Overall, MIDF Research (MIDF) still expects buying interest on property to remain resilient in 2025.

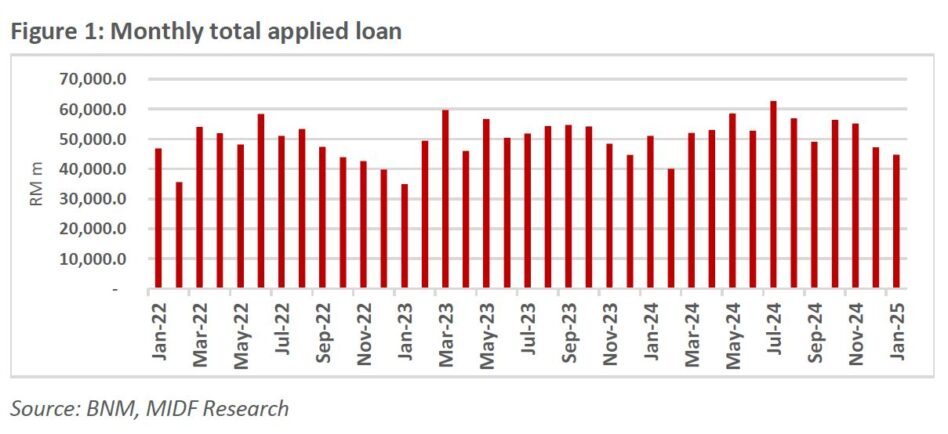

Approved loan for purchase of property eased -7.8% year-on-year (yoy) to RM18.8 bil in January 2025 after +32%yoy surge in December 2024.

Approved loans recorded the first decline in seven months mainly due to lower loan application.

On a monthly basis, approved loan in January 2025 was lower (-20.7%mom), in line with lower loan application while loan approval ratio normalised from 50% in December 2024 to 42% in January 2025.

“Moving forward, we expect approved loans to remain subdued in February 2025 and subsequently grow higher in March 2025 onwards in tandem with higher loan application,” said MIDF in the Monthly Sector Report.

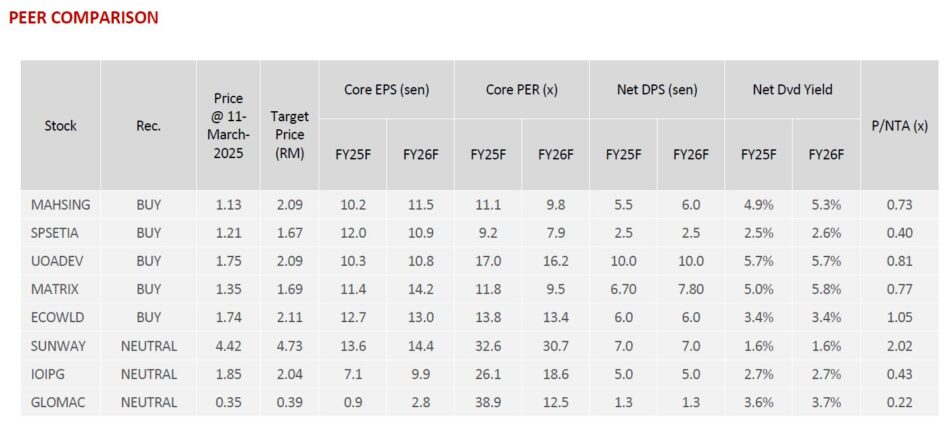

Overall, earnings growth in quarter four calendar year 2024 ( 4QCY24) was positive at average of +5% yoy while most of the property companies recorded earnings growth in CY24, underpinning by stable new progress billing and lower costs.

On the other hand, new property sales were generally in line or higher than management expectation in CY24 as buying interest on property is stronger.

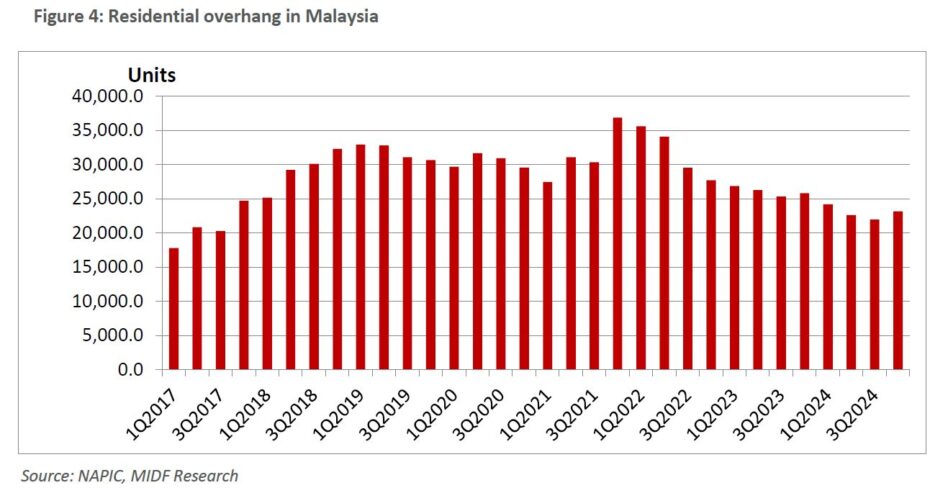

“We opine that property overhang in Malaysia remains healthy as residential overhang remains below 3-year average of 27,000 units,” said MIDF.

Meanwhile, property overhang in Johor continues to improve with lower residential overhang which fell from 3,030 units in 3QCY24 to 2,964 units in 4QCY24.

Similarly, serviced apartment overhang in Johor declined to 10,624 units in 4QCY24 from 11,810 units in 3QCY24 due to improving sentiment on Johor property market.

MIDF maintains their positive stance on property sector as the sector is expected to benefit from Johor-Singapore Special Economic Zone (JS-SEZ), The Johor Bahru–Singapore Rapid Transit System (RTS), growing demand for data centre and industrial property in Malaysia which will unlock value of landbank of property developers.

Besides, the overnight policy rate is unchanged at 3% which should remain supportive to buying interest on property. —Mar 12, 2025

Main image: seen.com