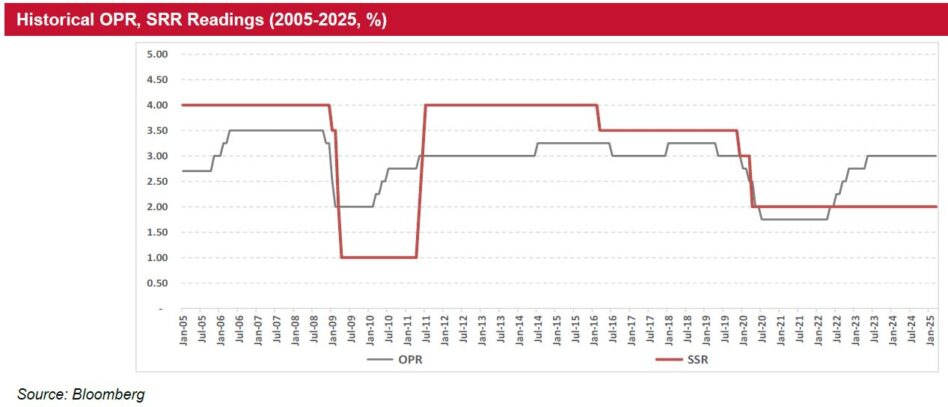

OVERALL, Kenanga Research (Kenanga) was surprised by Bank Negara Malaysia (BNM)’s move to cut the statutory reserve requirement (SRR) by 100 basis points (bps) to 1% from 2%, effective 16 May 2025.

Notably, the previous time in which the SRR was lowered to 1% was in Mar 2009 post the 2008 Global Financial Crisis, while the last notable cut occurred in Feb 2020 just before the implementation of pandemic movement control orders.

“BNM cites downside risk to growth, but we do not see the current move alludes to strong economic pressures ahead, as this would otherwise be accompanied by an overnight policy rate (OPR) cut, as it did in the past,” said Kenanga.

By lowering the SRR, BNM could release RM19 bil into the economy. As the deposits that banks place with BNM for SRR purposes are not interest bearing, the RM19 bil of liquidity if assumed lent out at an average yield of 5.06%, would improve bank’s net interest margin by an estimated 3-4 bps.

That said, the added liquidity could give a better allowance with the bank’s funding strategies as deposit competition is still present, though now more focused on shorter-term fixed deposits.

“We also do not anticipate the liquidity concerns in the near-term, as banks continue to appear willing to be selective with their loan approvals, citing a need to keep profitability and asset quality in check over volumes, and amid a relatively strong MYR,” said Kenanga.

The research house believes industry readings may exhibit mixed signals, fuelled by uncertainties surrounding trade policies.

It opines that investors anticipate a stronger second half of 2025, where it anticipates better loan growth to stay supported by foreign investment to spur gross domestic product as well as inflation to stay well-contained.

“While we expect OPR to remain stable at 3%, our recently conducted sensitivity analysis reflects a moderate impact of 1%-3% lower earnings with every 25 bps cut,” said Kenanga. —May 9, 2025

Main image: Wikipedia