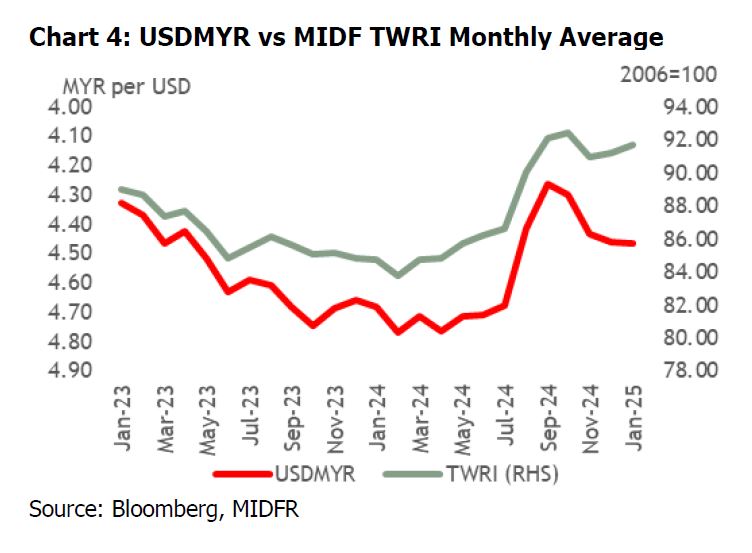

THE ringgit turned to a slight appreciation against the USD, appreciating by +0.3% month-on-month, and ended the month at RM4.458 (previous: RM4.472), being the strongest level last month.

“While we remain optimistic about Malaysia’s economic fundamentals and outlook, the recent weakness in the ringgit can largely be attributed to a reversal of capital flows from emerging markets back to the US, driven by a longer-than-expected period of interest rate differentials,” said MIDF Research (MIDF).

Given the slower pace of rate cuts, MIDF foresees the Fed would not ease its monetary policy aggressively in 2025.

However, they remain cautious of the potential for inflation to pick up again, driven by ongoing economic and job market strength.

Meanwhile, as they obtain further clarity on the US newly elected government’s stance on tariffs, MIDF foresees the increasing probability of a higher inflationary environment in the US to pan out, which could again shift market expectations on the trajectory of the federal funds rate path.

However, at the moment, MIDF does not think it would derail their current view of at least one -25 basis points rate cut in the second half of calendar year 2025.

“Echoing Powel’s speech after the Jan-25 FOMC meeting, we do not think that the central bank is in a hurry to cut rates again,” said MIDF.

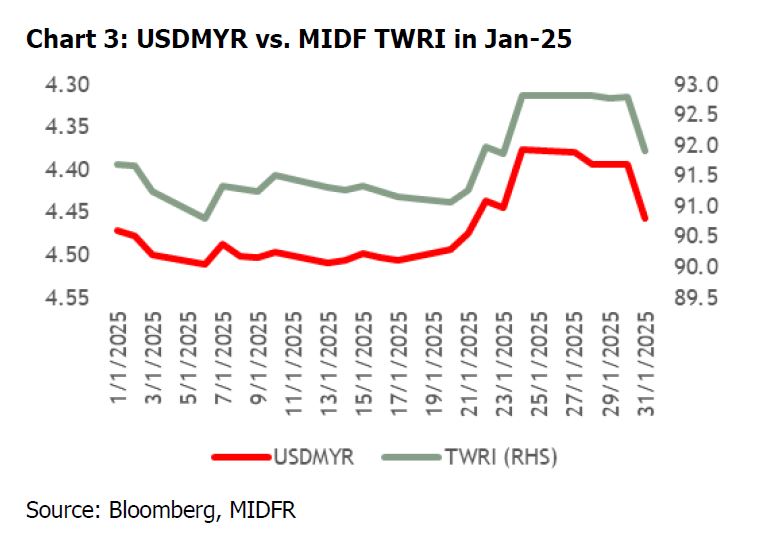

Ringgit strengthened against currencies of Malaysia’s major trading partners as shown by the MIDF Trade-Weighted Ringgit Index (TWRI) increased by +0.3% month-on-month to 91.90 (Dec-24: 91.56), this indicates that the ringgit performed better against its trading partner while the ringgit appreciated against the USD.

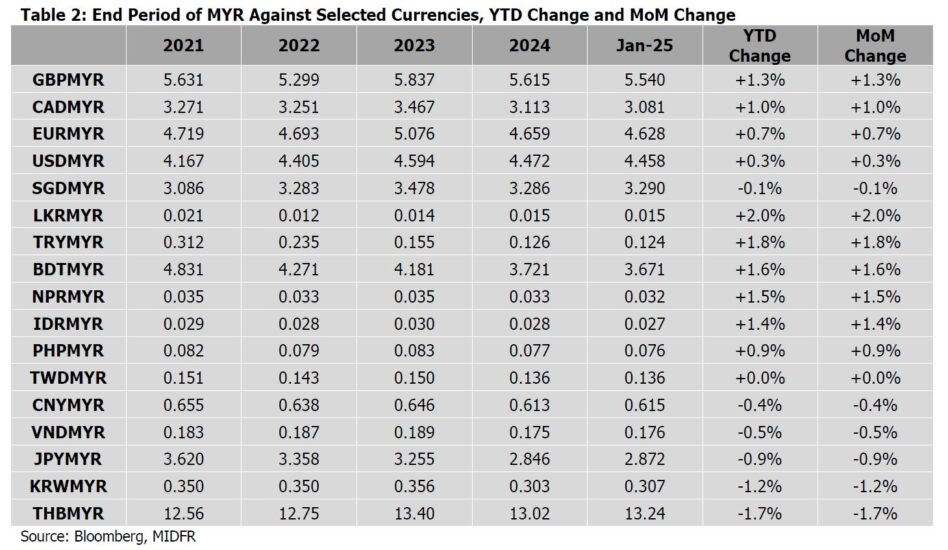

The appreciation of the ringgit against the US dollar is also reflected towards the ringgit’s performance against other cross-currency pairings.

Ringgit experienced appreciation against the major currency, the ringgit appreciated against the euro by (+0.7% mom) and the pound sterling (+1.3% mom).

The ringgit appreciated the most against the Sri Lankan Rupee (+2.0% mom).

In contrast, the ringgit depreciated the most against the Thailand baht (-1.7% mom) and Korean won (-1.2% mom) as these currencies registered relatively stronger appreciation during the month.

“We continue to expect that the Malaysian ringgit will remain on track on its strengthening trend against the USD, however at a more gradual pace on the back of the movement in the US monetary policy trajectory,” said MIDF.

MIDF thinks that the ringgit will appreciate with an average of USDMYR4.23 for the year.

Although the unwinding of the US monetary policy will be slower than previously expected and interest rate differential spreads may continue to remain wide, the narrowing later in the year will still favour the emerging market currencies including the ringgit.

Malaysia’s growth fundamentals also remain supportive for ringgit to strengthen given the continued surplus in terms of the balance of trade and current account.

“On the same note, we expect our MIDF TWRI to increase towards 95.0 by year-end as we expect the ringgit could appreciate further against other currencies,” said MIDF. —Feb 4, 2025

Main image: Choo Choy May