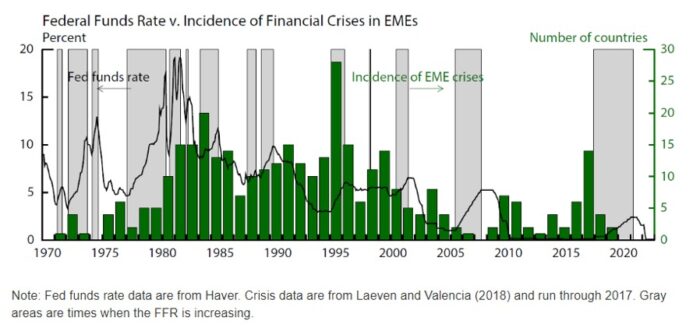

RISING US interest rates coupled with the quantitative tightening (QT) are often disruptive through negative spill-over effects on emerging market economies (EMEs) as they triggered capital reversals due to the interest rate differential, increased debt burdens, increased cost of imports, exchange rates depreciation, and a tightening of financial conditions that can lead to currency and financial crises.

The incredible Volcker disinflation that occurred in the early 1980s which saw a steep rise in US interest rate to fight inflation was associated with a sharp rise in the incidence of financial crises in EMEs.

In the mid-1990s, the US Federal Reserve chair Alan Greenspan who was once hailed as the omnipotent “maestro” of the US economy, had raised interest rate to manage inflation and avoided a recession.

But this had triggered massive negative spill-overs for the vulnerable emerging markets. What ensued was the Tequila Crisis in Mexico in 1994; the collapse of the hedge fund Long-Term Capital Management (LTCM) and the Russian Crisis in 1998.

The 1997-1998 Asian Financial Crisis (AFC) was triggered by Thai baht devaluation on deteriorated economic fundamentals and capital outflows, sparking a contagion currency and financial crisis sweeping across Asia.

However, during the Fed’s tantrum in 2013 and 2015, the US central bank started raising interest rate for the first time since keeping the rate at zero between 2008 and 2015, EMEs had weathered rising US rates pretty well amid experienced volatility in the financial and foreign exchange markets.

Contagion effect

To what extent the disruptive spill-overs of higher US interest rates and strong US dollar have to emerging markets would depend on domestic economic and financial conditions of these economies.

Economies with higher macroeconomic vulnerabilities tend to be more disruptive and sensitive to capital outflows that caused sharp depreciation of their currencies, surge in borrowing cost due to tightening liquidity conditions and rising US interest rate.

Can the emerging economies withstand the capital outflows pressure? Some central banks have raised interest rates and use foreign reserves to defend their sinking currencies, but raising rate (which means higher borrowing cost) can cause economic growth and domestic demand to slow.

Moreover, the indebted borrowers (households and businesses) have to service more of their debt payment in domestic currencies. In addition, borrowers with loans denominated in foreign currencies also have to incur higher payments to service their existing debt, an action which may trigger capital outflows.

Raising the US interest rates is an indispensable trigger for the collateral damage of emerging economies that have low level of foreign reserves, high exposure of external debt, especially short-term debt, persistent large current account deficits, unsustainable budget deficits, weak economic growth and high inflation.

We reckon that central banks in the region will continue to monitor the spill-overs and put in safeguard measures to intermediate the impact of capital reversals and currencies depreciation, hence, a full-blown financial crisis in the region is unlikely.

Nevertheless, we should not underestimate the collateral impact. While we expect pressures on exchange rates and bond yields to persist for some time on rising US interest rates, it is unlikely for the strong US dollar to spark a contagion currency crisis in the region stemming from the fall-out in a currency of another country given many countries are now better prepared fundamentally.

Most central banks have adopted flexible exchange rate regime which allows them to adjust to two-way capital flows:

- Accumulated large stock of foreign reserves buffer against the capital reversals. Regional economies have learned from the painful experiences of the 1997-1998 AFC to build ample reserves resilience to buttress their currency and economy.

Thailand’s reserves stood at US$220.0 bil as of end-July 2022 (1997: US$26.9 bil); Indonesia (US$133.2 bil as of end-July 2022; 1997: US$17.5 bil), South Korea (US$415.0 bil as of end-July 2022; 1997: US$20.5 bil), and Malaysia (US$108.2 bil as of end-August 2022; 1997: US$15.2 bil).

- External debt of emerging market economies has risen significantly in the aftermath of the 2008-2009 Global Financial Crisis (GFC). Higher US interest rate and increasingly tighter global financial conditions have resulted in a re-orientation of global capital flows and depreciation of emerging markets currencies, raising concerns on their external financing vulnerabilities.

Malaysia’s external debt is higher relative to her peers (2020: 67.6% of GDP): Indonesia (39.4% of GDP), Thailand (40.9% of GDP), the Philippines (27.2% of GDP). Malaysia has a higher proportion of domestic currency external debt due to the holding of Malaysian bonds by non-residents.

As about one-third of national external debt is ringgit denominated (90% of total Federal Government debt), it is not affected by the ringgit’s depreciation, but the outflows (non-residents reducing the holdings of government bonds) will accentuate the ringgit’s depreciation. In addition to Malaysia’s external buffers (increased in the value of external assets), the country’s reserves accumulation will also help to mitigate and adsorb the impact of interest rate and exchange rate shocks.

- Many countries have strengthened their current account and fiscal balances, and not all have twin deficits. The current account surplus mirrors the excess savings of the economy which will facilitate the repayment of external debt.

Malaysia has been enjoying current account surpluses since 1998 though the surpluses have been narrowing over the years (2021:3.5% of GDP vs 1997: -5.5% of GDP). However, since 1998, the budget balance has been in persistent deficits for decades (2021: -6.4% of GDP; 1998: -1.8% GDP).

Indonesia’s current account surplus stood at 0.3% of GDP (1997: -1.5% of GDP) while budget deficit was 4.6% of GDP in 2021. Thailand has registered twin deficits in 2021 (current account deficit of 2.1% of GDP and higher budget deficit of 6.9% of GDP).

- Government debt in emerging markets have generally been increasing, reflecting the deficit spending to counter cyclical amid increased spending commitments. As of end-2020, Malaysia’s Federal Government debt (62.0% of GDP) was higher than Indonesia’s 39.4% of GDP, Thailand (44.9% of GDP) and South Korea’s (42.4% of GDP). For Singapore, the debt to GDP ratio of 155.4% is not a concern as these borrowings are backed by assets. It has a strong balance sheet with assets well in excess of our liabilities, thus making it a net creditor country.

Managing external spill-overs

Malaysia has experienced several episodes of large and volatile capital flow reversals and has been able to withstand external shocks considerably well.

The 2008-2009 Global Financial Crisis saw portfolio outflows of US$26.0 bil during the 3Q 2008 to 1Q 2009 period while the 2014-2015 oil price shock saw portfolio outflows which amounted to US$13.7 bil between 3Q 2014 and 3Q 2015.

Since 2015, when the US Federal Reserve had increased its policy rate nine times by 225 basis points, the ringgit depreciated by about 50% from RM2.9675 per US dollar in May 2013 to the trough of RM4.4995 per US dollar in January 2017.

Bank Negara Malaysia (BNM) has deployed its international reserves to mitigate the significant withdrawal of foreign currency liquidity and to prevent excessive ringgit exchange rate fluctuations that would have harmed the Malaysian economy and businesses.

The central bank’s BNM’s international reserves (US$108.1 billion as of end-August 2022; 5.4 months of imports of goods and services and 1.1 times total short-term external debt) remain adequate to meet the potential foreign currency needs during periods of sizeable capital withdrawals and to ensure sufficient liquidity. The flexible exchange rate regime allows the ringgit to adjust against the two-way capital flows.

The banking sector remains strongly capitalised and domestic capital market is deep and efficient to mitigate the impact of capital-flow volatility. Malaysia’s participation in regional and global international financial adds another layer of buffer against foreign currency liquidity crisis.

We have to work on reviewing policies and regulations as well as implement structural reforms to reduce regulatory barriers to enhance market efficiency, thus ensuring policy transparency and certainty as well as sustaining better growth prospects.

The Government should move to alleviate structural fiscal deficit and reduce debt and liabilities to rebuild fiscal buffer against future shocks. – Sept 13, 2022

Lee Heng Guie is the executive director at Socio-Economic Research Centre (SERC) Malaysia.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.