FOLLOWING its sovereign rating outlook revision on Malaysia to “stable” from “negative”, S&P Global Ratings has similarly revised the economic risk trend for the Malaysian banking sector to “stable” from “negative” to reflect stabilisation of operating conditions.

The revision takes into account five banks, namely Malayan Banking Bhd (Maybank), CIMB Bank Bhd, Public Bank Bhd, RHB Bank Bhd and AmBank (M) Bhd

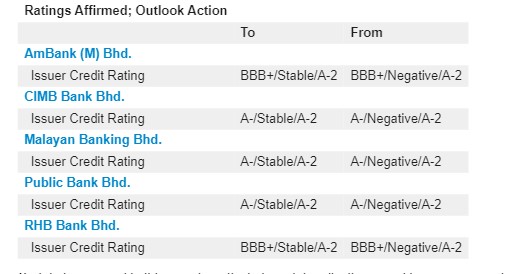

At the same time, S&P affirmed its ‘A-’ long-term and ‘A-2’ short-term issuer credit ratings on Maybank, CIMB Bank and Public Bank, and its ‘BBB+’ long-term and ‘A-2’ short-term issuer credit ratings on RHB Bank and AmBank.

“These rating actions follow our outlook revision on the sovereign credit rating to ‘stable’ from ‘negative’,” justified the Top-Three international credit rating agency. “We revised the outlook to stable in recognition of Malaysia’s consistently strong growth trend that is faster than countries of similar income level.”

“Though Malaysia’s budget deficits remain high, we expect its growth dynamics to offset vulnerabilities associated with its weak fiscal settings. In addition, political commitment to resume fiscal consolidation post-pandemic is strong, in our view,” added S&P.

S&P further noted that it has revised its economic risk trend on the banking sector to stable from negative to reflect the improvement in operating conditions.

“Malaysian banks’ financial profile will likely stay resilient against higher inflation and rising interest rates. Asset quality risks have subsided with loans under repayment assistance for our rated banks dropping sharply to 5%-6% of domestic loans as of end-April 2022 from 15%-25% as of end-February 2022,” observed the credit rating agency.

“The non-performing loan (NPL) ratio also remains contained at 1.6% as of April 2022, marginally higher than 1.4% as of end-December 2021.”

As a response to COVID-19, Malaysia allowed two rounds of six-month automatically approved moratorium programs for all retail and small and mid-size enterprise customers. Such customers account for about 75% of loans in the commercial banking system.

The second round of moratoriums expired in early 2022 with the corresponding loans under relief having eased significantly. The majority of the remaining relief loans are to B50 (bottom 50% of individual borrowers by income) customers who have lost their jobs or are experiencing an income loss of at least 50%.

In S&P’s opinion, 25%-30% of these restructured loans are at risk of turning into NPLs.

“These represent loans to people working in industries that suffered long term dislocation such as tourism or hospitality. Such loans could add up to 1.0-1.5 percentage points to NPLs,” projected the credit rating agency.

“They would likely crystallise in late 2022 or even 2023 because the moratorium programme allows debt restructuring of up to 24 months. The sector-wide NPL ratio could therefore peak at 2.5%-3% in the next two years.”

S&P expects the controlled increase in NPLs to be manageable given that banks have made significant pre-emptive provisioning over past two years.

As such, the need for additional provisioning should be lower despite the higher NPLs. In addition, the banking sector has ample capital buffers as reflected in its 15.2% common equity Tier-1 ratio as of Dec. 31, 2021 and prudent dividend pay-outs. – June 29, 2022