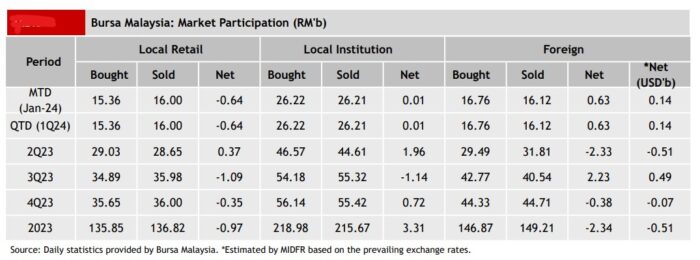

FOREIGN investors returned as net buyers of Bursa Malaysia by contributing to a net foreign inflow of RM267.7 mil albeit last week being a shortened trading week in conjunction with the Thaipusam public holiday on Thursday (Jan 25).

They only net sold -RM66.6m on Tuesday (Jan 23) but were net buyers for the rest of the week, according to MIDF Research.

“As expected, Bank Negara Malaysia (BNM) kept its overnight policy rate (OPR) unchanged in its first 2024 Monetary Policy Committee (MPC) meeting at 3.00%,” the research house pointed out in its weekly fund flow report.

“We expect the central bank to maintain status quo on its monetary policy stance throughout 2024 to ensure a sustainable growth momentum for the Malaysian economy.”

The top three sectors with the highest net foreign inflows were financial services (RM112.2 mil), utilities (RM97.3 mil) and property (RM86.6 mil) while the top three sectors with the highest net foreign outflows were consumer products & services (-RM39.6 mil), industrial products & services (-RM38.0 mil) and healthcare (-RM21.2 mil).

However, local institutions turned net sellers for the week, after disposing -RM167.1 mil worth of equities. They only net bought RM21.0 mil on Tuesday (Jan 23) but were net sellers for the rest of the week.

Likewise, local retailers remained on a net selling spree with a -RM100.6 mil disposal of Bursa Malaysia stocks last week.

This is their fourth consecutive week of net selling. Like local institutions, they only net bought on Tuesday (Jan 23) at RM45.6 mil but were net sellers for the entire week.

In terms of participation, there was an increase in average daily trading volume (ADTV) among local institutions and foreign investors by +3.3% and +2.5% respectively while local retailers recorded a decrease of -14.6%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Vietnam sustained its net foreign inflows for the second consecutive week at US$36.5 mil while the Philippines posted foreign funds inflow of US$14.2 mil, reversing the brief net selling of -US$8.9 mil observed the prior week.

However, Thailand witnessed net foreign outflows for four consecutive weeks at -USD320.1 mil last week followed by Indonesia whose six-week streak of net foreign inflows ended after foreign investors net sold -US$33.8 mil last week.

The top three stocks with the highest net money inflow from foreign investors last week were Malayan Banking Bhd (RM117.9 mil), YTL Power International Bhd (RM79.7 mil) and Malaysian Resources Corp Bhd (RM62. 1 mil). – Jan 29, 2024