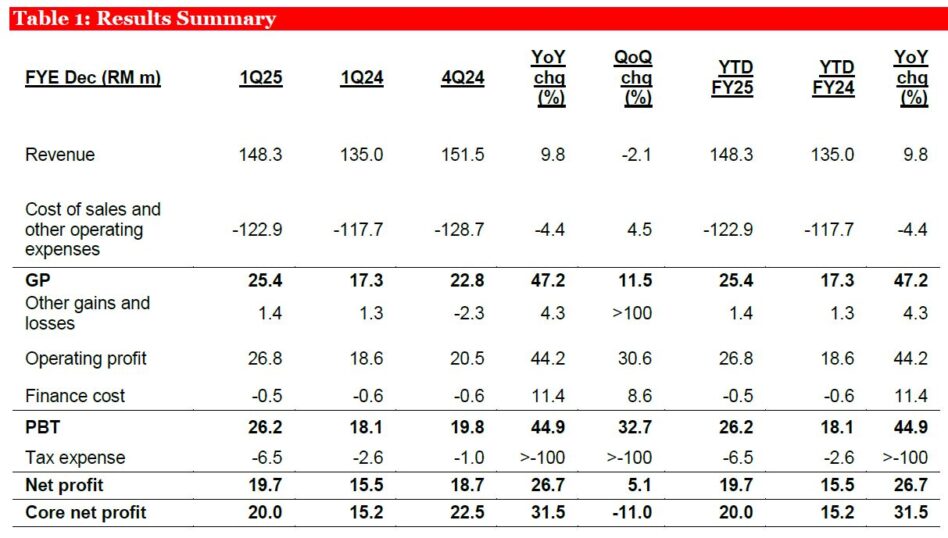

SPRITZER reported a strong set of results, with quarter one financial year 2025 (1QFY25) headline net profit rising 26.7% year-on-year (YoY) to RM19.7 mil, driven by higher sales volume and average selling prices. After adjusting for non-core items, core net profit stood at RM20 mil (+31.5% YoY).

“We remain upbeat on Spritzer’s near-term prospects, supported by resilient bottled water demand, bolstered by the recovery in tourism and stable domestic consumption,” said Public Investment Bank (PIB) in a recent report.

All told, PIB reiterates their Outperform call on Spritzer with a higher Target Price of RM1.82.

Spritzer’s 1QFY25 net profit rose 26.7% YoY to RM19.7 mil, in tandem with stronger bottled water sales.

Excluding non-operating items, core net profit grew 31.5% to RM20 mil in 1QFY25. Notably, gross profit margin expanded by 4.3 points to 17.1%, mainly due to favorable sales mix and lower average PET resin prices at RM4.15 per kg.

“We also note that the improvement in cost efficiency was well supported by economies of scale following the commissioning of new production lines, which enhanced operational productivity,” said PIB.

PIB remains optimistic on Spritzer’s earnings growth trajectory, underpinned by effective branding strategies and targeted marketing initiatives.

The demand for bottled water remains robust, supported by rising tourism activities and the upward revision in the minimum wage, boosting consumer spending.

“We are also encouraged by Spritzer’s ongoing efforts to improve operational efficiency through automation, process enhancements, and market expansion,” said PIB.

Looking ahead, PIB believes profit margins will remain robust, supported by stabilised PET resin costs and greater economies of scale from enhanced production capacity. —June 3, 2025

Main image: Spritzer