THE Prime Minister’s announcement on Monday that the Government has agreed to a proposal to restructure the toll concessions of four concessionaires with expressways in the Klang Valley, including Gamuda Bhd and Lingkaran Trans Kota Holding Bhd, offers hope of clearer skies ahead for the broader highway sector.

This is a welcome development following a hard-hitting past few years which saw volatile traffic volumes due to mobility curbs amid the pandemic, sensitivity over toll rate hikes in a tough economic climate, and rising government compensation payments to concessionaires.

Continued toll increase deferrals in a single year is reported to cost the government RM2.25 bil in compensation while its narrowing fiscal headroom makes the abolition of tolls implausible, considering the high compensation sums payable.

Accordingly, Amanat Lebuhraya Rakyat Bhd (ALR) in offering to acquire highways partly owned by Gamuda has, in our view, signals stronger intent by the Government to seriously address the restructuring of toll rates across highways nationwide by end-2023 based on a parliamentary response by the Works Ministry.

If successful, this restructuring model could serve as a blueprint for further renegotiations of other expressway concessions.

ALR’s proposed solution to the impasse in the sector – via the acquisition of four expressways partly owned by Gamuda for RM5.48 bil – achieves different but complementary objectives:

- It seeks to reduce the burden on the public from a cost inflation perspective (with no further toll rate hikes until the concessions expire);

- Provides some respite against the Government’s ballooning annual compensation bill for non-revision of scheduled toll rates; and

- Takes into consideration interests of other stakeholders including lenders and shareholders.

On balance, the tenures of the four highway concessions are expected to be restructured and lengthened.

According to its official website, ALR was established under the Companies Act 2016 to function solely as a holding company of highway concessions while its shareholders are not profit motivated.

ALR’s role and responsibilities will entail a high degree of social accountability in keeping toll rates affordable in addition to settling its debts and returning the highway assets to the Government in the shortest possible timeframe.

Owing to its social impact and objectives, ALR’s offer, among other conditions, is contingent on the four concession companies and itself being tax-exempt entities.

ALR’s offer to buy up the equity stakes in the four highway concessionaires is valid up to end-April 2022, following which a definite agreement will be inked, expected by end-July 2022.

Necessary approvals of the buyout offer from shareholders, lenders and the authorities are still pending as is the due diligence on the cumulative RM5.48 bil valuation of assets to be acquired.

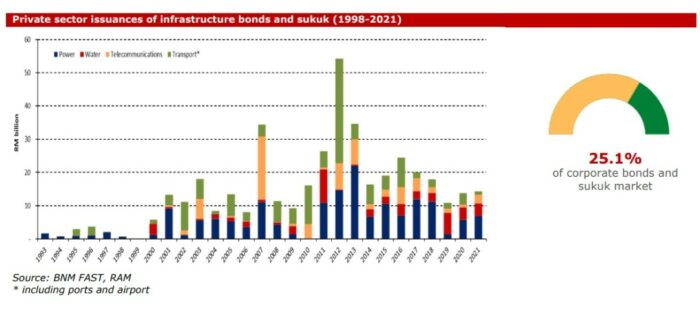

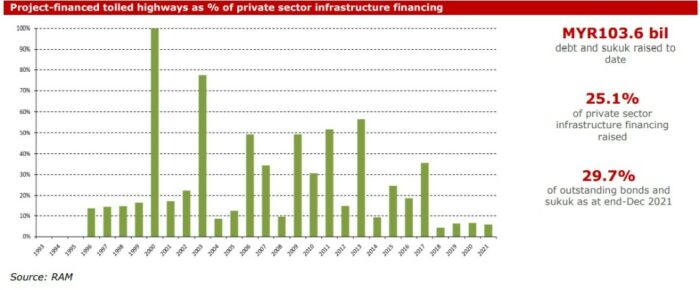

Given the significant role of infrastructure funding in the domestic capital market (having successfully funded up to RM103.6 bil in highway and highway-related transactions since the 1990s), it is important for any funding solution proposed by ALR to consider the preservation of investor confidence as key to the continued sustainability of financing/funding for this sector.

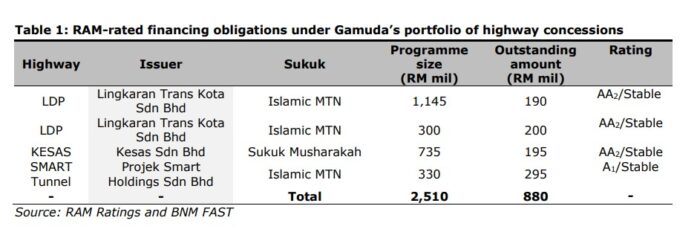

At this point, details of the financing arrangement and mechanism to be adopted by ALR in funding the proposed highways’ acquisitions nor the resolution of the sukuk raised by the respective concessionaires have yet to be made public.

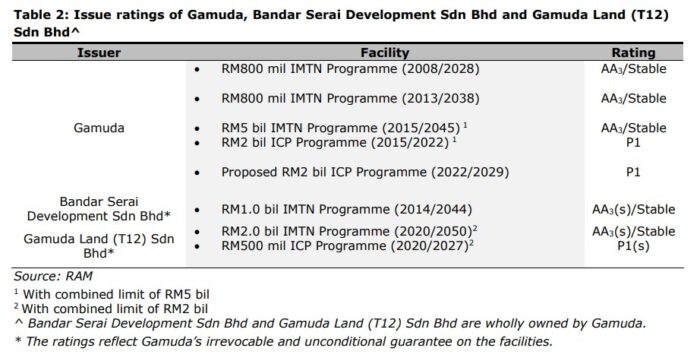

The proposed sale of the highway concessions does not have an immediate rating impact on Gamuda’s (the group) and its subsidiaries’ debt programmes. The disposals will reduce the group’s business diversity as the concessions segment is a significant and relatively stable earnings contributor.

The segment accounted for 27% of pre-tax earnings in its FY July 2021 despite the ravages of the pandemic.

Nonetheless, the RM7.4 bil of construction contracts in Australia and Singapore recently awarded to Gamuda will, in our view, lessen the impact, boosting long-term earnings visibility and representing important breakthroughs into these markets.

The highway disposals are expected to yield proceeds in excess of RM2 bil, thus strengthening Gamuda’s balance sheet to a net cash position.

As the proceeds could be channelled to new construction and property development projects and/or to reward shareholders via special dividends, the group’s longer-term financial impact will hinge on the utilisation of the sale proceeds.

In the interim, RAM will maintain surveillance of the ratings of the relevant highway concessionaires and Gamuda’s issue ratings.

We will reassess the ratings for credit impact when details of the proposed restructuring exercise become available. Meanwhile, we understand it is business as usual for the four highways until the implications of the buyout are addressed. – April 7, 2022

RAM Ratings is the largest credit rating agency in Malaysia and Southeast Asia (ASEAN).

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.