THE Royal Malaysian Customs Department (RMCD) has provided some basic guidance on the 2% rise, from 6% to 8%, in service tax from March 1, 2024.

On Feb 15, it issued separate guidance for non-resident providers of digital services.

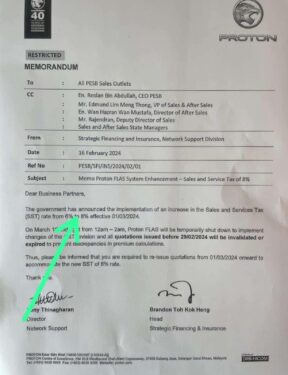

Proton has already announced an increase in its services. A letter issued on Feb 16 from the Strategic Financing and Insurance, Network Support Division addressed to all its PESB Sales Outlets stated that the service centres will be temporarily shut down to implement changes to the service tax revision and all quotations issued before Feb 29, 2024, will be invalidated or expired to prevent discrepancies in premium calculations.

Netizens are reacting to the Proton directive for its sales and services centres, saying the government is now imposing all sorts of taxes on the people.

Nevertheless, on March 1, there will also be an expansion of the scope of the service tax.

The taxable services that remain at 6% include food and beverages, telecommunication services, parking, and logistics, with credit card and charge card fees remaining at RM25 per card per year.

All the other prescribed taxable services not mentioned above will be subject to 8% (eg accommodation, clubs, professionals—legal, accounting, engineering, IT, digital services, etc.)

In the comments section of the Facebook post, users are blaming Economy Minister Rafizi Ramli for failing to control soaring prices in the country. They are also saying he is a failure of the ‘Raja formula’.

Some are saying the ‘tambah nilai’ for services like toll gates will also increase and others are jokingly asking where the Pakatan Harapan supporters are who always defend the government at all costs. – Feb 18, 2024