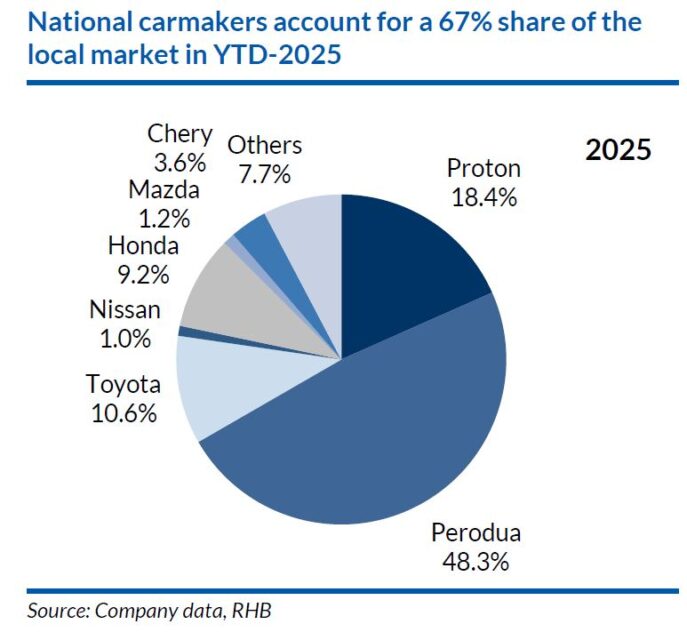

RHB keeps neutral on the auto and autoparts sector, given their expectations for a cyclical sector slowdown premised on a lack of catalysts to drive sales and earnings to new highs.

RON95 subsidy rationalisation is imminent, but could be delayed as the full criteria for the eligibility has yet to see the light of day.

“We understand the MyKad will be used in conjunction with a 2-tier pricing system, though this could be subject to abuse,” said RHB.

Furthermore, the T15 classification, that is those not be eligible for the subsidy, is still being reviewed, which could delay the rollout to beyond mid-2025 in RHB’s view.

While details remain unclear, RHB believes policy will raise car ownership costs. It could also drive EV adoption and prompt some buyers to down-trade, given the limited availability of affordable EVs.

The direction of national EV adoption remains unclear, as the question to whether exemption of import and excise duties for complete build up (CBU) EVs gets extended beyond end 2025 remains unanswered.

The end of the CBU EV tax holiday aligns with the government’s aspiration to attract original equipment manufacturers (OEMs) to manufacture and assemble their EVs locally, as complete knockdown (CKD) EVs will continue to enjoy a tax holiday until end 2027.

However, this may come at the expense of EV adoption in Malaysia, as most EVs on the road currently are imported.

This short-term policy also leaves the OEMs in a limbo, as they would prefer long-term policy visibility before committing to setting up their manufacturing plants locally.

Additionally, an unresolved policy issue remains on the revision of open market value (OMV) for excise duty calculations on CKD cars.

Originally based on manufacturing costs, the revised OMV may include selling-related expenses, potentially increasing car prices by 10-30% if implemented in Jan 2026.

This could lead to a surge in car sales before the new excise duty takes effect. Nonetheless, strong opposition from Malaysian carmakers may influence the final decision on this policy change.

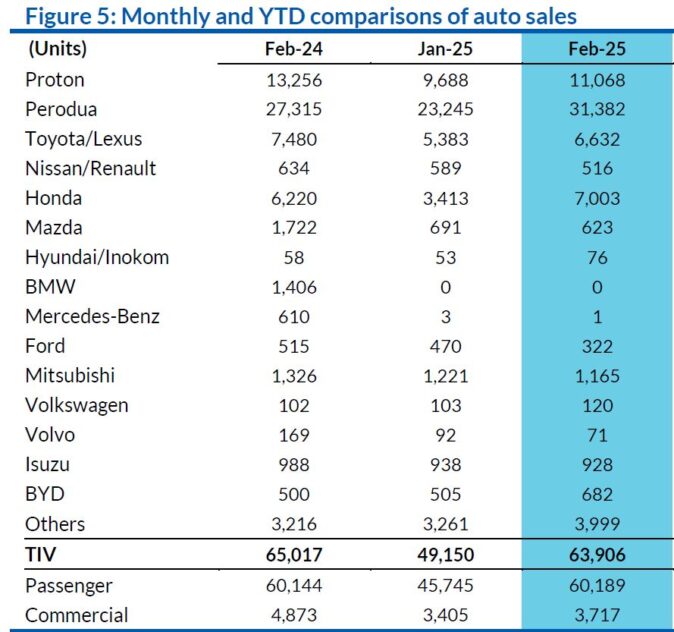

“We anticipate total industry volume (TIV) for March to increase month-on-month (MoM), driven by carmakers ramping up sales through aggressive festive season promotions ahead of the Aidil Fitri festivities,” said RHB.

As at February, TIV was exceptionally weak and RHB believes quarter one 2025 (1Q2025) TIV will decrease year-on-year (YoY).

This supports their expectation of a cyclical sector slowdown, supported by tapering order backlogs for the major carmakers.

For 2Q25, RHB anticipates TIV to be seasonally weaker, given the Aidil Fitri festivities, on top of scheduled factory maintenance works by Perodua and Proton.

“We remain cautious in our outlook due to ongoing price competition in the non-national segment and softening order backlogs,” said RHB. —Apr 18, 2025