IT seems that airline caterer Brahim’s Holdings Bhd will not be alone to greet the end of its lifespan as a listed entity.

Following hard on its heels is Scomi Group Bhd whose days are numbered after Bursa Malaysia Securities Bhd rejected its request for more time to submit its regularisation plan after the global service provider in the oil & gas (O&G) and transport solutions industries fell into Practice Note (PN17) status in December 2019.

This came about as Scomi Group’s shareholders’ equity spread was less than 25% of its issued share capital with its equity having dropped below RM40 mil based on its financial results for the quarter ended June 30, 2019.

Scomi Group is now at risk of being delisted from the Main Market on April 22 unless it is able to submit its appeal by April 18 to prevent its securities from being removed from the local bourse.

“Upon submission of the company’s appeal and pending Bursa Securities’ decision, the delisting of the securities of the company from the Official List of Bursa Securities will be deferred,” Scomi Group noted in a Bursa Malaysia filing yesterday (April 11).

“However, Bursa Securities shall proceed to suspend the trading of the company’s securities on April 20, 2022,” it said.

At the time of writing Scomi Group nosedived 2 sen or 80% to 0.5 sen with 58.49 million shares traded thus valuing the company at a mere RM6 mil.

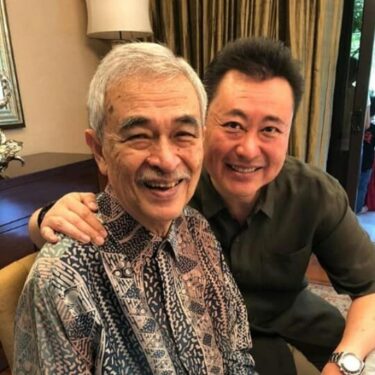

Coincidence or otherwise, the sound of the death knell on both Brahim’s and Scomi Group spells a blow to two listed entities with family link to Malaysia’s fifth Prime Minister Tun Abdullah Ahmad Badawi (2003-2009) – Brahim’s was founded by Abdullah’s brother Datuk Seri Datuk Seri Ibrahim Ahmad Badawi while Scomi Group which was listed on May 13, 2003 was controlled by businessman son Tan Sri Kamaludin Abdullah.

Recall that Kamaludin and his partner Shah Hakim @ Shahzanim Zain (who is currently the CEO) controlled 44.32% of Scomi Group via their vehicles Kaspadu Sdn Bhd and Onstream Marine Sdn Bhd. Abdullah became PM on end-October 2003, five months after Scomi Group’s listing.

In a cover story in The Edge Weekly (Feb 11-Feb 17, 2019) entitled “Scomi’s Colourful Past”, writer Jose Barrock made the following historical observation on Scomi Group:

“Just a few years before that, the company had been known as Subang Commercial Omnibus & Motor Industries Sdn Bhd and was largely in the business of buses, but the emergence of Kamaluddin and Shah Hakim as shareholders in 2000 paved the way for much bigger things, specifically, forays into the oil and gas sector.

“At the time, a head of research of a Singapore-based group said, ‘It (SGB) can’t go wrong, future PM’s son’s company, oil and gas some more … can close eyes and buy.’

“In July 2003, two months after its flotation exercise, Scomi Group’s stock hit a record high of RM16 per share and it was trading at a price-earnings multiple of almost 70 times in anticipation of stronger oil prices. This, in turn, spurred demand for Scomi Group’s services which included supplying drilling fluids, a substance used to reduce friction in exploring for oil.”

Well, needless to say, Scomi Group – like many other listed entities that were ultimately delisted in the past – went through numerous upheavals which left it in the state that it is in today.

At the end of the day, suffice to say that crony capitalism which leverages collusion between a business class and the political class will never be able to outlive the test of time. – April 12, 2022

Main photo credit: Bernama