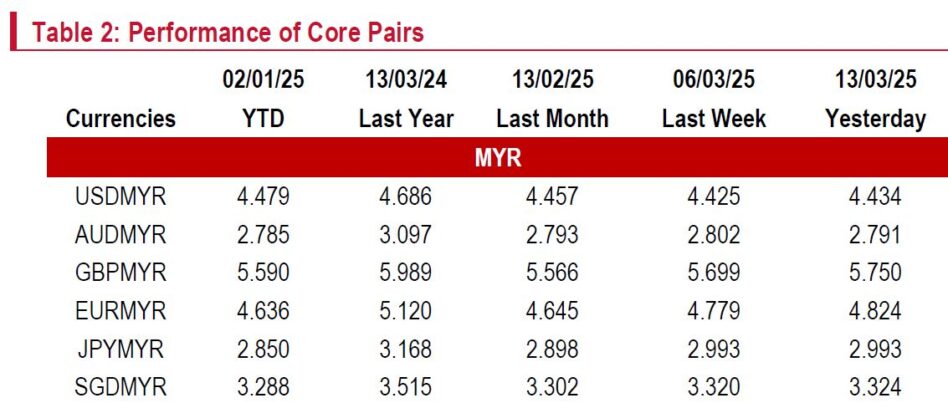

AS expected, the ringgit remained defensive within the 4.41–4.43/USD range this week. Focus has shifted from Europe to tariffs, the US recession narrative, and the Fed’s policy outlook.

“Despite Fed Powell’s optimistic speech last Friday and escalating trade tensions, the USD index (DXY) remained weak, trading below 104,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

This was largely due to the US equity slump, scattered recession warnings, and optimism over a potential Russia-Ukraine ceasefire. Interestingly, despite cooler-than-expected US CPI and PPI readings, the DXY regained some ground.

Markets, however, remain hesitant to embrace the deflationary narrative until the impact of tariffs becomes clearer.

Markets, however, remain hesitant to embrace the deflationary narrative until the impact of tariffs becomes clearer.

While the US House passed a bill to avert a shutdown, Senate Democrats pose a key hurdle, sustaining political risk.

Next week, central banks take centre stage, with the Fed, BoJ, and BoE expected to hold rates.

Markets will closely watch their tone and economic projections for guidance. US retail sales will also be a key indicator—if data fails to confirm economic pessimism, the DXY may recover losses.

The ringgit could test 4.45/USD but is likely to stay defensive within 4.43–4.47/USD as markets seek clarity.

Optimism surrounding China and a brighter European outlook may continue to weigh on the DXY.

However, a “higher-for-longer” Fed stance and a cautious BoJ amid trade risks could support a rebound.

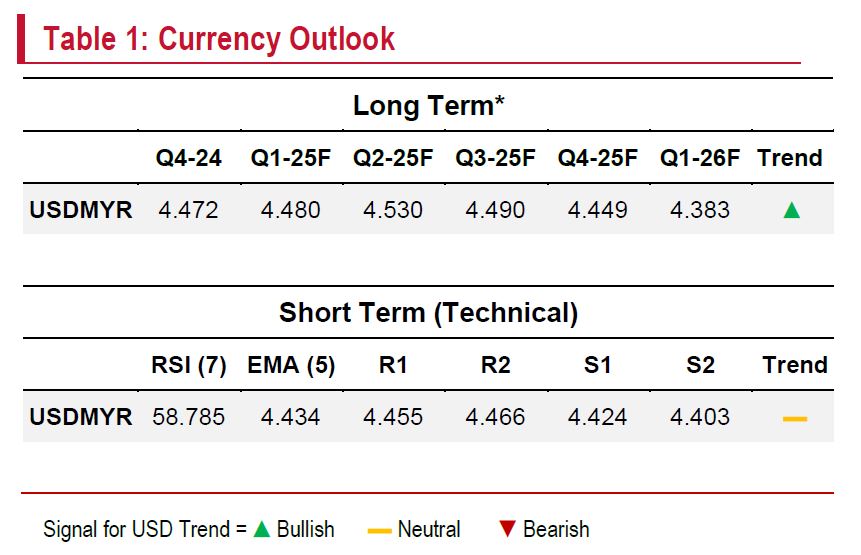

USDMYR remains neutral, hovering near its 5-day exponential moving average at 4.434, with the relative strength index in the mid-range.

Persistent market volatility is likely to keep the pair fluctuating within (S1) 4.424 and (R1) 4.455. —Mar 14, 2025

Main image: The Star