WHILE the recent floods will not have a long-term influence on the country’s gross domestic product (GDP) growth which is expected to be between 3% and 4% in 2021, it will nevertheless have a short-term impact on key sectors of the Malaysian economy.

In its assessment of the flood’s impact on the economy and growth prospects, TA Securities Research noted that previous incidents of major flooding had an “adverse” influence on selected key economic variables “in the short run”.

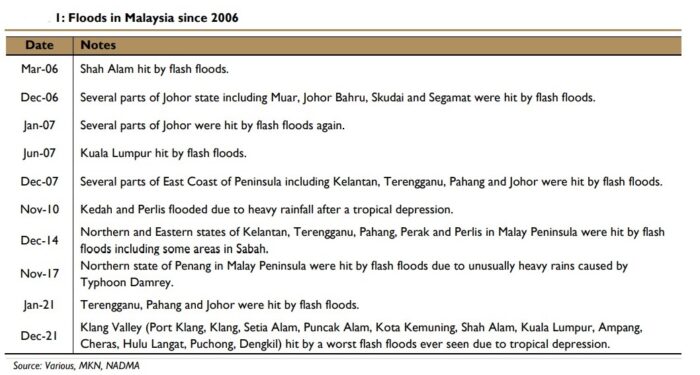

Based on flood occurrences between March 2006 and December 2021, the research house observed that flood shocks tend to negatively impact GDP growth rates with a lower average growth of 0.7% quarter-quarter (qoq) during the flooding period compared with 2.2% qoq in prior period.

“Moreover, the GDP declined further in the next period by an average of -0.6% qoq,” economist Farid Burhanuddin pointed out in flood impact quick assessment report.

The agriculture sector which was most affected contracted by an average of 6.1% qoq in the flooding period compared to a growth of 2.1% qoq in the preceding period.

Performance of the construction sector during flooding period declined by an average of 0.5% qoq while the services and manufacturing sectors registered a slower growth of 1.9% qoq and 0.3% qoq respectively.

Other macroeconomic impacts of floods were reflected in lower exports, muted industrial output and high inflationary pressure.

According to Minister in the Prime Minister’s Department (Economic Affairs) Datuk Seri Mustapa Mohamed, the floods that wreaked havoc across Malaysia last December cost the country between RM5.3 bil and RM6.5 bil in damages

In tandem, the Finance Ministry said the disaster could result in an estimated RM4 bil to RM8 bil reduction in the economic sector’s production value.

Elsewhere, shocks caused by floods also have detrimental effect on the FBM KLCI and ringgit, according to TA Securities Research.

The FBM KLCI index grew marginally by an average of 0.40% month-on-month (mom) during the flood event period compared with 1.98% mom increase in the period before.

‘On top of that, we can conclude that the stock market reacted faster after the flood events as it continued to increase at a more rapid pace of 2.71% mom given that the stock market responds instantly to the news (good or bad) compared to macroeconomics indicators.”

However, the floods negatively affected the ringgit which posted a lower average gain of 0.21% during the period. Nonetheless, it climbed by an average of 0.51% mom after a month. – Jan 21, 2022