KENANGA Research has upgraded to “overweight” from “neutral” its automotive sector outlook on expectation of sustainable car sales post the sales and services tax (SST) exemption period.

It further expects believe order cancellations to be minimal as demand would still outweigh supply given the massive back-logged orders accumulated since last year coupled with the Government’s commitment to absorb the SST for orders before June 30 with Road Transport Department’s (JPJ) registration before March 31, 2023.

“The revision (to ‘overweight’) is driven by the re-opening of economic activities and further boosted by buoyant recovery in car sales as evident from the growing number of back-logged bookings for popular models (up to six months) with stream of new higher-margin models launched in 2022 (including models that were postponed from 2021),” justified analyst Wan Mustaqim Wan Ab Aziz in a sector update.

Yesterday (June 20), the Finance Ministry (MOF) announced that the sales and services tax (SST) holiday for passenger car purchases in Malaysia will end as scheduled on June 30.

But in view of the delays in new car deliveries, buyers who make bookings for a new vehicle up to June 30 will have until March 31, 2023 to register their vehicles with the JPJ to enjoy the tax incentives.

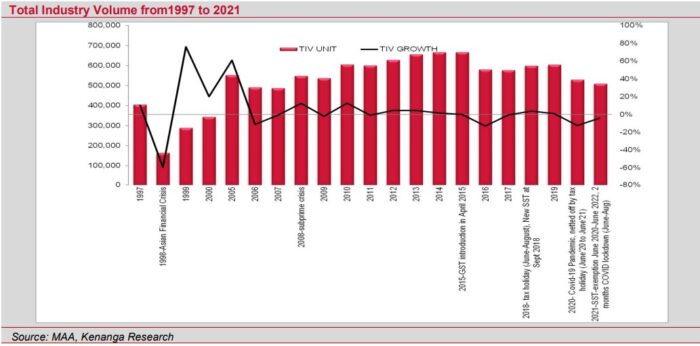

“Our 2022 TIV (total industry volume) target at 600,000 units (+18%) is in line with MAA’s (Malaysian Automotive Association) 2022 TIV target,” noted Kenanga Research.

“Additionally, battery electric vehicles (BEVs) new launches are expected to be boosted by full exemption on import and excise duties, sales tax, road tax, and individual tax relief of up to RM2,500 for the costs of purchase and installation as well as rental and subscription fees of EV charging facilities up to Dec 31, 2025 (for CKD and CBU up to 2023) to support development of the local EV (electric vehicle) industry.”

Meanwhile, CGS-CIMB Research described the Government’s “mid-point solution” as positive for Malaysia’s auto sector as it will provide healthy demand visibility for the next nine months.

“However, we see downside risk to 2023F total industry vehicle (TIV) numbers as a consequence. We keep our projection of 580,000 TIV (+14% year-on-year [yoy]) for 2022F which is slightly lower than the MAA’s 2022F forecast of 600,000 (+18% yoy),” opined analyst Mohd Shanaz Noor Azam.

“Despite the potentially higher TIV, we still see earnings risks for the sector in view of (i) unfavourable forex; and (ii) inflationary pressures from rising raw materials and labour costs.”

All-in-all, CGS-CIMB Research retained its “neutral” outlook on the sector as it thinks that the sector’s valuation reflects its mixed growth prospects in 2022F.

“Key upside risks to our ‘neutral’ call are (i) the strengthening of the ringgit vs the US dollar and Japanese yen; (ii) a reduction in interest rates; and (iii) favourable government policies to revive domestic demand,” suggested the research house.

“The ringgit’s depreciation vs the US dollar and Japanese yen, interest rate hikes, a new wave of COVID-19 infections, and extended delay in delivery of orders due to the global semiconductor shortage are key downside risks to our call,” added CGS-CIMB Research. – June 21, 2022