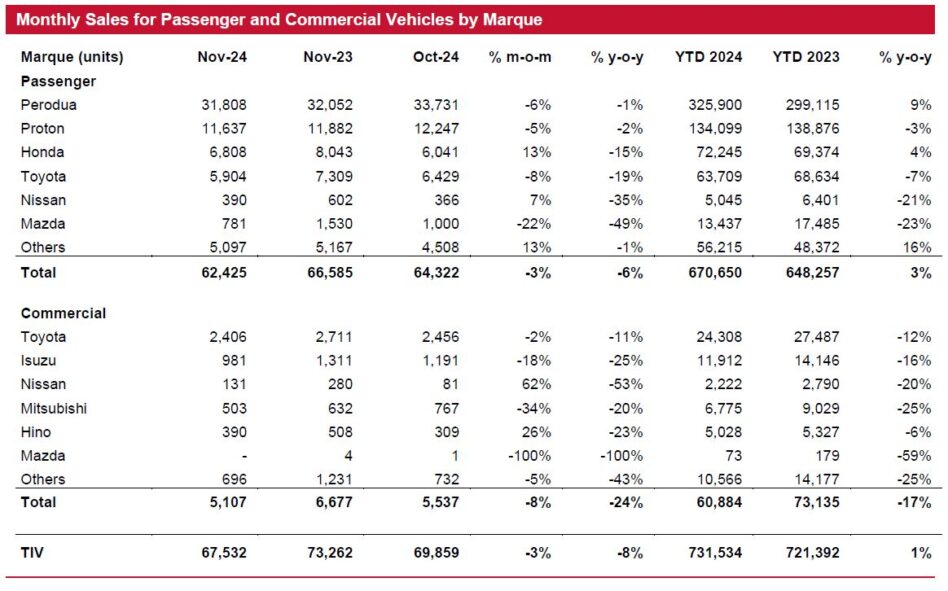

TOTAL industry volume (TIV) fell 3% month-on-month (MoM) to 67,532 units in November 2024 as consumers are waiting to maximise savings from the year-end promotion.

These incentives which typically offers the biggest discounts in December (typically, the month of December alone makes up 9−10% of annual TIV).

“With the 11 months of calendar year 2024 (11MCY24) TIV making up 91% of our full-year projection of 800K units, we consider the number meeting our expectation,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Kenanga’s CY24 forecast of new vehicle sales in Malaysia, or total industry volume that was maintained at 800K units is proving to be unaggressive, as the Malaysia Automotive Association (MAA) had also in November revised upwards its target to this level.

Looking ahead, Kenanga believes December 2024 TIV will be higher than November 2024 TIV driven by year-end promotional campaigns as automakers rush to clear this year’s inventories.

A detailed analysis of the passenger vehicle segment in November 2024 at 62,425 units are as follows:

Overall, passenger vehicles segment fell month-on-month (MoM) as consumers are waiting to maximise savings from the year-end promotion which typically offers the biggest discounts in December.

A two-speed automotive market locally is being played out as expected in CY24 and will persist in CY25.

It will be business as usual for the affordable segment as its target customers, that is the B40 and lower tier M40, will be spared the impact of the impending fuel subsidy rationalisation and could also potentially benefit from the introduction of the progressive wage model.

The pay rise for most civil servants (top management will receive a 7% rise, while those in professional and executive roles see a rise of 15%) in Dec 2024 will also partially restore their spending power eroded by high inflation.

However, the same cannot be said for the premium segment as its target customers, that is the upper tier M40 and T15 may hold back from buying a new car, or they may down trade to a smaller car or switch to an EV to cut their fuel bills upon the introduction of fuel subsidy rationalisation.

The implementation of e-invoicing is having lesser impact to car sales than we initially believed. Automakers are racing to provide discounts and rebates to ensure sustained demand and lessen the impact of e-invoicing on consumer sentiment.

E-invoicing essentially will cease the common practice of providing 100% hire purchase financing, circumventing the Hire Purchase Act 1967 whereby customers are required to make a minimum down payment of 10%.

In general, the industry’s earnings visibility is still good, backed by a booking backlog of 150K units as at end-November 2024.

More than half of the backlog is made up of new models, alluding to the appeal of new models to car buyers. This trend is likely to persist in CY25 given a strong line-up of new launches.

More battery electric vehicles (BEVs) in the market. Vehicle sales will also be supported by new BEVs that enjoy SST exemption and other EV facilities incentives up until CY25 for complete built up (CBU) and CY27 for complete knockdown (CKD).

The new registration for BEVs leapt from 274 units in CY21 to over 3,400 units in CY22, 10,159 units in CY23, and almost 16,000 units for 9MCY24 (based on the Ministry of Transport’s press release), or 3% of TIV.

“We expect more favourable incentives from the government which has set a national target for EVs and hybrid vehicles of 15% of TIV by CY30 and 38% by CY40,” said Kenanga.

Meanwhile, the government will speed up the approval for charging stations.

The number of proposed charging stations currently stands at 4,225 (3,354 built to date) should more than double to 10,000 by end-CY25. —Dec 20, 2024

Main image: Reuters