IN my previous article, I addressed the importance of having adequate Mortgage Reducing Term Takaful (MRTT) or Mortgage Reducing Term Assurance (MRTA) coverage.

It is quite common to encounter clients who have MRTA or MRTT coverage for only 15 years but their mortgage is for 30 years.

One client that I have encountered said the tenant of his property would pay the mortgage for the remaining years if something should happen to him.

For property investors, this may sound all too familiar to you. Especially when you have this thought in mind:

- Do not plan to keep forever, want to exit at 10/15th year.

- It is for investment, hence tenant is paying the mortgage.

- Want to trim costs of the investment or to increase your return of investment (ROI) and internal rate of return (IRR).

Oversight

Have you ever thought of what will happen if one of the below situation occurs:

- There was a bad accident that resulted in total permanent disability and you suffered the inability to work. How would this impact your heirs in terms of repayment of the mortgage? What if the property has negative cash flow OR is still under construction?

- In the event of demise or disability, would your heirs and family members know what to do with the investment property?

- Your desired timeline to dispose is delayed or postponed due to weak demand or prices, hence resulting in lower target price to sell, so you hold for longer instead leading to no or little sum assured for the balance loan you currently have.

Here’s an example:

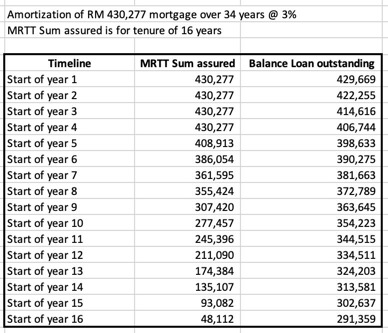

A client of mine bought an investment property that was under construction with loan value of RM 430,277.

It has a remaining loan tenure of 34 years and for simplicity sake, we use an interest rate of 3% and the mortgage is tied to a MRTT of 16 years.

The table below illustrates the schedule of the sum assured against estimated loan balance. Do note that as the base lending rate changes over time, the outstanding loan amount will also be impacted.

As we can see, for the first five years of the property (including under construction period), the sum assured from the MRTT is enough to cover the loan balance.

However, this is not the case after next the five years where the sum assured decreases. At the end of the 16th year of MRTT, coverage is where the property loan is at its riskiest with a substantial loan amount with no coverage.

Should anything happen, there is no guarantee of continuous rent payments. Can your heirs handle vacancies and serve the full amount of the mortgage due (on top of other considerations such as repairs, maintenance fees, refurbishments to maintain the property and maintain a desired rent, and breakeven on mortgage instalments)?

Furthermore, bear in mind that in the event of demise or total permanent disability (TPD) during the under construction phase, there is no tenant to chip in with rental payments to help your heirs sustain the financial commitments.

Before you embark on the journey of engaging into long term, substantial loan commitments, think about the WHAT IFs and remember that you are not invincible.

Can you bear to leave your heirs in a state of grief and frustration of dealing with the worldly commitments you left behind?

Rozanna Rashid, CFP, IFP is a director and Licensed Financial Planner with Alpine Advisory Sdn Bhd.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.