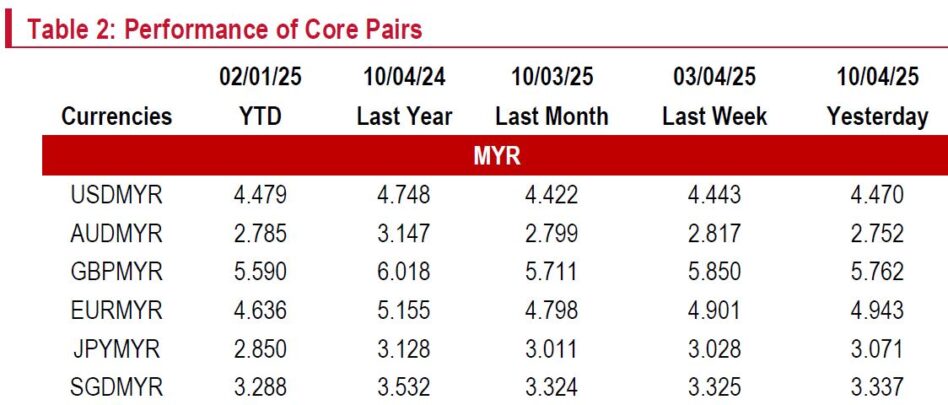

THE ringgit traded softer-than-expected, hovering around 4.47 to 4.50 of the USD, but resisted a sustained break above the key 4.50 threshold.

The forex markets were thrown into disarray this week amid renewed trade tensions, driven by Trump’s tariff manoeuvres.

“The ringgit briefly slipped past 4.50/USD intraday after Trump imposed sweeping tariffs on 75 countries, including a 104.0% rate on Chinese goods, prompting a knee-jerk selloff,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

The losses were short-lived, however, as markets recalibrated after a 90-day tariff pause for most countries. The DXY fell below 101.0, reflecting growing risk aversion toward US assets.

A softer-than-expected US core CPI print, slipping below 3.0% for the first time in four years, reinforced expectations of a possible Fed rate cut soon, despite the inflationary impact of tariffs.

Attention now turns to upcoming PPI and consumer sentiment data for further confirmation.

Next week, markets will focus on China’s key macro numbers, US retail sales, and the ECB’s rate decision. The US-China trade war remains a key risk.

While the ringgit may gain some support from delayed tariffs and waning confidence in USD assets, the broader trade war narrative remains intact with a 145.0% tariff on China and a baseline 10.0% globally.

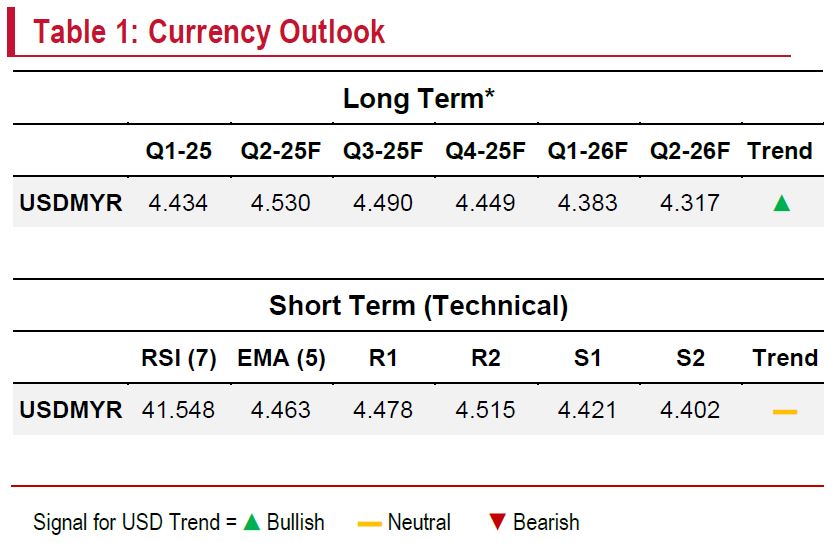

“We maintain our view that the ringgit will remain resilient, trading within 4.43–4.48 of the USD range next week.The USDMYR remains neutral, anchored near its 5-day exponential moving average at 4.463,” said Kenanga.—Apr 11, 2025

Main image: Reuters