A CEASEFIRE deal that had been brought to the table was reached on 15 Jan. Thereafter, shipping heavyweights namely Maersk and Hapag Lloyd have stated that they do not see an immediate return to the Red Sea after the ceasefire between Israel and Hamas, stating that they are monitoring the situation.

Over the weekend, Houthi forces have backed the ceasefire agreement, with a spokesperson reportedly stating that they will halt military operations against Israel as well as commercial ships in the Red Sea when the ceasefire comes into force.

“This is caveated, however, with the condition that US, UK and Israel cease their aggression,” said Kenanga Research (Kenanga) in the recent Thematic Report.

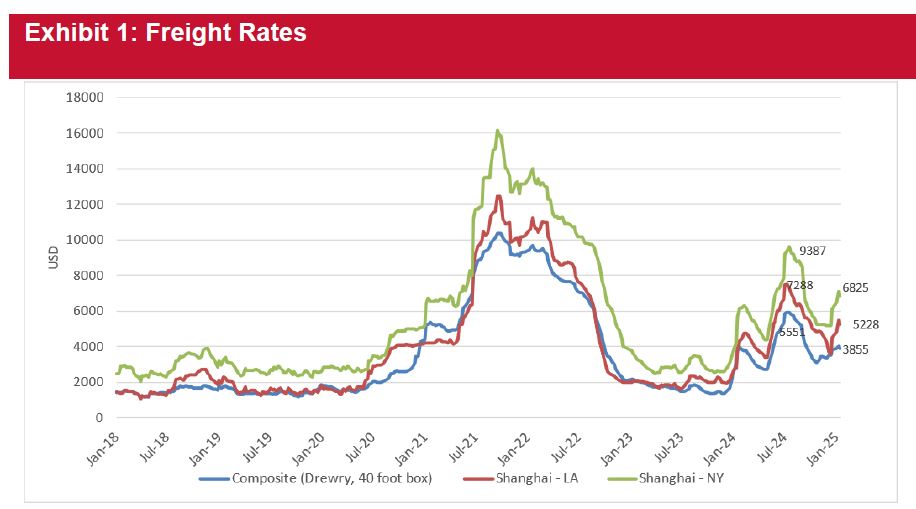

Freight costs peaked in quarter three of calendar year 2024 (3QCY24) and gradually eased thereafter. This is before it inched back up slightly towards the turn of the year due to reasons such as frontloading.

The expectation of shipping rates being benign from here may be anecdotally seen in the share prices of shipping giants as Hapag-Lloyd Ag and MAERSK, respectively, losing 9% and 3% on Thursday and Friday.

“For the effect on freight cost, we will watch for developments in phase 2 (6 weeks from now) where Israeli troops are set to fully withdraw,” said Kenanga.

The diversion from the Suez Canal to the Cape of Good Hope as well as port congestion could gradually ease, and thereby increase the frequency of calls that shipping lines could make at WPRTS, as well other ports in the region.

Locally, the Malaysian government had in Dec 2023 banned Israeli-flagged cargo ships to dock locally, but as WPRTS predominantly serves the intra-Asia route, it wasn’t heavily burdened by the developments.

Even so, the port operator is likely to benefit most indirectly from better scheduling and reduction in vessel bunching, which could remove schedule unpredictability and the occasional accompanying congestion.

Spillover beneficiaries of better shipment scheduling would be exporters.

“To make the case, we look at glove makers. Sales or order shipments by glove makers are made free on board (FOB), which means buyers assume the liability and bear the cost of transportation,” said Kenanga.

Even so, glove makers have experienced delays in shipments due to logistics caused by the Red-Sea conflicts.

Over the past three quarters the glove makers Kenanga covered had each have to endure back-logged orders to the tune of 400 mil to 600 mil pieces of gloves, which delays timing of revenue recognition; for context, Kenanga estimate that TOPGLOV, HARTA and KOSSAN combined have 130 bil pieces annual running capacity.

“Our preferred plays for gloves are HARTA and KOSSAN,” said Kenanga.

More directly, firms in the plastics supply chain have had to contend with elevated freight rates as seen in recent quarter’s results.

Kenanga estimates that freight could be their second largest cost component after resin (raw materials cost), at around a 5% mix, generally speaking.

As such, lower freight may bring a degree of relief for these firms.

“We monitor for downward normalisation of tanker rates as vessels may no longer need to be rerouted through the Cape of Good Hope which is a longer voyage, if the ceasefire manages to bring about a stop in the Houthi attacks, which have been presumably brought about following the conflict in Gaza,” said Kenanga.

This may have the effect of dampening the oil tanker rates and we watch for impact on MISC.

To this end however there are opposing factors which include expectations of a tightening supply from wider sanctions by US on the Russian fleet, which are pressuring rates upwards.

All considered, a Gaza ceasefire is seen as a favourable outcome for those impacted by the boycott sentiment, including that for NESTLE.

The magnitude of recovery also has to take into account shifts by customers to competing brands, and behavioural change that could hinder a return to pre-boycott market levels.

“We note that NESTLE’s sales have in nine months of financial year 2024 dropped 11% year-on-year albeit this also could also be partly due to overall prevailing soft consumer spending,” said Kenanga.

The benefit to consumer companies from the import of goods from China such as MRDIY and PADINI is expected to be small, given that their shipping costs have stabilised recently.

A recovery in the Malaysian consumer sentiment towards international brands perceived as supportive of the Israeli cause, may also in turn increase their marketing budgets, and ultimately provide relief for the advertisement spending in the broader consumer space.

“We are watching the impact of recovery to firms such as MEDIA, although this would likely be a second order effect,” said Kenanga. —Jan 20, 2025

Main image: hegelmann