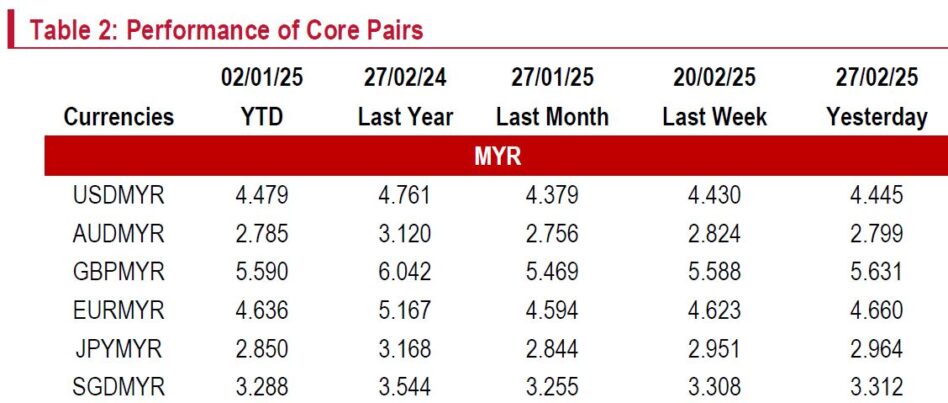

THE ringgit briefly strengthened below 4.40/USD on Monday, buoyed by soft US macro and expectations that Trump’s tariffs would be short-lived.

“However, it later retreated to 4.44/USD after Trump reaffirmed the Canada-Mexico tariffs,” said Kenanga Research in the recent Economic Viewpoint Report.

The USD found support as the House passed the budget blueprint, though a weak US consumer confidence reading deepened concerns over slowing consumption and growth, shifting investor expectations to two Fed cuts this year.

Meanwhile, a market-friendly German election result and the US-Ukraine mineral deal strengthened the EUR, pressuring the USD.

A spike in US weekly jobless claims, attributed to weather, has heightened concerns over broader layoffs.

Any labour market deterioration could shift the Fed’s policy stance. Market now awaits core PCE data tonight, where an inflationary surprise could strengthen the USD.

Investors will focus on USMCA trade negotiations and China’s response to new US tariffs, alongside Elon Musk’s attempts to scale back US government spending.

The ECB’s expected 25 basis points rate cut may bolster the USD, while Bank Negara Malaysia is likely to stay on hold, limiting the ringgit’s downside.

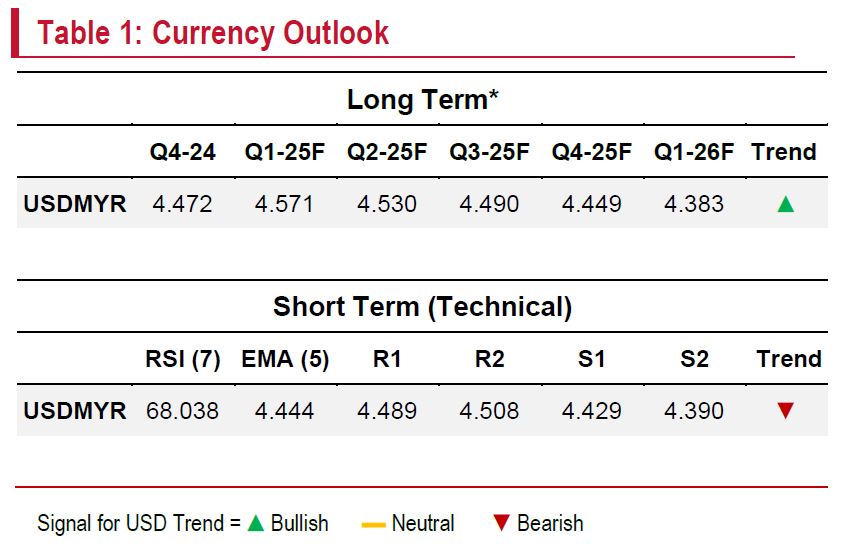

Barring surprises, the local note is expected to trade between 4.44-4.49/USD.

With the relative strength index nearing overbought territory, USDMYR may consolidate around 4.44. However, lingering uncertainty should keep the pair volatile within (S1) 4.429 – (R1) 4.489. —Feb 28, 2025

Main image: Reuters