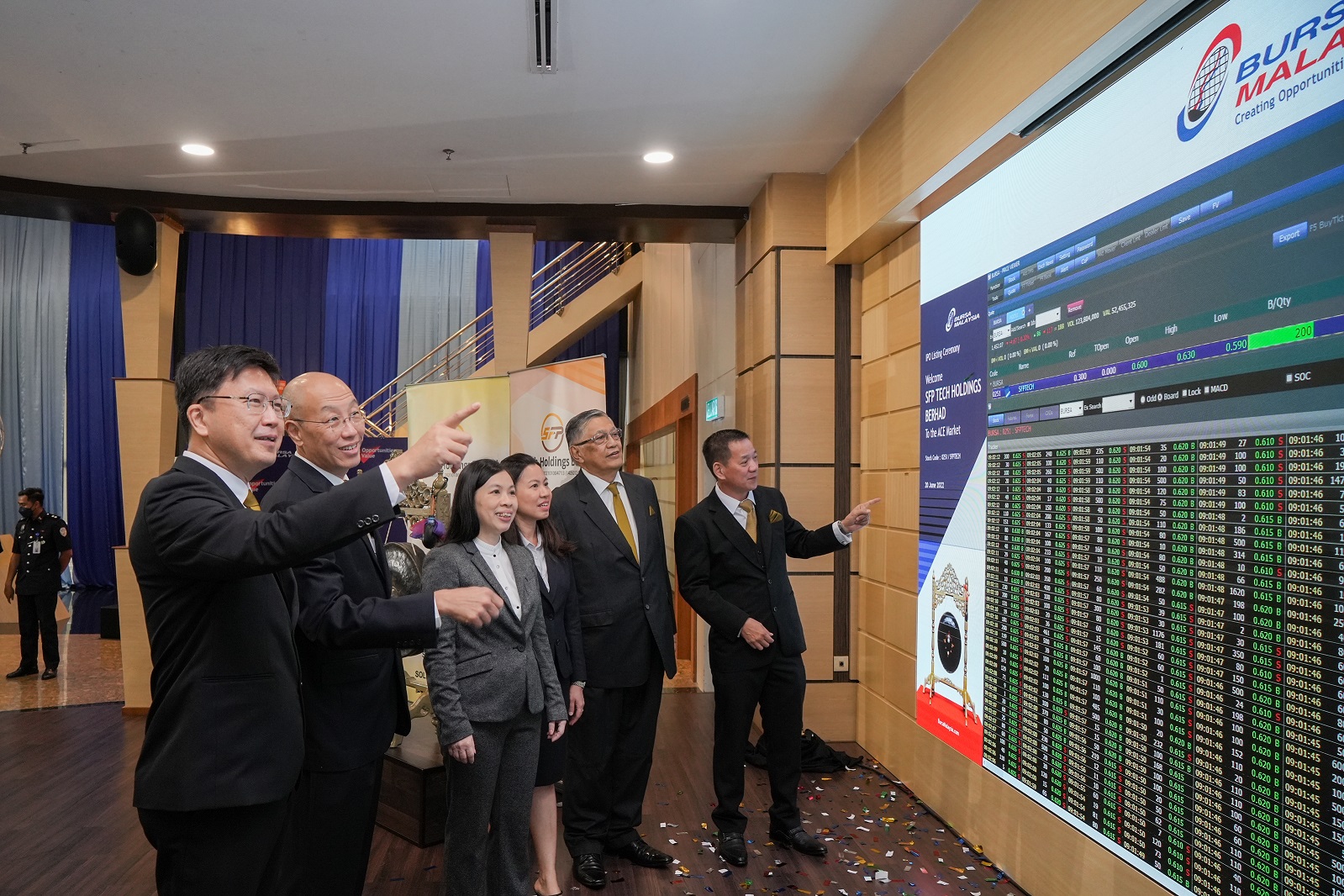

IN a day when soaring inflationary concerns have been wreaking havoc on global stock markets, ACE Market debutant SFP Tech Holdings Bhd stoutly withstood the storm with a handsome 120% premium over its initial public offering (IPO) price of 30 sen/share.

The one-stop integrated engineering and automation solutions provider surged to 59 sen at the sound of the gong before rallying to an intra-day high of 68.5 sen prior to consolidating at 66 sen, up 36 sen to be the day’s most actively traded stock with a volume of 237.46 million shares.

In fact, the 36 sen gain which gave the counter a commendable market cap of RM528 mil is enough to position the stock as the day’s second biggest gainer (thus far) behind Nestle (M) Bhd (which rose 40 sen to RM131.60).

SFP Tech’s IPO exercise entails a public issue of 207.44 million new ordinary shares which based on its issue price of 30 sen and the enlarged issued share capital of 800 million, will generate a market cap of RM240 mil.

The IPO proceeds of approximately RM62.23 mil will be predominantly utilised for its capital expenditure which includes the construction of a third manufacturing plant in Penang Science Park and purchase of machineries. The proceeds will also be utilised for the set-up of a design and development (D&D) centre.

“As demonstrated from the public portion of our shares, which was oversubscribed by 41.61 times, this is a strong testament from the public of our abilities and potential which we are greatly thankful for,” commented managing director Keoh Beng Huat after the company’s listing ceremony.

“We have developed a clear roadmap and hope to grow from strength to strength and create value for all our shareholders as we now embark on a more challenging growth trajectory aiming for better and higher returns to all our shareholders.”

Moving forward, the SFP Tech plans to further expand both its engineering supporting services and automated equipment solutions into other industries such as the automotive and healthcare industry.

The group also intends to move into the semiconductor back-end inspection industry through the manufacturing of vision inspection equipment platforms embedded with camera imaging and electronics system.

Indeed SFP Tech has outclassed fellow ACE Market debutant Unitrade Industries Bhd which ended its maiden day’s trading last week with a 2 sen ‘deficit’ from its IPO price of 32 sen.

The counter is currently trading at 26 sen, down 1.5% or 5.45% with 23.62 million shares traded, thus valuing the company at RM406 mil. – June 20, 2022