PRUDENTIAL Malaysia Assurance Berhad (PAMB) has released “Fulfilling Futures – Seeking Future Financial Security: The challenges facing young Malaysians”.

The report, written by Economist Impact, looked at how Malaysians across different age groups are saving for their future and the challenges faced by young Malaysians to become financially resilient.

According to the report, concerns about personal finances are strongest among the youngest cohorts of Malaysians, aged between 25 and 34.

These are mainly young adults who may be in the early stages of their careers. However, they face challenges that limit their ability to save and invest in the future including low wage growth, increase in the cost of living, changes in the employment landscape and limited financial literacy.

“This year, Prudential is celebrating 100 years in Malaysia. As such, it is fitting that this report explores how we can continue to serve the needs of the next generation of Malaysians as they embark on adulthood,” said PAMB CEO Lim Eng Seong.

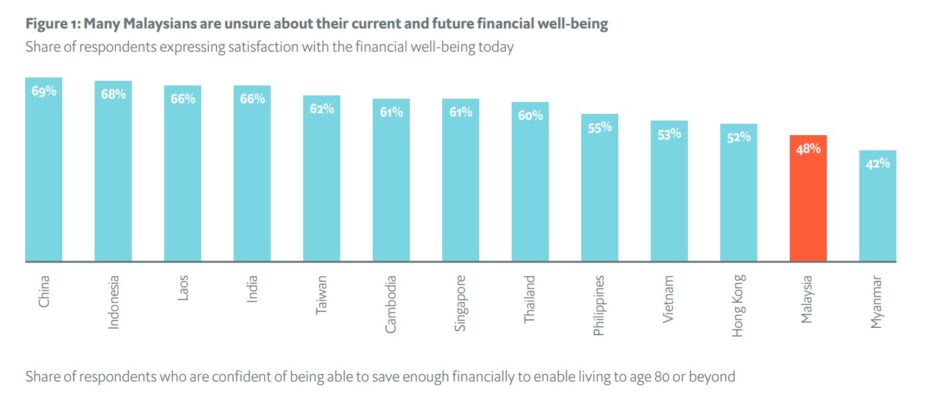

“Though the country has gone through many changes over the decades, one issue persists. Malaysians, especially young adults, profess a low satisfaction in their ability to prepare for their future. this is one of the lowest of the 13 markets surveyed.”

Lim also pointed out that the limited financial acumen to make decisions on how to save, spend and invest may be contributing to the lack of confidence in their future financial stability.

“This is why financial empowerment needs to start from a young age and it should not be a once-off classroom session, but rather constant learnings that evolve alongside the individual’s growth,” he added.

Skillset mismatch

The Malaysia findings are part of a region-wide report by Economist Impact’s “Re-thinking wellbeing in Asia: How outlooks on life are changing” which surveyed 5,000 people across 13 Asian markets.

For the report, Economist Impact interviewed two experts, namely Balqais Yusoff, head of the Policy and Strategy Department at the Employees Provident Fund (EPF) and Dr Norma Mansor, president of the Malaysian Economic Association and director of the Social Wellbeing Research Centre at University Malaya.

“Young people are finding it increasingly difficult to save,” said Balqais.

According to the research, one reason for that is a skill set mismatch – a misalignment between the skills sought after in the labour market and those possessed by individuals – as well as structural wage challenges, which particularly impacts the youngest members of the workforce.

Balqais noted that 78% of EPF members earn less than RM5,000 per month, and for half of members, the monthly earnings are less than RM3,000.

Meanwhile, Dr Norma noted that wages have stagnated in recent years for most workforce members, including the youngest ones.

“Wage stagnation has driven many young people, especially those with higher education abroad – to Singapore, Hong Kong and further afield – where the earnings opportunities are greater,” she noted.

According to EPF’s Balqais, the COVID-19 pandemic had also led to an increase in the number of people, including younger workforce members, taking freelance and gig work jobs in the nation’s informal sector where wages are often unpredictable and social protections are non-existent.

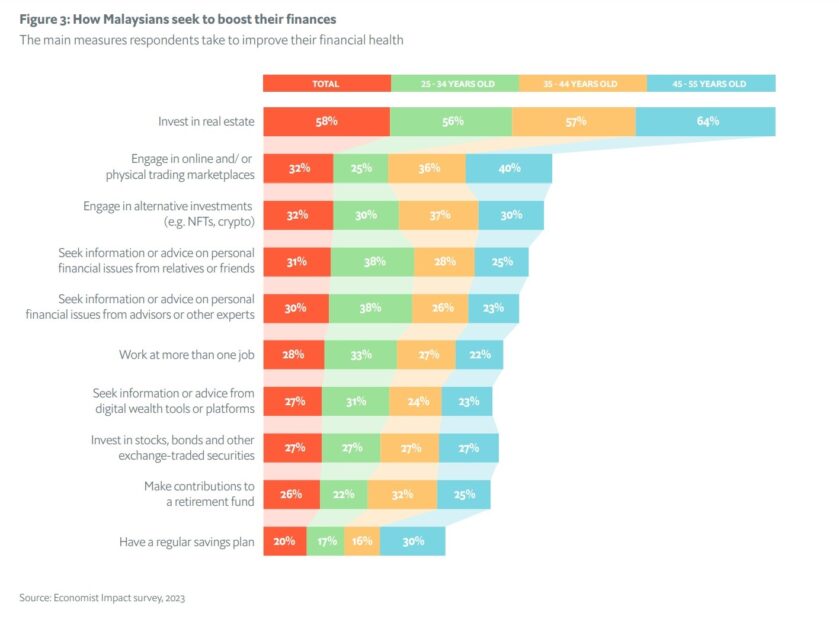

Many hold multiple jobs to make ends meet: 38% of the survey respondents in the 25-34 age group say they work at more than one job, compared with 26% of those aged between 35 and 44.

One result of this crunch, said Dr Norma, is a high level of indebtedness among young people.

In fact, data from the Malaysian Department of Insolvency revealed that bankruptcy declarations between 2018 and 2022 among individuals in the 25-34-year-old age group accounted for 22% of the nationwide total.

“As a cohort, these individuals are highly geared, [and] many having declared bankruptcy due to the burden of car and other personal loans as well as credit card debt,” Balqais noted.

She also notes that household debt in Malaysia is high, citing a debt-to-income ratio of 146%. “So, we have a crisis in the making, in which many young people, when they become eligible to take their retirement income, will have to use a large chunk of it to pay off their debts,” she added.

These circumstances translate into a low rate of savings among working-age Malaysians. That is evident in the EPF, with data indicating that 47% of its members under the age of 55 had total savings of under RM10,000 at the end of 2023.

This figure almost certainly understates the savings-poor status of working-age people in Malaysia, as only those employed in the formal sector are EPF members.

It is also a situation exacerbated by the pandemic, as COVID-19 pressured many to dip into their retirement funds.

The EPF reported that six in 10 members made such premature withdrawals, and estimates that it will take them an additional four to six years of work to rebuild these savings.

Implications for Malaysia’s future

The research further highlighted that more needs to be done to improve financial literacy among young Malaysians. This includes greater awareness about the riskier financial instruments.

Additionally, more communication is needed about the benefits of protecting incomes and health that will instil stability in later life.

“This will help address the issues young Malaysians face on their future financial stability. Financial empowerment needs to start from a young age and include continuous learnings that evolve alongside the individual’s growth and stage in life,” PAMB’s Lim asserted. – Jan 22, 2024

Main pic credit: Access Partnership