THE recently announced reciprocal tariffs are not expected to have a direct material impact on M-REITs, but may have knock-on effects on Malaysia’s macro outlook.

“Amid uncertainty, M-REITs with strong underlying asset quality, diversified portfolios, and consistent income visibility offer a defensive option for investors,” said Maybank Investment Bank (MIB).

While luxury-focused retailers may see some drag from weaker sentiment, well-located prime malls should remain resilient.

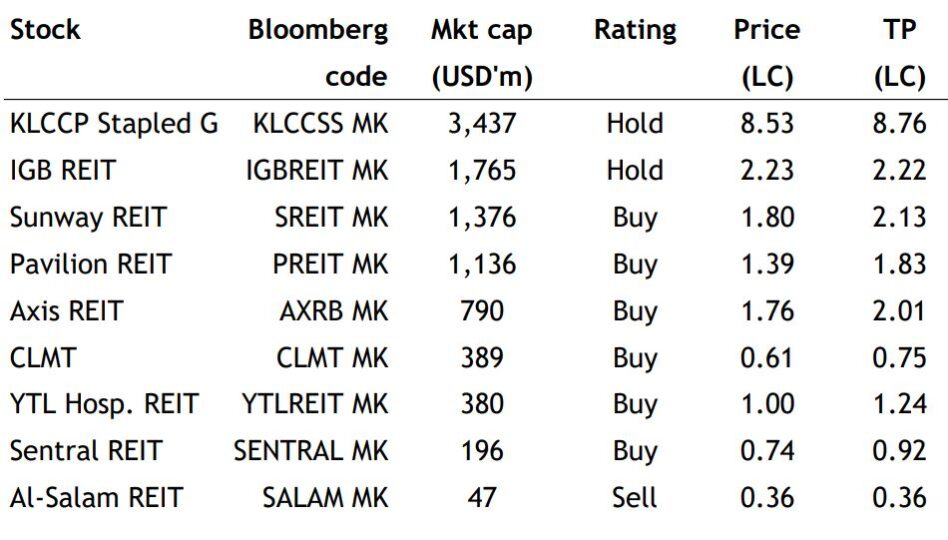

Pavilion REIT (Pavilion KL), Sunway REIT (Sunway Pyramid Mall) and IGBREIT (Mid Valley Megamall, The Gardens) are expected to continue to benefit from steady footfall and tourist recovery.

CLMT is gradually repositioning its retail assets to attract mass-market tenants and improve occupancy, which could cushion against any softness in the higher-end segment.

“Overall, the retail REITs in our coverage are expected to retain stable base rent contributions, especially in sub-urban locations,” said MIB.

An interest rate cut by Bank Negara Malaysia, amid softer growth and benign inflation, would be positive for M-REITs, especially those with higher floating-rate debt exposure.

Lower borrowing costs could reduce interest expenses and may translate into higher distributable income. —Apr 8, 2025

Main image: PropertyGuru