HEALTHCARE demand in Damansara and the larger Klang Valley area remains robust.

“With population growth and an increasingly ageing demographic, a growing middle to upper income segment, rising affluence and higher case mix complexity, we believe that Malaysia’s private healthcare’s structural strengths remain intact for hospitals to expand in support of growing demand,” said Maybank Investment Bank (MIB) in a recent report.

MIB’s most recent sector update elaborated on these points at large, and they reiterate their view that medical tourism remains a catalyst to further bolster both patient growth and revenue intensity as Malaysia remains a key destination within ASEAN for an affordable yet high quality healthcare offering.

“However, while there is undeniably room for multiple players to coexist and thrive, we believe that hospitals have to continuously differentiate themselves to sustain long term profitability,” said MIB.

While demand is strong, patient distribution is not uniform, and competition for premium paying patients, specialists, and advanced medical services is intensifying.

Ultimately, while MIB believes that the market can sustain multiple hospitals, not all will benefit equally, making strategic positioning and service excellence the key to long term survival.

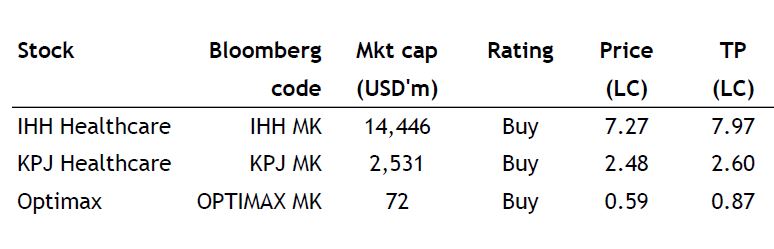

As for the hospitals within their coverage, MIB maintains their buy calls on KPJ and IHH as they believe earnings should remain intact in the near term as they have established their brand standings, care quality and patient loyalty even in the face of new challenges whether from potential regulation restructuring or direct competition in the form of new hospital launches for now.

Note that IHH has no hospitals in the Damansara area with the nearest being Pantai Hospital Kuala Lumpur in Bangsar which is 15km away from SMCD.

As MIB understands, IHH has no plans to build or acquire hospitals in the Damansara area. —Feb 2, 2025

Main image: Malaysia Healthcare Travel Council