ALL planters under Hong Leong Investment Bank (HLIB)’s coverage will likely deliver quarter-on-quarter (QoQ) earnings growth in their upcoming results season starting from Nov 2024.

Seasonally stronger output season will likely lift planters’ quarter three 2024 upstream earnings.

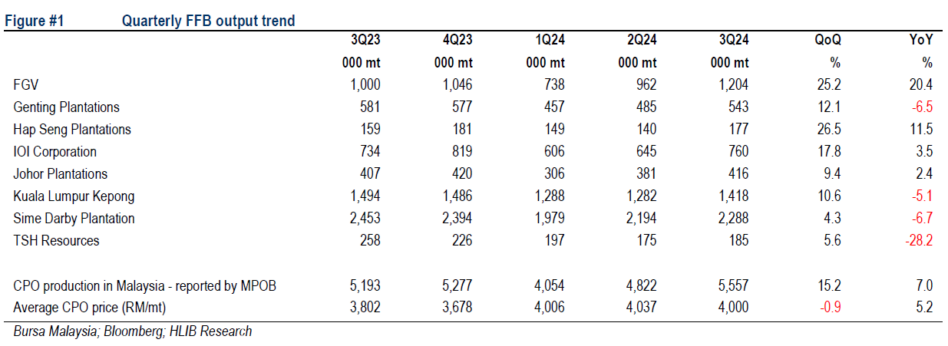

“During the quarter, all planters under our coverage registered QoQ fresh fruit bunch (FFB) output increase of 4.3-26.5%. For downstream segment, we believe weak refining margin arising from export tax differential between Malaysia and Indonesia, and overcapacity of refining sub-segment in Indonesia will likely be partly mitigated by improved performance at oleochemical sub-segment. This is on the back of replenishing activities by European customers ahead of EUDR implementation,” said HLIB in the recent Sector Update Report.

Planters with higher exposure in Malaysia (namely FGV, HSP, IOI, and JPG) will likely register better upstream earnings than those with higher exposure in Indonesia.

This is due to better palm productivity in Malaysia arising from improved labour availability, while palm productivity in Indonesia likely weakened, mainly on the back of the carryover effect from El Nino in end-2023.

Performance at the downstream segment likely improved on a year-on-year basis, mainly on the back of low base effect and improved demand from European customers.

Crude palm oil (CPO) price has surged by more than 10% since early-Oct, due mainly to concerns on weaker output from both Malaysia and Indonesia and seasonal cropping pattern and lagged impact from El Nino in end-2023.

Then there is the Indonesian government’s recent announcement to go ahead with its plan to raise its biodiesel mandate by 5% points to B40 from Jan-2025 onwards, which will boost palm oil consumption and reduce palm oil stockpile in Indonesia, and inventory replenishing by China.

“We raise our CPO price assumptions by RM150 per metric tonne to RM4,150 per metric tonne in 2024 and RM200 per metric tonne to RM4,000 per metric tonne in 2025, to reflect the recent uptrend in CPO price, and we believe this will remain at elevated levels possibly until 1Q25, supported by weak palm output and robust near term demand,” said HLIB.

HLIB will only adjust earnings forecasts and target prices on individual planters to reflect higher CPO price assumptions, changes in export taxes, and minimum wage hike, in the upcoming results season.

“Based on our estimates, every RM100 per metric tonne raise in our CPO price assumption will lift earnings forecasts for plantation stocks under our coverage by 3.5-15.0%,” said HLIB.

HLIB maintains our Neutral rating on the sector for now, pending a review in our earnings forecasts and TPs in the upcoming results season. For exposure, HLIB’s top picks are IOI and HSP. —Nov 6, 2024

Main image: palmdoneright.com