WHILE Bank Negara Malaysia (BNM) has resorted to raise the record low 1.75% overnight policy rate (OPR) which has been in place since July 2020 by 25 basis point to 2%, the hike should not be seen as a signal of aggressive tightening.

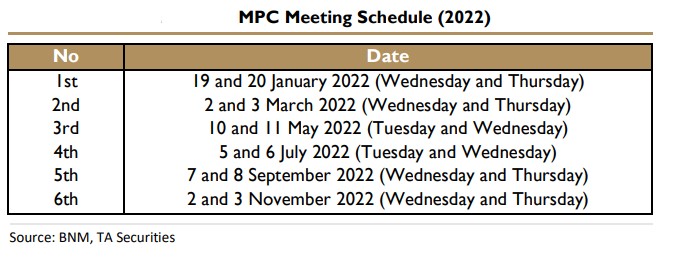

On whether such trend would persist in the near future – another round of hike when the central bank’s Monetary Policy Committee (MPC) meets on July 5 and 6 – TA Securities Research expects BNM to first assess the impact by vigilantly monitoring Malaysia’s economic performance that include real gross domestic product (GDP), private consumption growth and inflation.

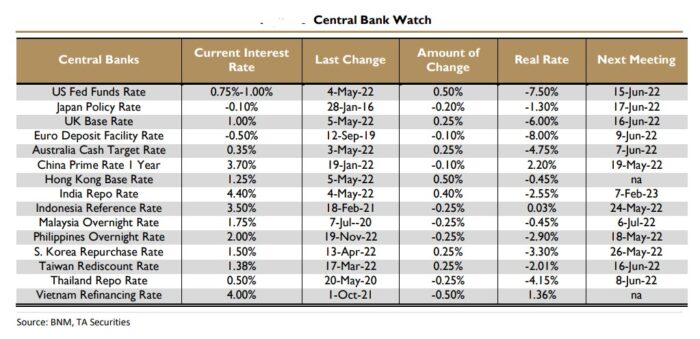

“Major central banks around the world have started – or at least hinted – to increase their benchmark interest rate to contain the inflationary pressure. The US had raised its benchmark interest rate by 50 basis points, the biggest increase in more than two decades,” opined economists Shazma Juliana Abu Bakar and Farid Burhanuddin in an economic update.

TA Securities Research further recalled that when BNM last raised the OPR in January 2018 by 25 basis point to 3.25%, private consumption growth recorded a moderate growth of 6.6% year-on-year (yoy) in 1Q 2018 versus 6.9% yoy in 4Q 2017.

However, it picked up pace to 8% yoy in 2Q 2018 driven by continued strength in income and employment. Back then, consumer spending was also boosted by lower inflation following the zerorisation of the Goods and Services Tax (GST) rate and stronger consumer sentiments.

“Meanwhile, the jobless rate stood at 3.3% and inflation rate at 1.3%. Having said that, we believe that the OPR hike will also affect inflation rate in the coming months as evident in January 2018 when the consumer prices moderated to 2.7% yoy from 3.6% yoy previously,” projected TA Securities Research.

A bright spark moving forward is that the rate hike is likely to induce capital flows into the Malaysian shores. The Malaysian bond market registered RM4.5 bil foreign net inflow in January 2018 with foreign investors being the net buyer of RM3.4 bil of local equities during the same period.

“We also believe that the hike would prevent the ringgit from further weakening as it is currently trading above RM4.38/US$,” opined the research house.

“We expect the ringgit to strengthen at least in the near term as what we have witnessed in January 2018 when our currency appreciated by 3.7% month-on-month (mom) to RM3.899/US$ from RM4.047/US$ the month before.”

TA Securities Research also expects another rate hike to be in the pipeline but towards end-2022. “If materialises, it will be by another 25 bps, bringing the OPR to 2.25%,” noted the research house.

To recap, the OPR climbed to its highest on record at 3.5% in April 2006 when the central bank raised the rate from 3.25%. It was subsequently maintained at 3.5% until Oct 24, 2008, according to BNM data.

“We do not expect BNM to simply adjust OPR in response to external changes such as aggressive tightening measures in the US and the recent weakness in ringgit,” TA Securities pointed out.

“Any decision to hike OPR will indicate BNM’s confidence in the country’s economic fundamentals including the stability of domestic market.

“We believe the focus will be on economic growth while balancing on inflation risks. Upside risks exist going forward from elevated commodity prices, a hike in minimum wages and the Government’s review of blanket fuel subsidies.”

For now, the research house is not changing its 2022 key macroeconomic projections – with real GDP at 6% and headline inflation at 2.8% yoy. – May 12, 2022