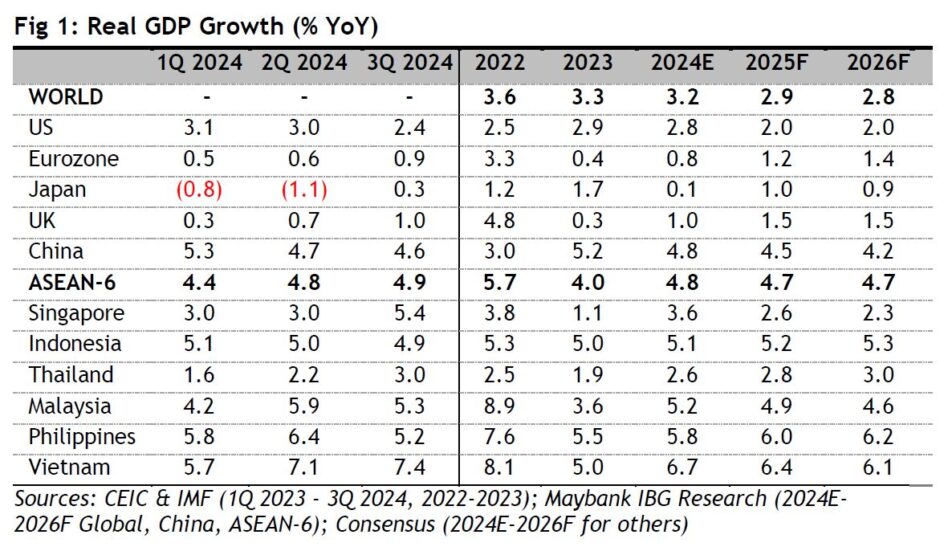

MAYBANK in a recent report said 2024 saw a stronger ASEAN gross domestic product (GDP) growth of +4.8% compared to +4% last year.

This is on the back of manufacturing and exports recovery, particularly those of electronics, from their slump in the previous year.

Robust US growth supported global demand, cushioning weaker China and EU growth.

But ASEAN’s performance was uneven. GDP surprised to the upside in Vietnam (+6.7%), Malaysia (+5.2%) and Singapore (+3.6%), but fell short of expectations in Thailand (+2.6%) and the Philippines (+5.8%). Indonesia’s growth (+5.1%) came in line.

Green shoots in electronic exports benefited the more trade-sensitive ASEAN economies, particularly Vietnam, Singapore and Malaysia.

Consumers remained cautious in the larger domestic-driven economies of Indonesia and the Philippines, and are still healing from the pandemic stresses and twin shocks of higher inflation and interest rates.

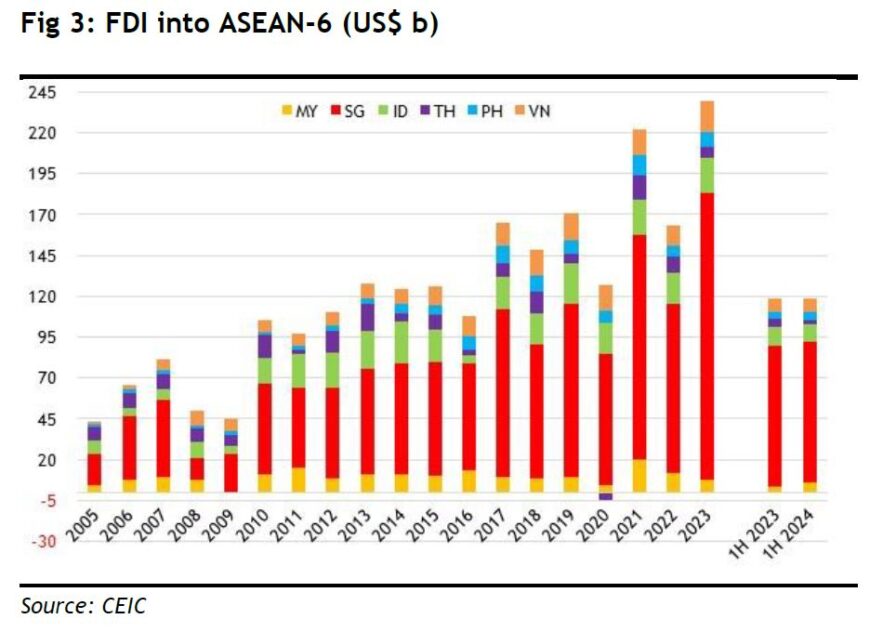

Global manufacturing supply chains continued to shift to ASEAN, with rising foreign direct investment (FDI) benefiting Vietnam, Malaysia and Indonesia, but remaining elusive in Thailand.

ASEAN stock markets reflected the macro divergence, with Singapore, Malaysia and Vietnam markets outperforming while Thailand, Philippines and Indonesia lagged.

Going into 2025, the outlook for ASEAN is clouded by President-elect Trump’s radical policy shifts and a looming global trade war.

“We forecast ASEAN-6 GDP growth remaining resilient at +4.7% in both 2025 and 2026. Easing monetary conditions, rising FDI and a consumer recovery in the second half of 2025 will cushion the shock from Trump’s trade measures,” said Maybank.

Several ASEAN central banks will continue easing in 2025, including the Philippines, Indonesia and Singapore.

Additional tariffs on China will widen the tariff divide with ASEAN and accelerate the shifts in global supply chains.

FDI will likely strengthen and spread more evenly across ASEAN, including to Thailand and Philippines. Singapore is on the cusp of a building boom.

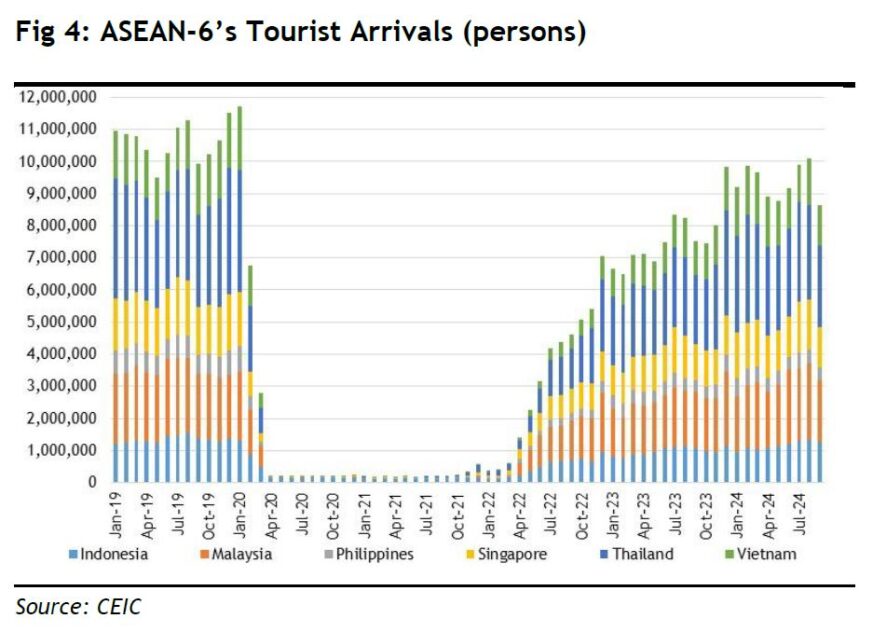

Malaysia is seeing an investment up cycle wave. Other non-trade growth engines which are tourism, data centres and ASEAN economic integration, remain intact and will support growth.

2025 will see a broader and more intense global trade war, but ASEAN will likely not be a priority and direct target.

Trump will focus on the purging of the “deep state” from the arms of the US government; deporting illegal immigrants; firing the opening salvo of tariffs on Mexico, Canada and China; and rolling back Biden’s executive orders, including the LNG export ban and prohibitions on drilling.

His proposed tariff hikes on the three largest US trading partners will cover about US$1.3 tril or 43% of total US imports.

Digesting the impact and negotiating on his demands will take a toll on Trump’s bandwidth and resources.

Southeast Asia will likely be spared from his tariff tantrums, at least in the first year of his second term of Make America Great Again.

China will unveil more monetary and fiscal stimulus to backstop growth and cushion the impact from Trump’s tariffs.

“In 2024, our wildcard, a Trump election victory, materialised and ushered in a more uncertain world. In 2025, our first wildcard would be Trump targeting specific ASEAN countries, because of widening bilateral trade surpluses, currency manipulation, undermining the dollar’s reserve status or being too close to China,” said Maybank.

Vietnam appears more vulnerable given its ballooning trade surplus with the US and is on the US Treasury “currency manipulation” watch list.

A second wildcard is America revoking China’s Most Favoured Nation or Permanent Normal Trade Relations status, widely seen as a “nuclear” trade option, triggering a sharp yuan devaluation and severe blow to the global trading system. Pray these two wildcards do not materialise in 2025. —Dec 13, 2024

Main image: globaltimes.cn