RINGGIT is poised to show its resilience against other currencies in 2H 2022 with the US Federal Reserve expected to slow down the pace of its policy tightening towards end-2022.

This will not only pose less drag on emerging market (EM) currencies but potentially boost financial flows towards EM markets while improving appetite for risk assets in regional currencies, including ringgit, according to MIDF Research.

“Moreover, EM currencies stand to gain from improved growth outlook in China in the latter part of the year after being negatively impacted by the COVID-19 lockdowns re-imposed in 2Q CY2022,” projected the research house in a ringgit outlook report.

“Considering the improved growth outlook and sustained current account surplus, we forecast ringgit could appreciate and reach RM4.25/US$ by end-2022.”

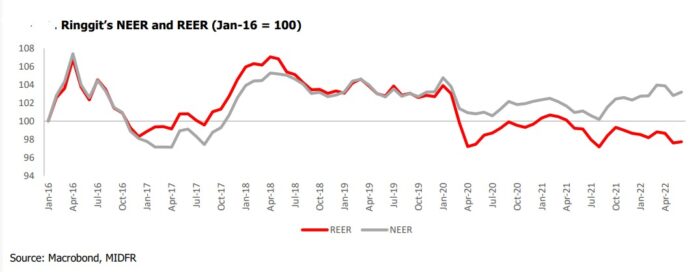

Based on real effective exchange rate (REER), MIDF Research said the ringgit remains undervalued with its value at REER even falling further in 1H CY2022.

Looking at improving growth momentum, elevated commodity prices, and increasing domestic economic activities on the back of economic re-opening, the research house expects the economic fundamentals to be in favour of a stronger ringgit.

“This explains why ringgit strengthened against other currencies according to nominal effective exchange rate (NEER). Ringgit has been strengthening on NEER basis from the recent trough in May 2021 when the full nationwide lockdown was imposed last year,” observed MIDF Research.

“Unfortunately, movements in the financial market which are more sensitive to the US FOMC’s (Federal Open Market Committee) rate decisions caused the ringgit to weaken specifically against the greenback.”

Fundamentally, MIDF Research noted that the ringgit is on strong footing underpinned by firming domestic demand, robust external sector and elevated global commodity prices. Malaysia’s unemployment rate is on descending trajectory – 3.9% in May (2021: 4.5%) which was slightly higher than the pre-pandemic level 3.4%.

Moreover, the country’s inflationary pressure remains stable in view of the capped retail fuel prices and other subsidy assistances. In addition, the research house foresees moderation of food price inflation in 2H CY2022 amid slight betterment in domestic food supply and correction in global commodity prices.

Relative to other currencies, MIDF Research said the ringgit has performed better against other major currencies. From end-2022 until end-July 2022, the local currency has appreciated against the euro (+4.1%), British pound (+4.0%) and the Japanese yen (+8.4%) although its performance against regional currencies is rather mixed.

Among others, ringgit has weakened against the Singapore dollar (-4.2%), Indonesian rupee (-2.6%), and Chinese yuan (-0.7%) but strengthened against the Thai baht (+2.4%), Korean won (+2.2%), the Philippine peso (+1.2%) and Taiwan dollar (+1.2%).

“We believe the overall resilience in ringgit performance in line with the trend in NEER, reflects the positive effect of elevated commodity prices on ringgit, particularly from the high prices of crude oil and palm oil,” added MIDF Research.- Aug 9, 2022