AMIDST the after tremors of the pandemic, it is timely to look into why some Sovereign Wealth Funds (SWFs) were able to cushion the impact on their local economies while phenomenally re-emerging with ever-stronger performance.

The SWFs are state-backed entities entrusted with managing the country’s temporary excess cash, originating from natural resource revenues, after commodities and energy boom or accumulation of foreign exchange reserves due to current account surpluses.

And although the keyword here is temporary, whether it is due to commodities boom or certain good exports or international investments flow, the key idea is to take advantage of it—maximise the impact for national intergenerational well-being per every cent.

However, as simple, powerful and fair as it sounds, the concept is yet to come to fruition for many countries, Malaysia included.

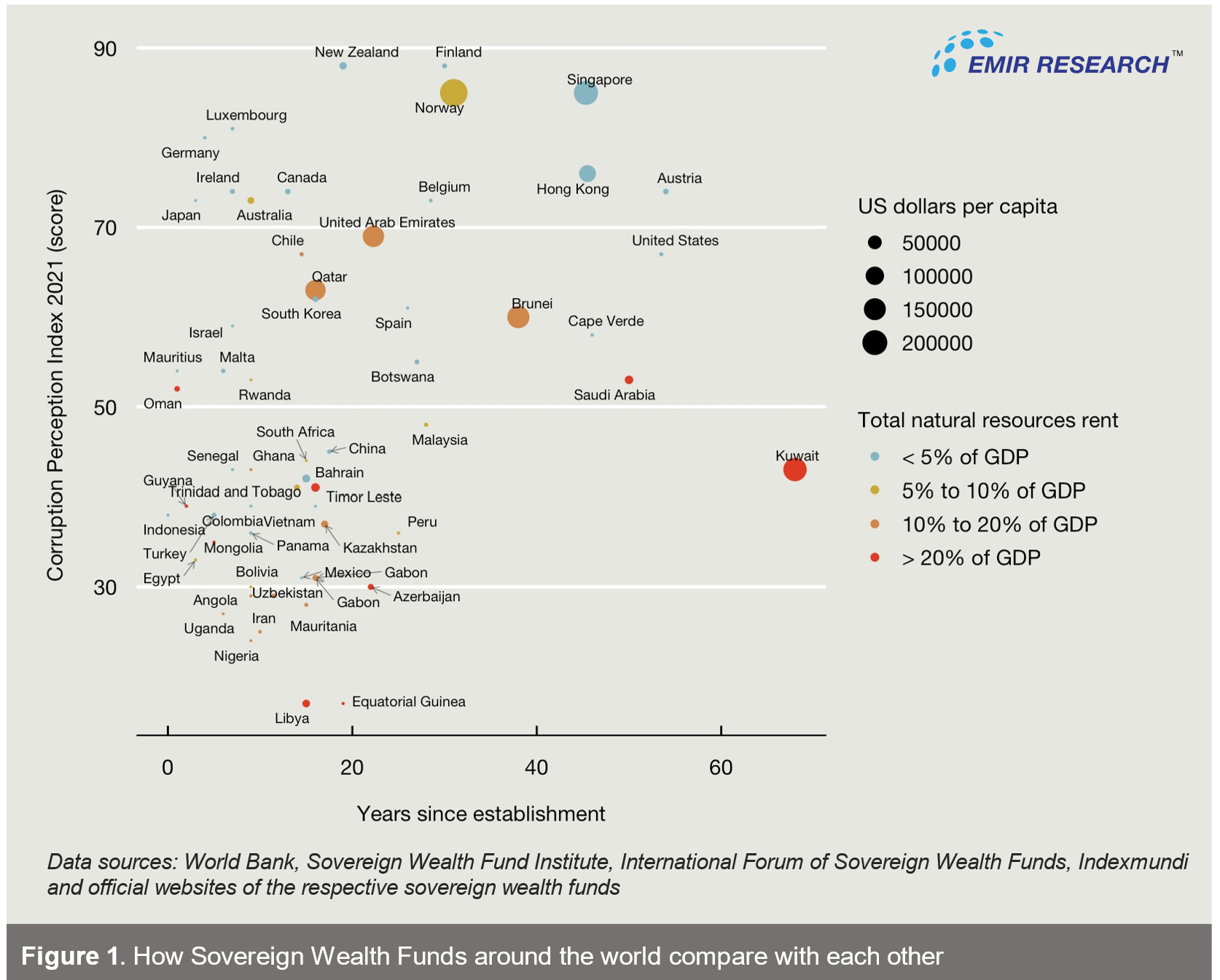

SWF Institute (SWFI) tracks and regularly updates its list of top 100 largest SWFs worldwide ranked by total assets. Figure 1 is the snapshot given the most recent available data.

We can draw a few interesting observations from the above chart.

First, stellar performing SWFs, given the size of their economies, tend to concentrate in the upper part of the graph, as expected, among the countries with extremely low levels of corruption as measured by the Corruption Perception Index (CPI).

Second, although commodity-based SWFs have a greater potential, the graph indicates that rich natural resources combined with a high level of corruption are not a winning combination.

And the third, the performance of Singapore’s and Norway’s SWFs is absolutely astonishing to the extent that we could classify all SWFs as “Norway/Singapore SWFs” and “the rest”.

According to the latest data, Norway Government Pension Fund Global (GPFG) as well as Singapore’s Temasek Holdings (Temasek) and GIC Private Limited combined have accumulated in their coffers a whopping US$1.4 tril and US$1.06 tril or about US$4250,000 and US$4187,000 per citizen, respectively.

For comparison, as of the latest reported data, Khazanah Nasional Bhd’s commercial (inter-generational) fund assets are valued at about US$25 bil or just below US$800 per capita.

Even though we lived through cycles when Malaysia’s SWF could benefit due to a boom in oil prices, commodities demand and investment inflow, there is still no impact for the nation in sight.

Therefore, it is worth understanding the critical success factors (CSFs) behind the staggering success of Singapore’s and Norway’s SWFs in securing their citizens’ future that sets them apart from “the rest”. – March 12, 2022

Dr Rais Hussin and Dr Margarita Peredaryenko are part of the research team at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.