ALTHOUGH weak ringgit could buoy export strength, prospects of moderating global demand could hinder the sustainability of Malaysia’s export growth.

CGS-CIMB Research foresees exports of electrical & electronic (E&E) goods to start coming down amid normalised global demand for E&E products.

“China, in particular, has the largest market share in semiconductor at 31.5% and likely to lead the slow growth onwards amid its own domestic growth issues as well as being affected by the US trade restrictions,” projected economist Nazmi Idrus in an economic update.

“Meanwhile, export prospects for palm oil also remain quite bleak as Indonesia has extended its export duty exemption of the product for the second time from October till year-end, putting domestic palm oil exports in a more prolonged suppression.”

CGS-CIMB Research’s bleaker outlook comes amid Malaysia’s exports having expanded 30.3% year-on-year (yoy) in September (August 2022: 48.1% yoy) – which is slightly lower than Bloomberg median consensus expectation of 31.5% – for its 13th consecutive month of double-digit growth since August 2021.

In terms of products, exports of manufactured goods moderated to 28.7% yoy (August 2022: 47.6%), underpinned by softer shipment of E&E products (39.8% yoy) and petroleum products (83.3% yoy).

Nevertheless, the country’s trade surplus widened to RM31.7 bil from RM17.0 bil in August, marking the highest surplus ever recorded (beating the previous high of RM31.5 bil in December 2021).

With the September data, Malaysia’s 3Q 2022 trade balance rose to RM64.3 bil from RM58.0 bil in 2Q 2022 and 3Q 2021’s RM60.9 bil.

On the positive side, although Malaysia has resumed its exports of fresh chicken – thus reversing a ban that began on May 23 – as supply stabilised, CGS-CIMB reckoned that this is inadequate as the share of exports of live animals and prepared meat products are minimal at 0.2% to total exports.

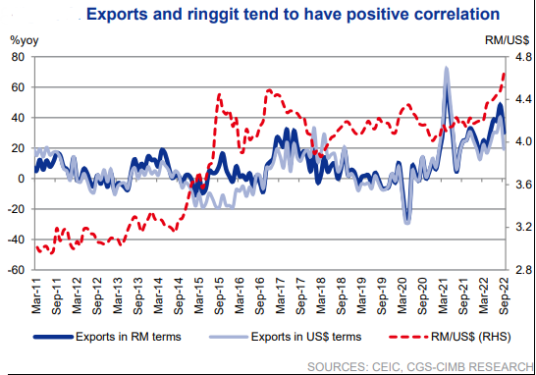

Even as it could see some sustained strength from the weaker ringgit, the research house remains wary of the pressure from the global economic slowdown which will likely be stronger towards the year-end as reflected by the contraction in the global manufacturing PMI (Purchasing Managers’ Index) reading at 49.8 in October – the first retreat below the neutral 50.0 level since June 2020.

“As such, we maintain our expectation of a moderating GDP growth rate in 2023F at 5.0% compared with an expansion of 7.3% this year,” added CGS-CIMB Research. – Oct 20, 2022