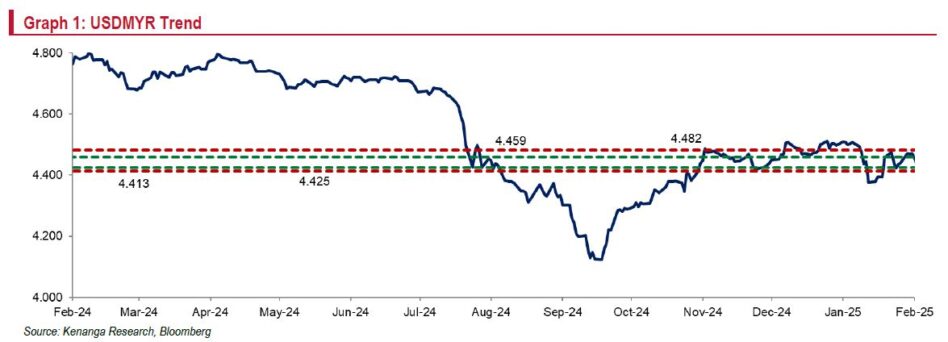

THE ringgit edged weaker than expected, trading between 4.44 and 4.47 against the USD.

The USD index (DXY) remained firm around 108.0, underpinned by strong US labour market data and renewed tariff threats, including a fresh 25.0% levy on steel and aluminium imposed over the weekend.

“Investor sentiment remained cautious amid uncertainty over Trump’s trade policies,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

A stronger-than-expected US inflation print further bolstered the DXY, tempering hopes for near-term Fed easing.

However, efforts by Trump and Putin to push for an end to the Russia-Ukraine war provided some relief, limiting USD gains.

Focus now shifts to US retail sales data and geopolitical developments in the Russia-Ukraine conflict.

Domestically, stable macroindicators, including GDP, trade, and inflation, should help limit the ringgit from further depreciation.

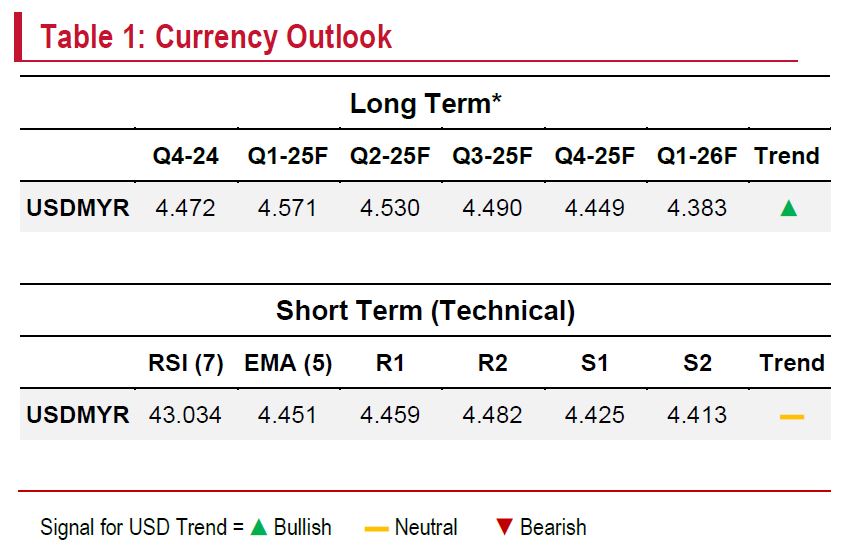

“Markets now expect just one Fed rate cut, likely in September, over the next 14 FOMC meetings, but we still anticipate two Fed cuts this year, contingent on Trump’s tariff policies and potential retaliation,” said Kenanga.

While the US has delayed reciprocal tariffs, implementation could begin as early as April 2, keeping risk assets on edge. The ringgit is seen trading between 4.42 and 4.47/USD next week.

USDMYR remains neutral, likely testing its five-day exponential moving average at 4.451 as the relative strength index hovers mid-range. —Feb 14, 2025

Main image: 123RF