WITH the exception of Vietnam at 10% of the US trade deficit (goods), most ASEAN countries contribute a small fraction to the US trade deficit, Malaysia particularly at only 2%.

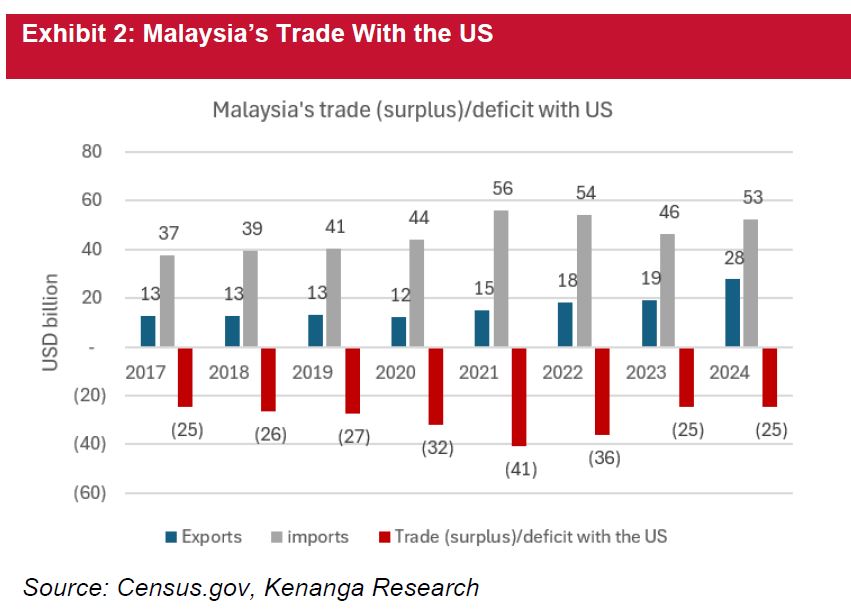

“The US ranks among Malaysia’s top trade partners. Imports of goods from the US have stepped up noticeably post Covid-19 years, which lowered our trade surplus position with the US,” said Kenanga Research (Kenanga) in the recent Market Strategy Report.

If Trump moves forward with reciprocal tariffs, risk to Malaysia’s growth may rise on supply chain disruptions and weaker global demand.

Malaysia has a sales and services taxes of 5% to 10% on taxable imports, in addition to excise duties, and import duties. Save for Singapore, ASEAN countries do not operate under bilateral free trade agreements with the US.

Malaysia has a sales and services taxes of 5% to 10% on taxable imports, in addition to excise duties, and import duties. Save for Singapore, ASEAN countries do not operate under bilateral free trade agreements with the US.

If reciprocal tariffs are levied at countries in this region, one scenario in which Malaysia could stack favourably is if reciprocal tariffs are placed matching prevailing import duty levels imposed by each country.

Under rules of World Trade Organisation, the concept of the Most Favored Nation (MFN) tariff rate applies to its members.

This rate, measured on customs/import duties, prescribes that once a favourable import tariff is made by one country for another country, that tariff must also apply to other member nations.

The MFN, measured on a trade-weighted average basis to better account for actual trade flow, is 3.3% for Malaysia. This is lower than ASEAN average of 5.3, excluding Singapore, per 2024 WTO report.

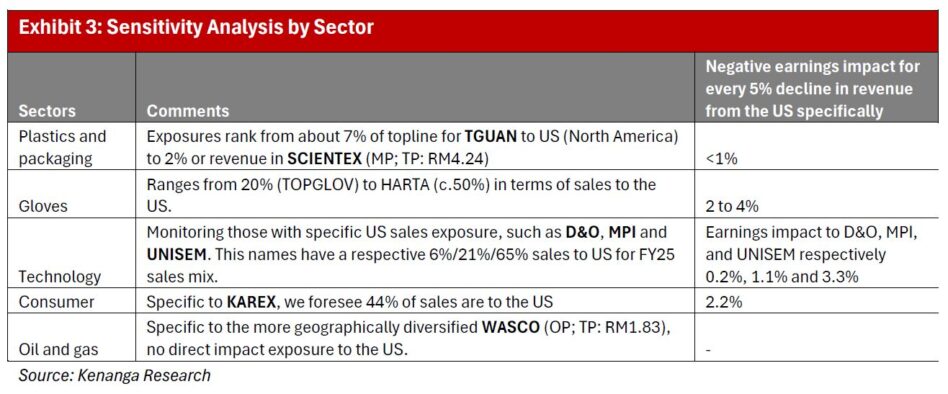

“Among names with US exposure under our coverage, US revenue mix ranges from 20% to more than 60%,” said Kenanga.

Assuming a 5% reduction in US revenue, earnings would be impacted by just 2% to 4%, and thus a large share price negative reaction would be an opportunity to accumulate.

“We see the 5% revenue reduction as a reasonable sensitivity assumption to apply judging from the effective tariff gap between our trade weighted MFN which is currently at 3.3% and that of the US at 2.2% for imports,” said Kenanga.

“If we used a simple-average of tariffs, where import duties on specific goods can vary widely, the Malaysia’s MFN stood at 5.6% versus 3.4% in the United States, that is a slightly bigger gap,” said Kenanga.

By sector, plastics and packaging companies appear most insulated.

“Specific to tech coverage, we monitor a few firms with direct US exposure including D&O, MPI, and UNISEM, ranked from least US revenue exposures to the largest,” said Kenanga.

Other more geographically exposed names include KAREX.

Gloves in theory could have most earnings impact for the same 5% US revenues being disrupted, but Kenanga recognises that there are other mitigating factors such as Chinese globemakers being impinged at the moment with higher tariffs of an additional 10% in addition to the 50% that was earlier imposed. —Feb 10, 2025

Main image: World Economic Forum