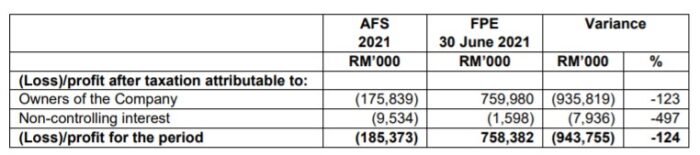

SERBA Dinamik Holdings Bhd has highlighted a deviation or variance exceeding 10% between its unaudited net profit for the 18-month financial period ended (FPE) June 30, 2021 and that of its audited financial statement (AFS) for the said period (AFS 2021).

The deviation amounting to 124% is derived from the company having stated RM758.38 mil as its unaudited net profit for FPE June 30, 2021 as opposed to a net loss of RM185.37 mil in its audited AFS 2021.

In compliance with Paragraph 9.19(35) of the Main Market Listing Requirements of Bursa Malaysia Securities Bhd, the global integrated oil & gas (O&G) service provider is required to make an announcement to the stock exchange on the matter.

Serba Dinamik attributed the variance exceeding 10% to adjustments of the following transactions recorded in AFS 2021:

- Impairment of trade receivables made by subsidiaries of the group amounting to RM395 mil which was underprovided during the release of the FPE June 30, 2021.

Those impairment was made in view of limitation addressed by the company’s external auditor Nexia SSY PLT in its auditors’ opinion to obtain appropriate audit evidence on trade receivables due to time limitations and occurrence of additional significant events.

In view of the above, the group has decided to provide impairment to those trade receivables and in the event that those trade receivables are collected subsequently, reversal of the impairment will be made accordingly.

- Inventory write down of RM552.6 mil due to current circumstances which has resulted to disruption and/or termination of several projects undertaken by the group by its customers.

Those inventories are further subject to valuation for potential disposal in future – and in the event that they are later disposed – the gain on disposal will be recorded in the subsequent audited financial statement.

In a related development, Serba Dinamik said it is taking the necessary steps to address its Practice Note 17 (PN17) status.

“The company is in the midst of formulating a plan to regularise its financial condition and the announcement on the same will be made in due course in accordance to the Main Market Listing Requirements of Bursa Malaysia Securities Bhd,” noted Serba Dinamik in a Bursa Malaysia filing.

Serba Dinamik has triggered the prescribed criteria pursuant to Paragraph 8.04 and Paragraph 2.1(d) of PN17 whereby the company’s external auditors has today expressed an opinion disclaimer in the company’s audited financial statements for the 18-month financial period ended June 30, 2021.

In the event the company fails to comply with any part of its obligations to regularise its condition within the time frames permitted by Bursa Securities, the market regulator can suspend the trading of Serba Dinamik’s shares on the sixth market day after the date of notification of suspension by Bursa Securities.

Additionally, Bursa Securities has the right to de-list the company subject to its right to appeal against the de-listing with the appeal to be submitted to Bursa Securities within five market days from the date of notification of de-listing by Bursa Securities. – Jan 6, 2022