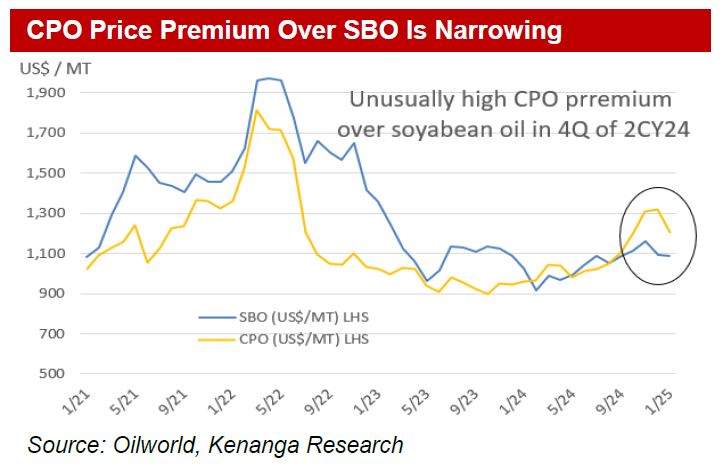

AS anticipated by the market as well as Kenanga Research (Kenanga), crude palm oil (CPO)’s recent narrowing in price premium to other edible oil such as soybean oil is against a backdrop of its unusually large premium in quarter four (4Q) of calendar year 2024 (CY24).

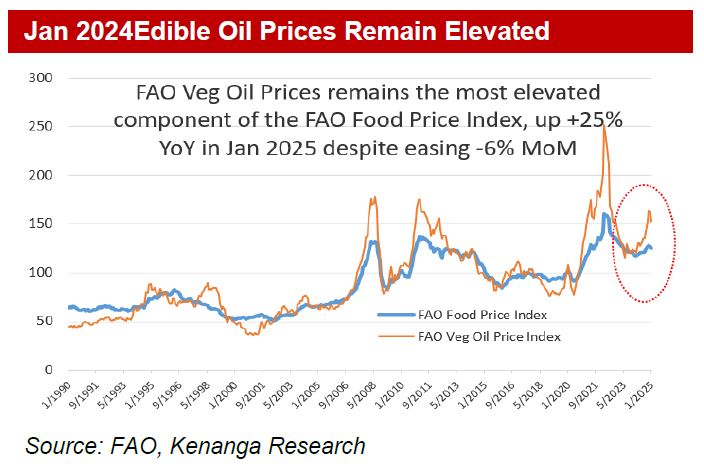

“The price of soybean oil, for example, held steady in Jan CY25 and was 6% higher year-on-year (YoY),” said Kenanga in the recent Sector Update report.

Prices of other edible oils also held well and stayed elevated despite ongoing palm oil price softness. Reflecting this, FAO’s vegetable oil price index for Jan CY25 slipped 6% month-on-month (MoM) but continued to be 25% above last January’s level.

“Our CY24-25 average CPO is RM4,000 per metric tone (MT), as further consolidation is likely among the various edible oils but the overall outlook is one of firmness for edible oil prices including palm oil due to pending deficits,” said Kenanga.

About 70% of edible oil still end up in the food chain. Another 22%-25% is converted into biodiesel with the rest consumed by the oleochemical and other industries.

Actual amount of biodiesel in circulation is higher due to the use of 15m-20m MT of Used Cooking Oil (UCOs) to produce biodiesel.

Although UCO does not affect the virgin edible oil market, it does show how sizeable the overall biodiesel market is today, approaching 25%-30% of the underlying primary edible oil market.

If edible oil prices soared higher and food inflation being politically sensitive, governments are more likely to tweak down biodiesel usage via top-down policies such as lower subsidies, quotas or push for more UCO biodiesel, possibly even electric vehicles (EV)s.

As such, there is an implied longer term constraints on edible oil prices if prices were to soar persistently; hence, Kenanga’s expectation is a firm outlook for CPO prices over CY25-26 rather than outright bullish.

After trading at a sizable premium in 4QCY24, palm oil price premium to other edible oil has narrowed but may remain sticky until palm oil’s output recovers more meaningfully in the second half (2H) of CY25.

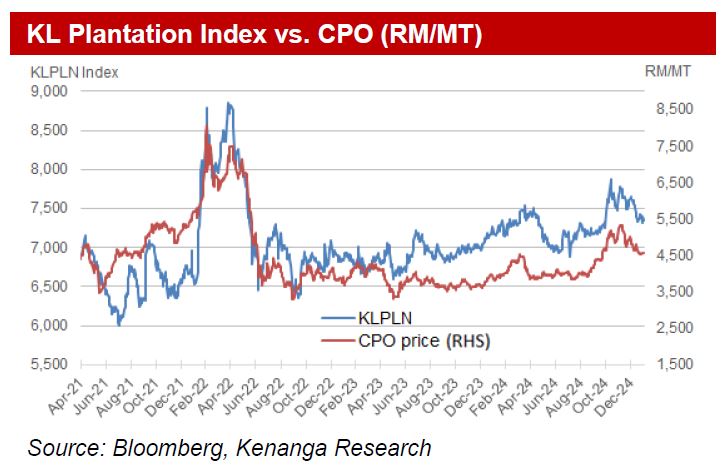

Upstream should do well in CY25, underpinned by firm CPO prices and stable costs.

Minimum wages have risen in Malaysia and Indonesia by 16% and 6-8% YoY, respectively, but the costs of fertiliser and energy remain subdued compared to a year ago.

Moreover, PK prices have been rising since mid-CY23 to average RM2,681 per MT for CY24.

However, PK prices have softened since Dec CY24 as have PKO prices but we still expect a robust year ahead for PK and PKO.

Rival coconut oil is expected to face some export tightness due to rising bio-diesel admixture in the Philippines, the world’s main producer and exporter of coconut oil.

Downstream earnings should improve, edging toward 3%-4% pre-tax margins as demand for oleochemical is expected to recover modestly on easing interest rates in US and EU while China is looking to stimulate its domestic consumption further in CY25. Margins should also normalise on better plant utilisation and prices.

Kenanga maintains overweight for the planters on the back of the following reasons:

1/ Another deficit year ahead for the edible oil market as supply improvement in CY25 is unlikely to catch up with normal demand growth.

As such, edible oil prices, including palm oil, are likely to stay sufficiently firm to temper demand from growing 3-4% down closer to 1%-2% YoY. Kenanga maintains a CPO price of RM4,000 per MT for CY25.

2/ Upstream and downstream earnings should recover. Year-to-date fertiliser and fuel prices have weakened by about 20% and 5%, respectively, while PK prices shot up by almost 30%, YoY. “As such, we expect CY25 upstream cost to remain manageable despite higher minimum wages,” said Kenanga.

3/ Recent CPO price correction has been expected in view of the high premium palm oil was trading at recently compared to soybean oil price. —Feb 12, 2025

Main image: The Star