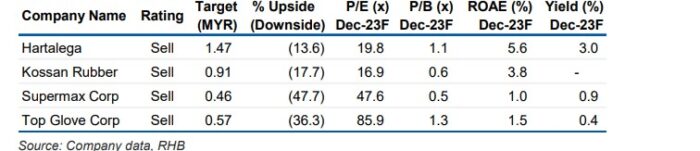

DESPITE obvious stock price recovery of the very much battered Big Four glove makers in recent times – thanks in part to a spike in China’s COVID-19 cases – RHB Research continues to foresee lack of near-term re-rating catalysts that is compounded by persisting imbalances in the demand-supply dynamics and stubbornly elevated costs.

Even as the pace of average selling price (ASP) softness could moderate in the near term post market consolidation, the research house reckoned that the sub-optimal industry utilisation will continue to be a drag on glove players’ margins before we can see a gradual pick-up in demand.

The industry’s ASP is currently at circa US$20-US$22 per 1,000 pieces which is similar to levels recorded prior to the COVID-19 pandemic.

“The quarter-on-quarter (qoq) decline in ASPs in 3Q 2022 has eased to a low single digit which suggests that ASPs may have bottomed already,” observed analyst Oong Chun Sung in a rubber product sector update who nevertheless cautioned about the impending price war from Chinese peers.

“The latest 3Q 2022 results from China’s glove makers may suggest the current ASP level could be deemed unsustainable in the long run following both Intco Medical Technology and Shandong Blue Sail Plastic & Rubber reporting operating losses.”

Demand-wise, RHB Research has gathered that industry players are still unable to ascertain the timing of de-stocking activities from their glove distributors.

“Under a bull case scenario, we expect such distributors’ inventory levels to normalise by 1H 2023 after taking into consideration the six to nine-month normalisation period from our last update in late September,” projected the research house.

“That said, our recent takeaways from the results briefings suggest an absence of re-stocking activities from the distributor front – as such, our assumption for 1H 2023 inventory normalisation stands. We keep our 2022 year-end demand outlook at 399 billion pieces follow by a 4% increase in 2023.”

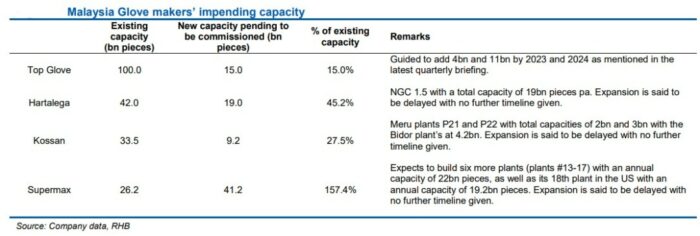

On the supply side, RHB Research said it makes no changes to its assumption of 429 billion pieces by 2022.

“To-date, no new capacity has been added so far as Malaysia’s Top-Four producers have collectively postponed the commissioning of their new production lines until 2023 – taking into account the current low industry utilisation rate of 50%,” revealed the research house.

“That said, we observed a similar trend for the Chinese producers as well – both Intco and Blue Sail have constantly been running utilisation rates of <50%.”

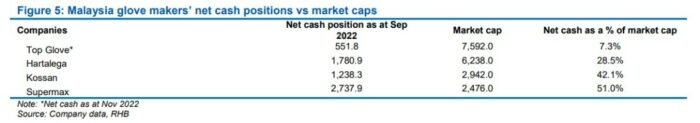

All-in-all, RHB Research which maintained its “underweight” outlook on its rubber product sector expects demand to only pick up by 2H 2023 under its bull case scenario.

“Our recent takeaways from the results briefings still suggest the absence of re-stocking activities from glove distributors,” warned the research house.

“Cost pass-through mechanisms also remain challenging at the moment. That said, we expect the recent run-up in valuation to pose further downside risks to the glove makers following the year-end FBM KLCI reconstitution.” – Dec 29, 2022