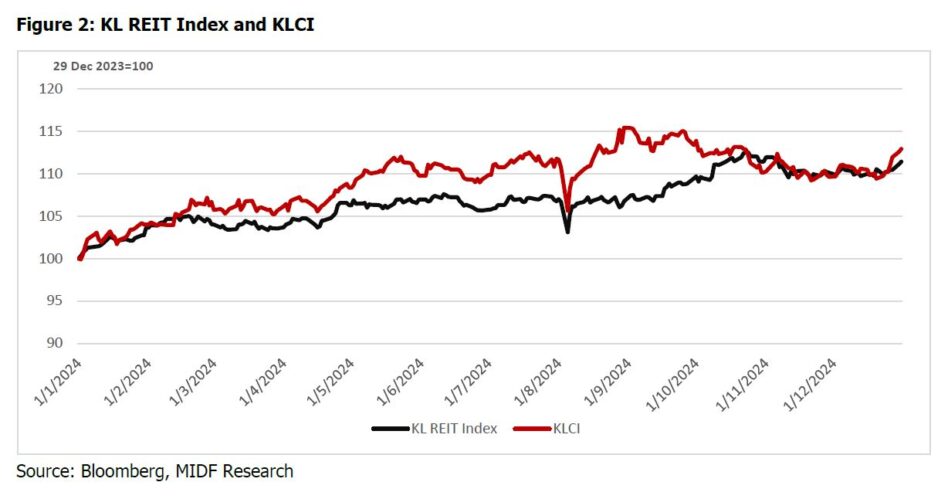

PERFORMANCE of REIT was decent in 2024 as KL REIT Index recorded gains of +11.4% which is just slightly lower than KLCI’s gains of +12.9%.

“The positive performance of REIT was mainly driven by the earnings recovery of REIT as earnings normalised to pre-pandemic level,” said MIDF Research (MIDF) in the recent Thematic Report.

Earnings growth of REIT was largely positive, underpinned mainly by the recovery of the retail and hotel industry.

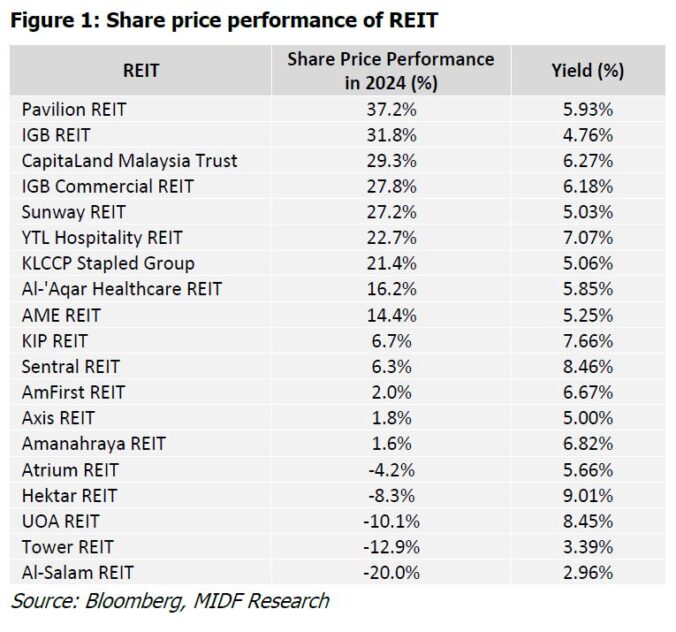

Meanwhile, top five performers of REIT in 2024 with highest share price appreciation are Pavilion REIT (+37.2%), IGB REIT (+31.8%), CapitalLand Malaysia Trust (+29.3%), IGB Commercial REIT (+27.8%), and Sunway REIT (+27.2%).

Notably, Pavilion REIT recorded higher earnings in the nine months of financial year 2024 (9MFY24), driven by higher contributions from Pavilion KL Mall.

Similarly, IGB REIT earnings were resilient due to the high occupancy rates of Mid Valley Megamall and The Gardens Mall.

Meanwhile, KL REIT Index was little-changed year-to-date at -0.2% against KLCI’s loss of -3.8%, showing REIT a safe haven amid market volatility.

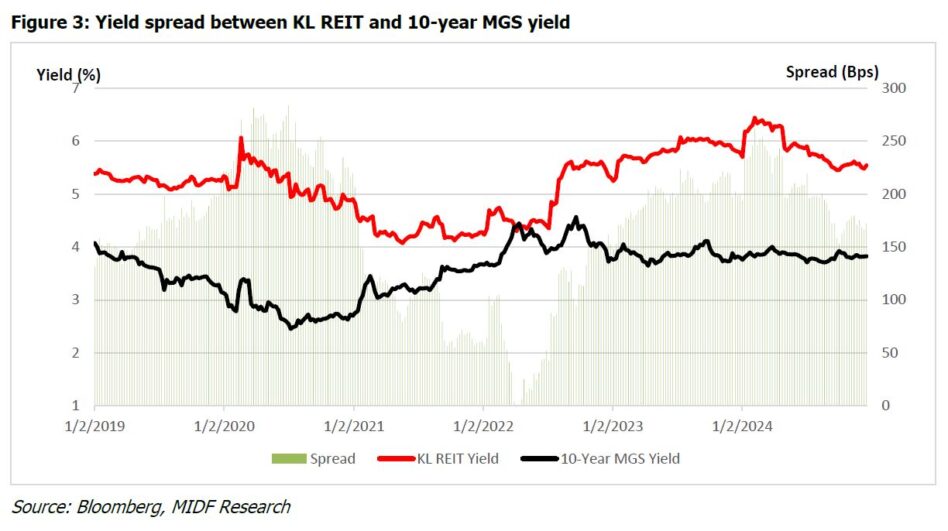

The positive performance of REIT could be also partly attributed to the attractive yield spread between REIT and 10-year MGS yield.

The U.S. Federal Reserve cut interest rates for the first time in four years in mid-September 2024 which compressed yield of fixed income assets such as 10-year MGS yield.

Meanwhile, 10-year MGS yield is hovering at 3.8% which translates into current spread of 170 basis points between KL REIT aggregate yield and 10-year MGS yield which is slightly higher than the 5-year average spread of 165 basis points.

“We view that the widening spread increases the attractiveness of REIT. Hence, we maintain our view that the yield of REIT which is at above 5% will remain attractive to investors who look for good yield stocks with defensive earnings amid market volatility,” said MIDF.

REITs are set to announce quarter four calendar year 2024 (4QCY2024) earnings with Axis REIT, IGB REIT, AME REIT and CapitalLand Malaysia Trust scheduled to release quarterly earnings this week.

Overall, MIDF expects the earnings of REIT, particularly REIT with high exposure to retail and hotel sector to remain resilient in 4QCY24 as earnings should be supported by seasonally stronger footfall and higher tourist arrivals in 4Q amid year-end holiday season.

Looking forward, MIDF forecasts that earnings of REIT in 2025 to remain healthy, driven by organic growth of positive rental reversion, specifically retail REIT on the back of high shopper footfall and healthy tenant sales.

Similarly, REITs with hotel assets are expected to be spurred by more events at hotels and higher tourist arrivals as the government aims to attract more visitors for Visit Malaysia 2026.

“Overall, we estimate earnings of REIT under our coverage to grow by an average 5% in 2025,” said MIDF.

Notably, MIDF expects earnings growth of ~6% for Sunway REIT in 2025 due to good prospects for retail division which will be driven by Sunway Pyramid Mall following reconfiguration of Oasis wing.

Note that Oasis wing accounted for 11% of Sunway Pyramid Mall’s NLA with encouraging rental reversion after reconfiguration of the space.

“Overall, we continue to see a positive outlook for REIT in calendar year 2025 (CY25) as earnings outlook for REIT is expected to remain stable which will be supported mainly by organic growth,” said MIDF.

Besides, REITs with defensive earnings and stable yield could provide shelter for investors amid market volatility.

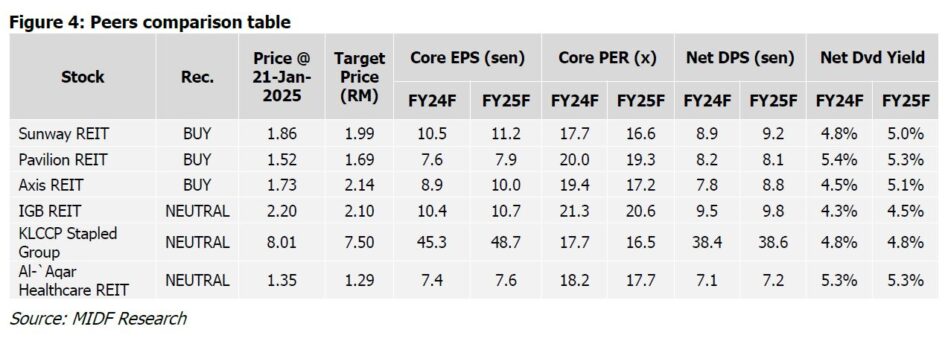

All in all, MIDF maintains their POSITIVE stance on REIT. Their top picks for the sector are Sunway REIT (BUY; TP: RM1.99) and Pavilion REIT (BUY; TP: RM1.69).

They are positive on Sunway REIT as earnings contribution from retail division is expected to drive by higher rental rate of Sunway Pyramid Mall’s Oasis wing post reconfiguration.

Besides, earnings of the retail division will also be supported by the higher contribution from Sunway Carnival Mall. Meanwhile, estimated distribution yield is attractive at 5.0%.

On the other hand, MIDF is positive on Pavilion REIT as earnings outlook remains promising with stable contribution from Pavilion KL Mall while the growing contribution from Pavilion Bukit Jalil provides upside to the earnings growth. Distribution yield is also attractive at 5.3%. —Jan 22, 2025

Main image: CGS International