“THIS mortgage loan amount is within my Debt Service Ratio (DSR) range.”

“Since the bank said I am eligible for RM xxx,xxx amount of loan, I am going to take up the max loan amount.”

Just because you get approval for a huge mortgage loan amount doesn’t mean that’s the right choice for you.

It’s really a question of Affordability vs Eligibility.

There is much more to consider beyond the DSR calculation when deciding what size of mortgage is best for you and your family. Yes, you may qualify for a large mortgage but that doesn’t mean it’s the right thing to do. There is a difference between how much you can qualify for and how much you can actually afford.

Truth of the matter

How much mortgage you can be eligible for is based on your ability to pay. How is that determined?

When it comes to determining your ability to pay, lenders will look at your income and assets as well as your current liabilities or what you owe to others. For instance, if you have other commitments to banks or creditors, your ability to pay is reduced.

Taking together all of these factors help to determine the maximum mortgage loan you can qualify for.

However, it does not end here. As a borrower, you must always consider affordability.

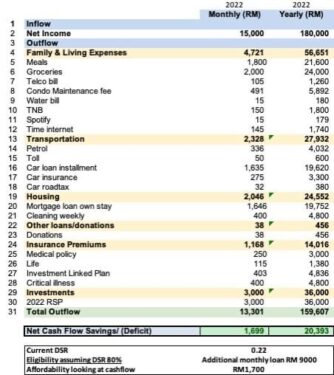

How much can you actually afford? We all have financial obligations that go beyond the credit report and bank approvals

Family groceries, utility bills, medical expenses, insurance, school fees & child-care, tuition costs and not to mention dreams and aspirations like traveling, hobbies, education and retirement (some day!) are commitments that are not part of the calculation factors to determine credit eligibility.

Affordability is determined by considering these many factors that make up a snapshot of your cash flow and financial standing. Affordability largely considers whether you can sleep comfortably at night with the property acquisition and ensuring a balance that your home fits into your family’s goals and priorities.

Also, each person is different on how much risk one is comfortable with. Having a mortgage and owning a home involves risk (although that may also come with rewards). Exploring these items and coming to a realistic and holistic view of your financial and personal situation, goals and priorities will only benefit you.

Don’t overcommit

Going through an affordability analysis empowers you to make a much wiser and more informed decision about what kind of mortgage best suits you, your family and your future. The mistake a lot of many people are making without realising is committing to a property acquisition coupled with long term loan prior to calculating their affordability.

Do remember that signing on a mortgage is a long term commitment, hence you need to be sure that you really understand the difference between qualification and affordability.

With the right (and unbiased) information and guidance, you can determine what’s truly best for you, your family, and your financial future.

The last thing you want is for your property acquisition to become a financial nightmare which is what can happen if you fail to properly consider mortgage affordability. This applies to both property acquisition for your own stay or for investment purposes. – Sept 4, 2022

Rozanna Rashid, CFP, IFP is a director and licensed financial planner with Alpine Advisory Sdn Bhd.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.