FUNDAMENTALLY, Kenanga Research (Kenanga)’s forecast is for Malaysia’s overnight policy rate (OPR) to be kept stable in support of economic growth, despite other central banks leaning towards easing.

MYR has so far been steady, versus the 2% decline in the Rupiah against the USD. Anecdotally, confidence can also be gauged from improved foreign holdings of corporate bonds.

The latest news from the US President Trump administration is that by 2nd April, countries will receive a number which the US government believes best represents their tariffs.

This is more specific from an earlier version where there was discussion about stratifying into a few categories its trade partners, by tiering, but this appears to have been ruled out.

The shift to a more individualised tariff depending on each country may make Malaysia relatively less worse off.

“Reiterating from our previous note, the Most Favored Nation (MFN) tariff rate applied to World Trade Organisation members gives us an indication of average effective tariff,” said Kenanga in the recent Market Strategy Report.

This rate, measured from customs/import duties, prescribes that once a lower import tariff is imposed by one country on another country, that tariff must also apply to other member nations.

Measured on a trade-weighted average basis to better account for actual trade flow, MFN stood at 3.3% for Malaysia.

That this is lower than the ASEAN average of 5.3, sans Singapore, means Malaysian exporters would stand at a relative advantage if this is used as yardstick for tariffs to be imposed by the US.

“Even so, we caveat that observing this metric alone isn’t holistic. When applying reciprocal tariffs, US will also consider non-tariff trade barriers, labour suppression etc, and where US deems there is unfairness, and thus it is challenging to accurately assess in our view,” said Kenanga.

US Treasury Secretary Scott Bessent has said countries can negotiate, and to lower the “tariff wall.”

This suggests as well that there may be a buffer with regards to timeline, and confirms that the bigger picture is to bring countries to the discussion table.

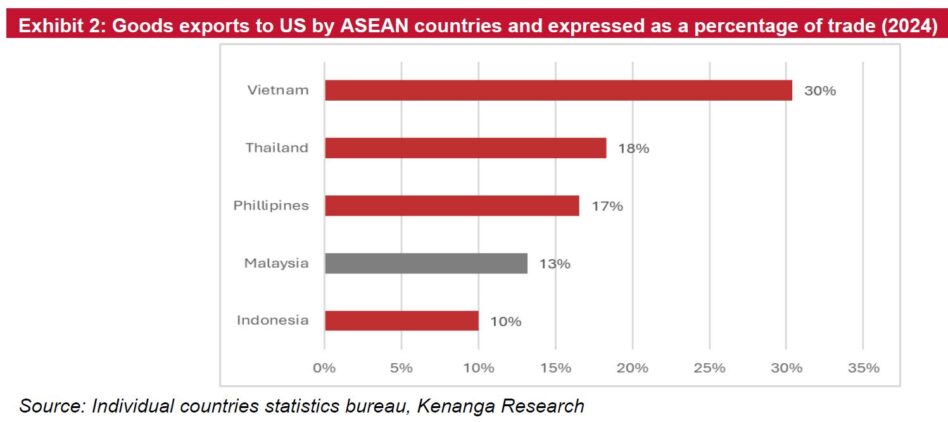

“Indeed, within ASEAN countries the pressure to negotiate for a good deal might also be lesser for Malaysia if we go by the grounds of how much each individual country is dependent on the US as an export destination,” said Kenanga.

Using goods exports to the US as a percentage of total exports for 2024, Indonesia is most insulated at 10%, while Vietnam is more dependent at 30%. Malaysia is closer to the former at 13%. —Mar 19, 2025

Main image: Autovista24