THE famous maxim by stock market participants – “sell in May and go away” – has apparently hold true for Bursa Malaysia in the long run according to Hong Leong Investment Bank (HLIB) Research’s observation.

Evidently, the FBM KLCI is down -2.8% month-to-date (MTD) as of May 18 while the regional ASEAN-5 has fallen by a larger quantum of -4.6%.

“Interestingly, the saying goes beyond just the month of May; in a broader sense, it is used to describe the market’s historical underperformance spanning from May to October (i.e., the Northern Hemisphere’s summer period into Halloween),” explained head of research Jeremy Goh in a strategy note.

“Proponents of this adage advocate staying out of equities from the May to October period and reinvest during November to April.”

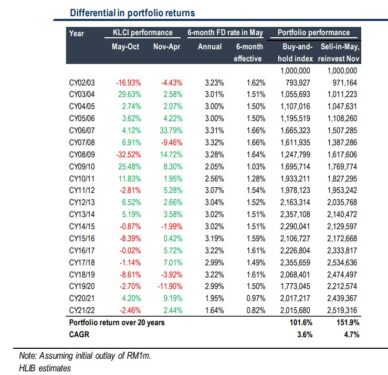

While both time horizons showed positive simple average returns over a 20-year study – 1.19% for May-October and 3.61% for November-April – the latter was three times higher than the former.

“Incidence of positive/negative returns was also higher/lower during the November-April period vs May-October,” noted HLIB Research.

As such, investors can leverage such passive long term (gauge) to undertake the following strategy:

- Stay out of the market from May-October and park their proceeds in a “risk-free asset” – the six-month fixed deposit (FD) rate in May averaging 2.90% per annum or 1.45% six-month-effective over the past 20 years which is higher than the FBM KLCI’s average return of 1.19% during that period; and

- Subsequently, re-invest in equities from November-April which yielded average returns of 3.61%.

“Such a strategy (i.e., sell-in-May and re-invest-in-November) would have generated a total portfolio return of 151.9% from May 2002 to Apr 2022 (compound annual growth rate [CAGR]: 4.7%), outperforming the ‘buy-and-hold index’ method which generated returns of 101.6% (CAGR: 3.6%) over that same period,” opined HLIB Research.

While its study supports the notion that the “sell in May and go away” phenomenon broadly applies (in the long run) to the local bourse, the research house cautioned investors against taking it literally, but rather as a guide that the market has greater odds of outperforming in the November-April period vis-à-vis the May-October period.

“Coming back to fundamentals, we keep our end-2022 FBM KLCI target unchanged at 1,680 (16.2 times CY22 PE [price-to-earnings ratio]), banking on (i) Malaysia’s relative appeal amid the Ukraine-Russia conflict; (ii) sustained endemic re-opening; and (iii) possibility of an early 15th General Election (GE15) (likely in August-October),” added HLIB Research. – May 20, 2022