FOREIGN investors remained net buyers on Bursa Malaysia for the fourth consecutive week with purchases amounting to RM873.9 mil which overturned the year-to-date (YTD) Bursa Malaysia’s foreign outflows into a net inflow of RM4.9 mil.

The sustained interest in the local bourse may stem from economic optimism as recent data revealed a +4.2% year-on-year (yoy) rise in gross domestic product (GDP) for the 1Q CY2024 period, according to MIDF Research.

“This exceeded both the +3.9% growth forecast by a Reuters poll and the advance estimates released by the government,” the research house pointed out in its weekly fund flow report.

Foreign funds were net buyers in Malaysia throughout last week with the highest amount being posted on Wednesday (May 15) with a net inflow of RM299.98 mil.

“This was a start of strong net buying by foreign funds as subsequent days saw a net inflow of more than RM100 mil every session – Thursday (May 16) at RM269. 2mil and Friday (May 17) at RM184.3 mil,” observed MIDF Research.

The sectors with the highest net foreign inflows were transportation & logistics (RM223.6 mil), utilities (RM189.1 mil) and healthcare (RM183.3 mil) while the two sectors with net foreign outflows were plantation (-RM64.7 mil) and construction (-RM6.7 mil).

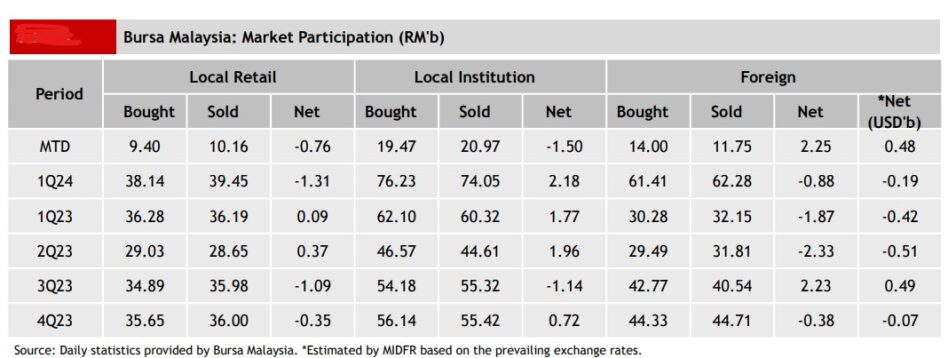

On the contrary, local institutions continued their net selling streak for the third week in a row at -RM379.7 mil while local retailers persisted in divesting domestic equities amounting to -RM494.1 mil for the 10tth week in a row.

In terms of participation, the average daily trading volume (ADTV) increased for local retailers (+27.1%), local institutions (+18.0%) and foreign investors (+8.5%).

In comparison with another four Southeast Asian markets tracked by MIDF Research, foreign funds re-entered the Thai equities market after two weeks of net selling by mopping up US$143.1 mil net worth of equities last week.

In the Philippines, foreign investors also resumed their role as net buyers last week with purchases amounting to US$50.5 mil.

However, Indonesia experienced the eighth consecutive week of net foreign outflow of -US$94.5 mil followed by Vietnam’s which streak of net foreign outflows has extended into the 11th consecutive week with an outflow -US$84.4 mil last week.

The top three stocks with the highest net money inflow from foreign investors last week were Malaysia Airports Holdings Bhd (RM170.7 mil), Hartalega Holdings Bhd (RM120.6 mil) and CIMB Group Holdings Bhd (RM114.7 mil). – May 20, 2024