THE quarter four 2024 (4Q24) sector results beat expectations, with expanding margins supporting double digit earnings growth for both PMAH and Malayan Cement (LMC).

“We continue to stay positive on the cement and aluminium sectors due to favourable supply demand dynamics which support prices, alongside easing cost pressures,” said RHB in the recent Malaysia Sector Update Report.

Both PMAH’s and LMC’s results exceeded expectations. PMAH’s 4Q24 core earnings of MYR446 mil brought FY24 earnings to MYR1,853 mil.

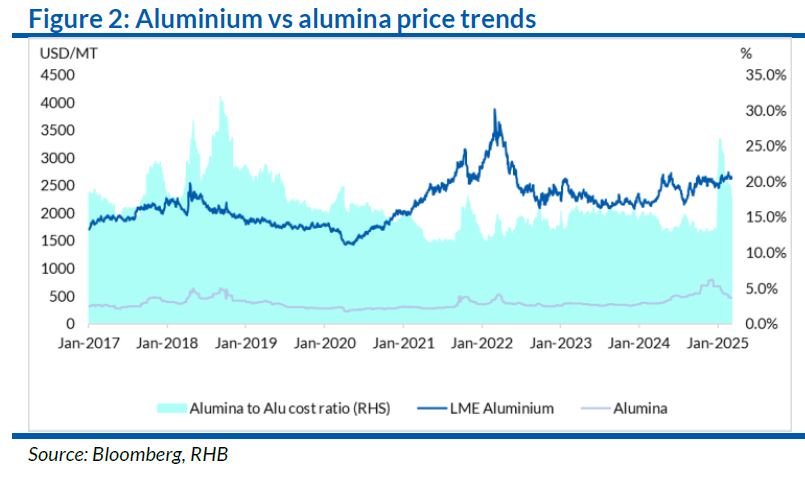

The slower quarter-on-quarter (QoQ) was partly from lower production capacity due to a fire incident at its smelting plant in Sep 2024, as well as a spike in alumina prices that squeezed margins.

However, this was partially offset by a higher associate contribution in line with the higher alumina prices.

Meanwhile, LMC’s quarter two financial year 2025 (2QFY25) June core profit of MYR159.8 mil led to a first half financial year 2025 (1HFY25) core profit of MYR304.3 mil.

The stronger performance was primarily driven by improved operational efficiencies and higher demand for ready-mixed concrete, notwithstanding a marginal 0.7% year-on-year (YoY) increase in revenue for 1HFY25 due to lower cement sales.

The proposed 25% US import tariff has minimal direct impact to PMAH due its limited sales to the region, while LME prices have remained stable, increasing 5.5% YTD to USD2,665 per tonne as the overall global supply remains tight amid delays in the ramping up of new smelters due to rising costs.

The US-Midwest premiums have almost doubled to an all-time high of USD920 per tonne following the tariff announcement, while the Main Japanese Port rose by 11% from production cuts.

But the European Premiums have lagged due to concerns of Canadian aluminium supply entering the market.

On the cost side, alumina prices have eased by 30% YTD as supply chain risks alleviate, which should support margin expansion for PMAH in FY25.

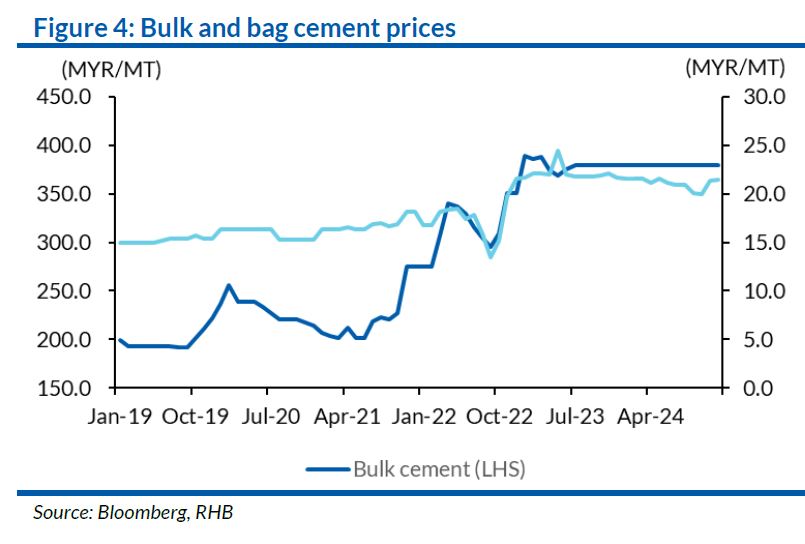

Bulk cement prices have stabilised and continued to sustain at MYR380 per tonne since Jul 2023.

“We foresee it remaining stable, given the expected demand from key projects such as the Penang Light Rail Transit (LRT), West Ipoh Span Expressway, and reinstatement of five LRT Line 3 stations, along with robust demand for industrial projects and property development,” said RHB.

Coal prices have also declined by 16% YTD, easing cost pressures for cement producers.

While LMC’s cement supply contract for the East Coast Rail Link Phase 1 ended in 2024, management guided that it is still supplying cement for Phase 2, albeit without an exclusive contract.

Key downside risks are higher-than-expected raw material costs and a sharp deterioration in global economic conditions, which will taper off construction activities and undermine the demand for aluminium and cement. —Mar 7, 2025

Main image: The Star