RHB thinks quarter two 2024 sector profit after tax and minority interest could be flattish Quarter-on-Quarter (QoQ) with Net Interest Income (NII) a bright spot, dampened by softer trading and investment income.

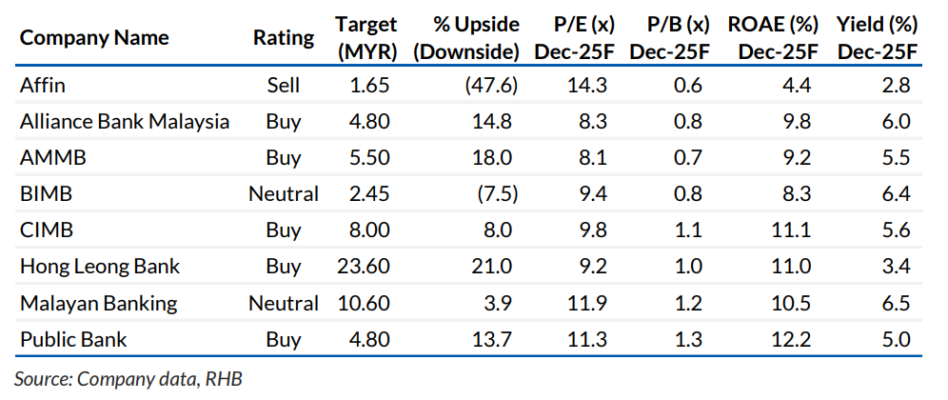

With the sector’s earnings back to trend growth, this may not excite investors. Still, therein lies the possibility of a potential sector rotation to tide through market volatilities given its inexpensive valuations, attractive dividend yields plus expectations for foreign institutional investor inflows as the US Federal Reserve embarks on its rate cut cycle.

System loans growth was a strong 6% Year-on-Year (YoY) vs +5% YoY deposits growth. While the system average lending rate eased 5 basis points QoQ, the 12-month fixed deposit (FD) rate fell 6 basis points QoQ on the ongoing efforts to reduce funding cost pressures.

Asset quality was sound, with the growth-to-investment-liquidity ratio contracting 2 basis points QoQ to 1.60%,the lowest since May 2021, while loan loss coverage stood at 91.7% in June 2024. We are generally positive on quarter two sector NII.

While some banks had guided for a possible slowdown in the pace of loan growth, such as net interest margin (NIM) and capital preservation, system loan growth was healthy.

Quarter two NIM also tends to be seasonally stronger QoQ, and this would be further supported by ongoing efforts to reduce deposit costs.

“On a YoY comparison, though, we think sector NIM would still be lower or, at best, flat. On the other hand, we think non-interest income would be a dampener this quarter, mainly due to the high base enjoyed in quarter one 2024 and quarter two 2023 by some banks from the more opportunistic treasury income,” said RHB.

Sector fee income, however, should stay well supported by loans and cards fees, wealth management and stockbroking.

Individual operating expense trends will likely be mixed. Some banks have begun accruing for the next collective agreement while for strategic investments, depending on their respective stages, some banks may need to catch up on spending while peak spending may be past for some.

YoY operating expense growth, however, is expected to be back to single digit rise due to base effect.

“On asset quality, we do not expect any major negative surprises but certain sectors such as SMEs and lower-income households are worth monitoring,” said RHB in the recent Malaysia sector update report.

Sector cost of capital, however, may continue to hover at the low 20 basis points levels, partly as the healthy loans growth would continue to require expected credit losses.

Several Dec and June financial year ended banks are expected to declare interim/final dividends during the quarter, which would translate to dividend yields of 1.9-3%.

“While we think banks such as CIMB have the capacity for capital management initiatives, we think it would likely be in quarter four rather than quarter two,” said RHB. – Aug 15, 2024

Main image: euromoneydigital.com