

- Malaysian Pacific Industries Bhd (MPI) has benefitted from the EV growth with a pick-up in sensor shipment volume, driven by recovery in the global automotive and EV market in FY2021. With the growing adoption of silicon carbide (SiC) in EVs due to higher efficiency and prolonged driving ranges as well as lower cost for such vehicles, MPI is set to be a beneficiary given its unique position as the exclusive back-end service provider for Cree Inc (the global leader in silicon carbide technology).

- Similar to MPI, Pentamaster Corp Bhd will benefit from the rising penetration of SiC in power management applications for EVs by capturing opportunities in the EV battery market. The automated test equipment (ATE) provider expects higher demand for its assembly and test equipment due to rising orders from global automotive component companies in Europe, US and China.

As of 2021, the automotive industry continued dominated Pentamaster’s ATE segment, contributing 44.6% of its revenue. Moving forward, the company has set its eyes on its next global expansion towards Germany being a major market in the automotive industry.

- Genetec Technology Bhd serves the Automotive-EV and internal combustion engine, hard disk drive (HDD), electronics, pharmaceutical, semiconductor, and home appliance industries. Citing the global EV outlook, Genetec is expected to benefit from the growing EV space as countries worldwide continue to ramp up production of such vehicles.

In terms of the business segment, the order book from EV and battery space made up 93% of its RM205.6 mil total secured orders since February 2021. It is noteworthy to highlight that the order book itself represented over two times its revenue for the financial year ended March 31, 2021.

In order to fulfil the greater orders from its major customers, Genetec has also expanded its EV battery production capacity as well as to commission new factories in Europe and North America in 2H 2021.

- KESM Industrials Bhd is the world’s largest independent burn-in and test service company. The shift towards EVs will create higher electronic content demand which will benefit the chip supplier company. Test and burn in are essential for cars as well as protecting digital information and growing needs for data analytics in connecting cars. – Sept 23, 2022