SUNWAY-HOI Hup’s joint development, The Continuum, is showing impressive progress, with its take-up rate rising from 44% at the end of July to 65.9% currently.

To recap, The Continuum, launched in April 2023, is a 30:70 joint venture between Sunway and Hoi Hup with a gross developmental value of SGD2.2bil and comprises 816 units.

“This recent surge in sales defies the typical pattern of the Singapore property market, where strong take-up rates are usually concentrated during the initial launch phase or the final stages of construction, within six months before completion,” said Hong Leong Investment Bank (HLIB) in the recent Sector Update Report.

The Continuum is likely reaping the benefits of spill-over demand from the highly successful launch of the nearby Emerald of Katong, which achieved a staggering 99% take-up of its 845 units within just three days.

Located only 950m away in the same neighbourhood, The Continuum boasts a significant advantage as a freehold project, compared to Emerald of Katong’s leasehold status.

Despite the freehold status, units at The Continuum were sold at an average selling price of SGD2,842 per sf, representing only a modest 7.8% premium over Emerald of Katong’s SGD2,637 per sf.

This is notably below the typical 15-20% premium commanded by freehold projects over leasehold counterparts.

“Consequently, we see upside potential for The Continuum’s pricing as the project gains traction, further bolstered by the current latent demand in the area,” said HLIB.

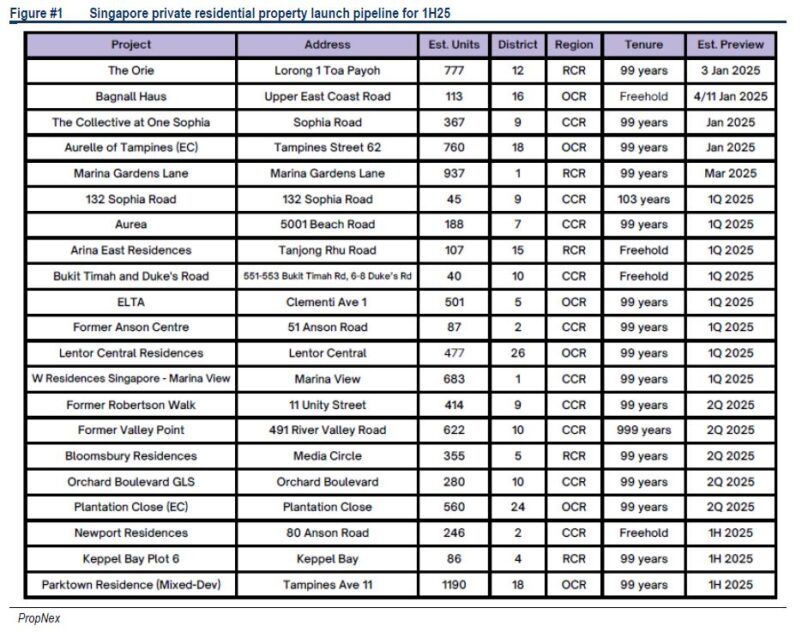

Based on information from PropNex, Marina View is now slated for launch in quarter 1 2025 (1Q25), a delay from the earlier guidance of a launch before the end of financial year 2024 (FY24).

While no official date has been announced, channel checks suggest the project may be opened to the public in early-Jan 2025.

Dec is less ideal for a launch due to year-end seasonality, with buyers and sales agents typically on holiday.

“In our view, time is of the essence for IOIPG to launch Marina View soon. Firstly, property sentiment remains robust, creating a favourable environment for new launches,” said HLIB.

Secondly, IOIPG faces an impending deadline for the developer’s Additional Buyer’s Stamp Duty (ABSD) in Sep 2026. An earlier launch would provide a better, albeit slim, chance of avoiding this penalty.

After a subdued first nine months, Nov 2024 is shaping up to record the highest private home sales in over a decade, pending official data release.

This surge reflects a significant shift in property sector sentiment, driven by the Federal Reserve’s rate cut cycle initiated in Sep, which has reduced mortgage rates and borrowing costs while boosting buyers’ loan eligibility.

For developers, the declining interest rates have also lowered development costs by providing cheaper funding, creating a more favourable environment for new projects.

Looking ahead, Dec is expected to be quieter due to year-end holidays, but private home sales are anticipated to regain momentum in 2025.

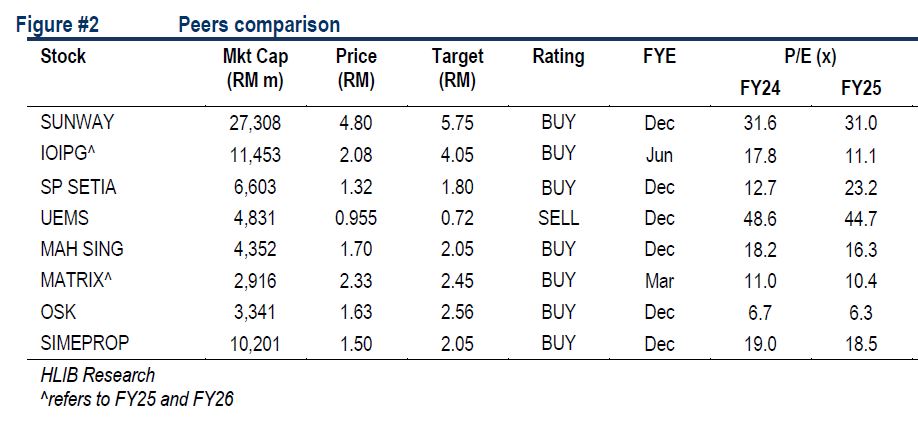

“We maintain our OVERWEIGHT rating on the overall property sector as we think that a multi-year upcycle for Malaysia is now set in motion. Our sector top picks are IOIPG, OSK, SimeProp and Sunway,” said HLIB. —Dec 3, 2024

Main image: jll.com.sg