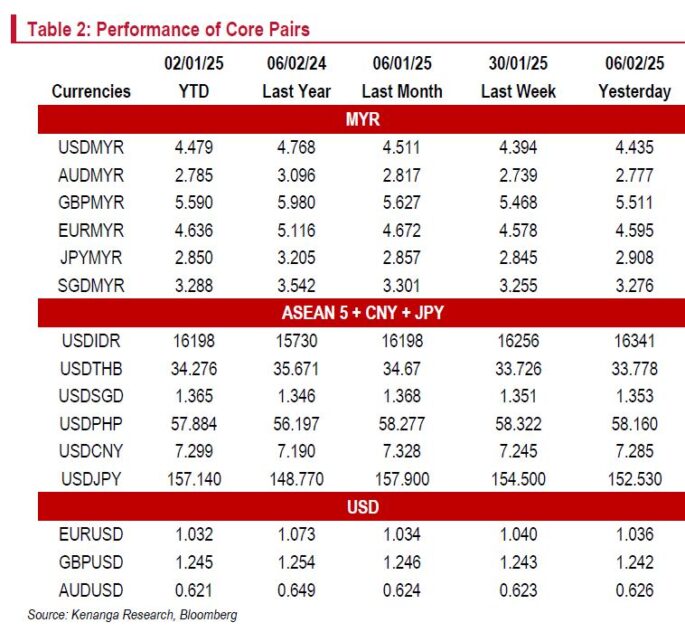

THE ringgit swung between gains and losses, briefly weakening beyond 4.50/USD on Monday after the Trump administration imposed tariffs.

“However, it later stabilised near 4.42-4.44/USD following a last-minute 30-day deal to delay tariffs on Mexico and Canada,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

Risk aversion persisted as China, now the sole tariff target, responded with measured retaliation.

Recession fears pushed the 10-year UST yield below 4.50% , the first time since Dec 2024, while Trump’s speculative remarks on Gaza added uncertainty, dampening sentiment.

Signs of a cooling US labour market emerged, with JOLTS data showing declining job openings.

Investors now await nonfarm payroll data; benchmark revisions may weigh on the USD.

A weak reading could signal slowing US growth, but an expected sticky inflation data next week keeps Fed policy uncertainty alive.

Moving forward, the USD may not react immediately to tariff announcements, as seen on Monday, but could strengthen once duties take effect and appear more permanent.

Focus remains on US-China talks and EU tariff risk. The ringgit is expected to trade within the 4.40-4.45/USD range, driven by trade developments and broader risk sentiment.

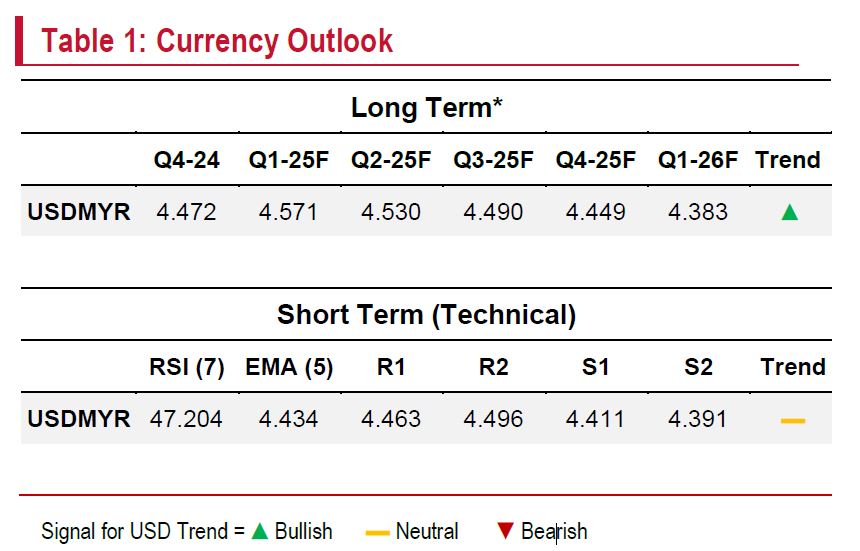

USDMYR outlook remains neutral, likely to test its five-day exponential moving average at 4.434 as the relative strength index hovers in mid-range.

Immediate resistance at (R1) 4.463; a break higher could target (R2) 4.496, especially if US-China tensions escalate. —Feb 7, 2025

Main image: The Edge