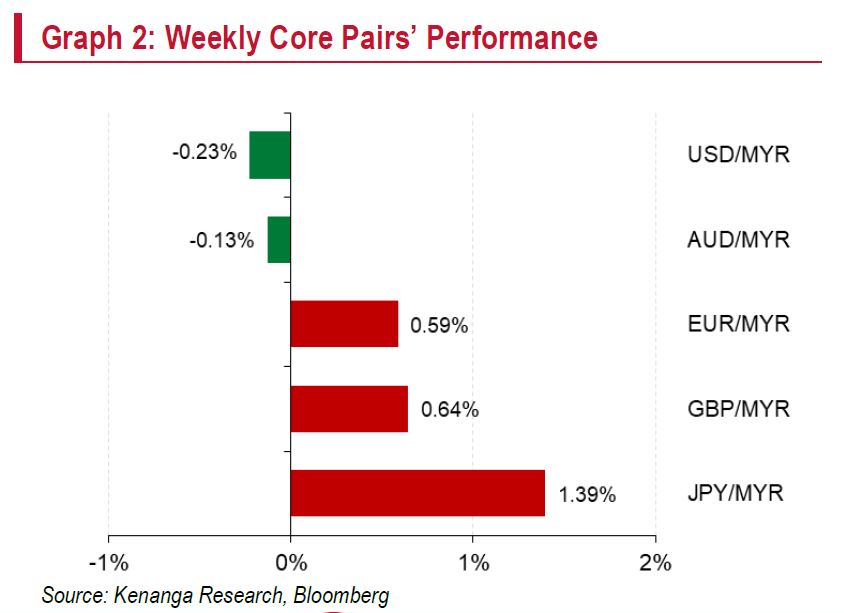

IN LINE with expectations, the ringgit strengthened modestly, trading between 4.27–4.30/USD. driven by continued rotation out of US assets amid growing fiscal unease.

Despite Moody’s downgrade of the US sovereign rating and Trump’s push for sweeping tax cuts, the ringgit held steady around 4.30/USD in early trading.

“It appreciated midweek, amid market chatter of a secret currency accord aimed at weakening the USD as part of trade negotiations,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

Gains in EU FX, bolstered by demand for USD alternatives and renewed optimism over a Ukraine-Russia peace deal, also supported the ringgit.

Next week, the focus shifts back to the US. Some Fed speakers may back just one 25 basis points rate cut this year, less than the two cuts priced in by markets and expected by Kenanga’s view.

However, such remarks are unlikely to meaningfully support the greenback. Investors remain focused on trade talks, ballooning deficits after Trump’s bill narrowly passed the House, and incoming hard data. Any hints of de-escalation could offer the USD a brief lift.

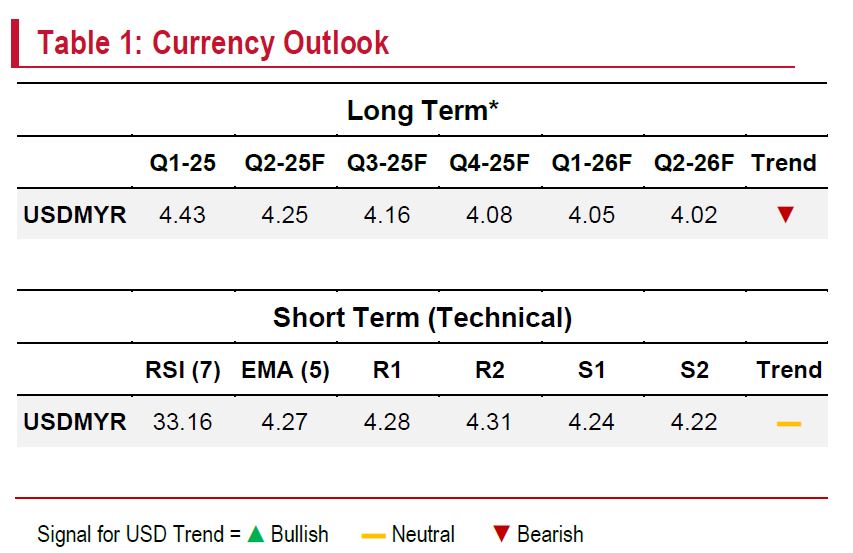

“Sentiment towards US assets continues to erode, leaving the USD vulnerable. In response, we revise our end-2025 USDMYR forecast sharply stronger to 4.08 (from 4.45), reflecting the ongoing capital reallocation towards more stable EM assets,” said Kenanga.

While domestic headwinds persist amid tariff uncertainty, the ringgit stands to benefit from global repositioning.

USDMYR remains range-bound, hovering near its 5-day exponential moving average of 4.27. —May 23, 2025

Main image: Malay Mail