WHILE non-cash payments are not entirely new before the onslaught of the COVID-19 pandemic, the coronavirus has certainly been a great accelerator.

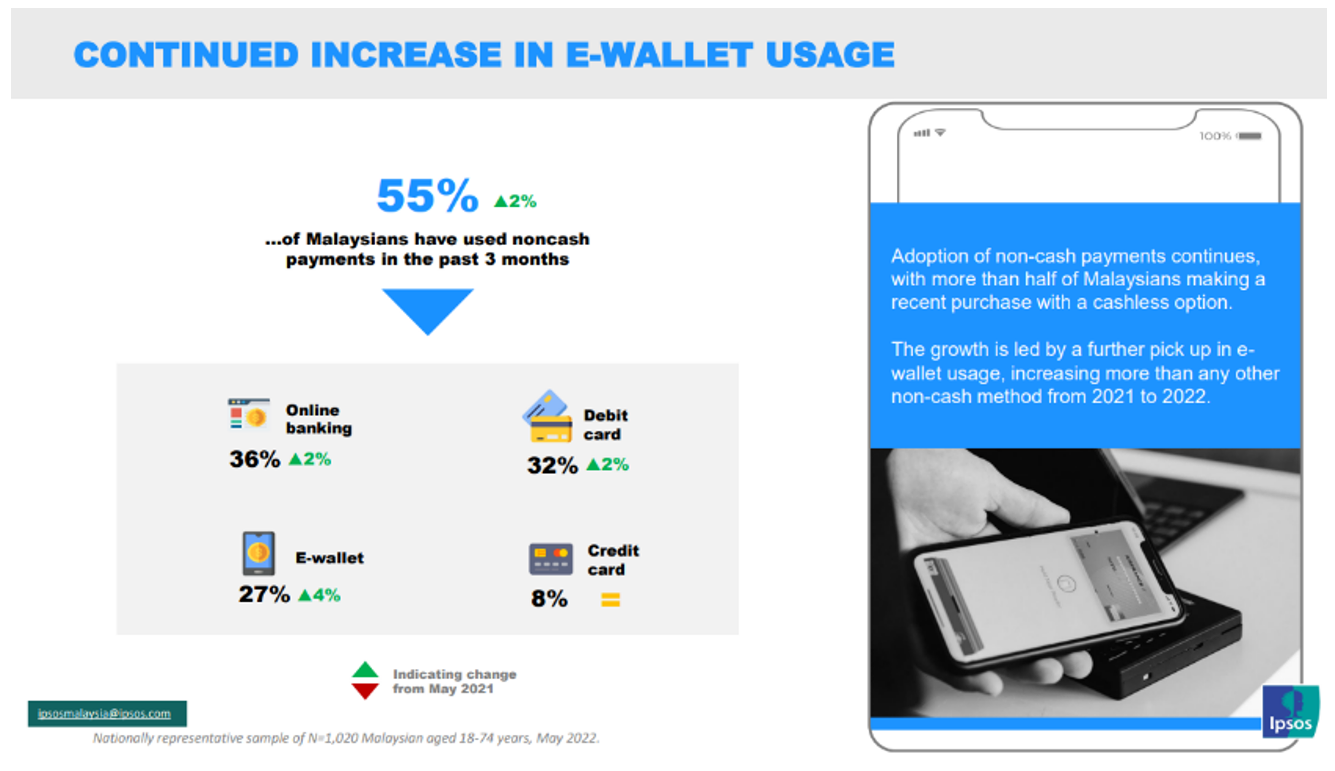

This is evident in an Ipsos Malaysia study, which found that more than half of Malaysians have used non-cash payments in the past three months.

The growth is led by a further pick-up in e-wallet usage, increasing more than any other non-cash method from 2021 to 2022.

The study further indicated that as ‘touchless’ interaction became an integral part of social distancing, more than half of Malaysians now have an average of two non-cash payment modes at their disposal.

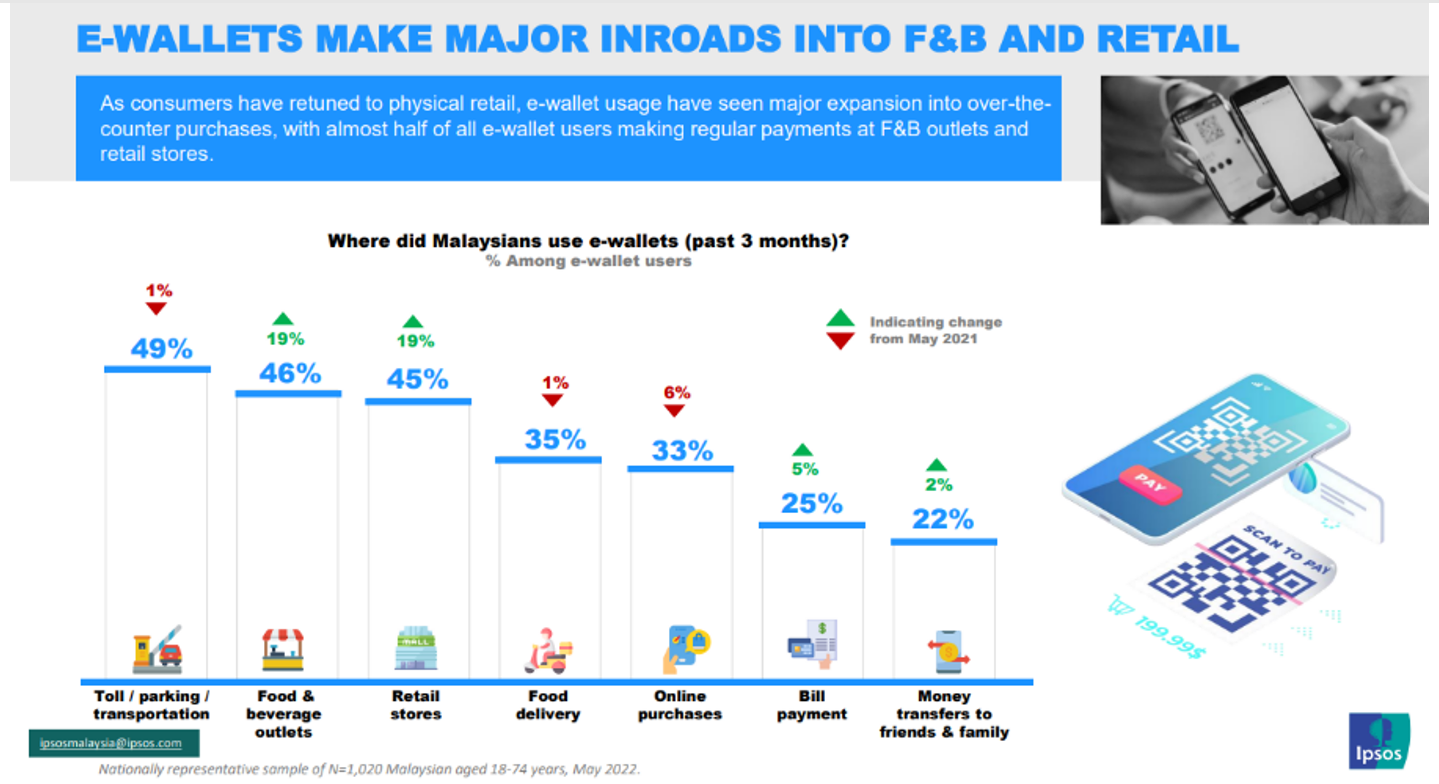

E-wallets, a relatively new entrant over the last two years, has successfully reached more than a quarter of Malaysians and are quickly becoming all-purpose payment methods – over the past year, there’s been significant growth in e-wallet usage for over-the-counter purchases.

In 2022, the continued growth in usage is driven by physical food and beverages (F&B) and retail as Malaysians are out and about again, with both segments seeing a 19% increase.

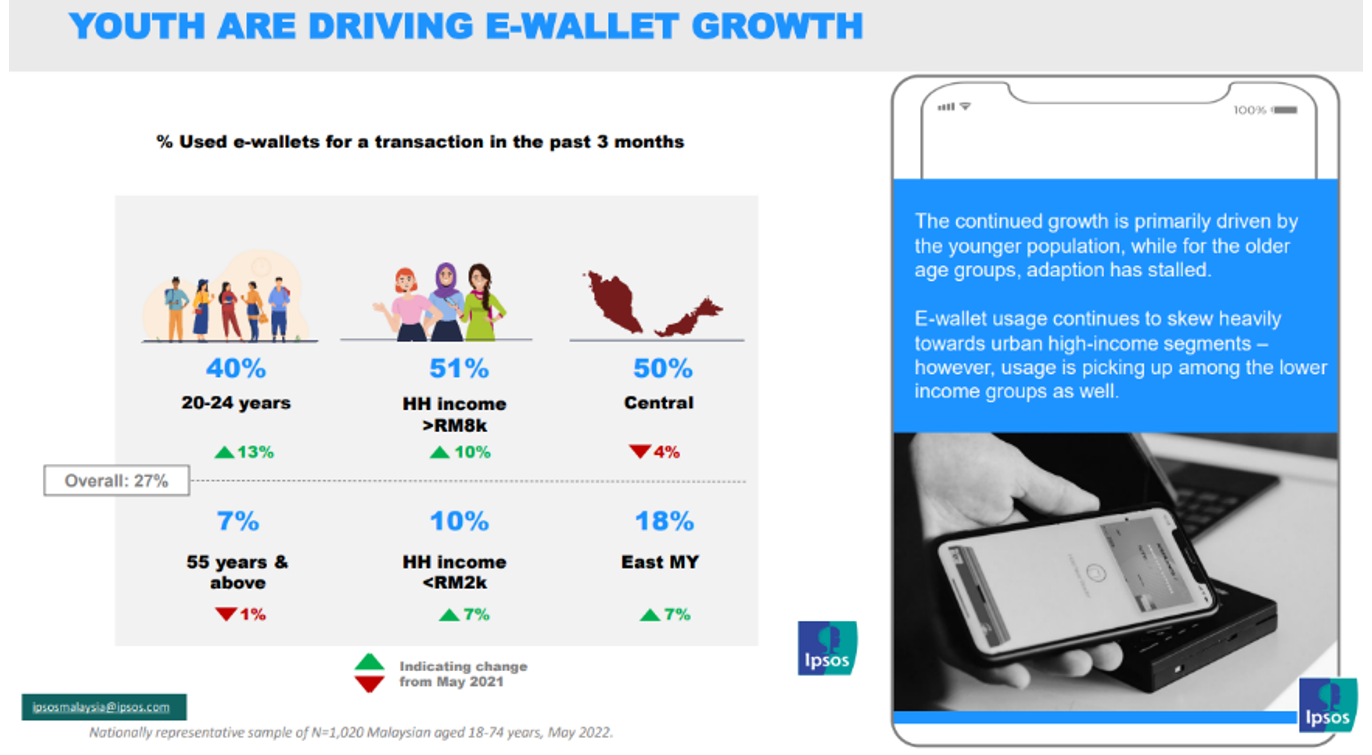

Meanwhile, the continued growth of e-wallet adoption is primarily driven by the younger population (20-24 years) while for the older population, the growth appears to have topped out.

“Furthermore, e-wallets continue to be more common in the more urban and affluent segments,” noted Ipsos Public Affairs associate director Lars Erik Lie.

“As e-wallet payment becomes viable across channels, there’s an indication that consumers are finding their favourite and sticking with it.” – July 22, 2022