MAIN market listed property developer Tanco Holdings Bhd has staged a turnaround to return to the black with a net profit of RM11.77 mil in its 2Q FY2023 ended June 30, 2023 from a net loss of RM2.83 mil in the corresponding quarter a year ago.

The earnings recovery was mainly due to the higher revenue generated from its property development and construction segment.

During the period under review, the group’s revenue jumped by more than 28 times to RM29.72 mil from RM1.04 mil in 2Q FY2022. The turnaround represents a significant milestone for the group as it returned to a quarterly profit for the first time since June 2018.

The earnings recovery was in line with the re-opening of the Malaysian economy, according to Tanco’s managing director Datuk Seri Andrew Tan Jun Suan.

“While the COVID-19 pandemic presented an unprecedented challenge to the group, the defensive strategy adopted by the management has allowed Tanco to emerge relatively unscathed from the pandemic,” he commented.

“This has put the group in a good position to resume its property development and construction works swiftly and benefit from the resurgence of the economy.”

Added Tan: “Going forward, we will leverage our unique positioning, project management capabilities and customer-centric approach to capitalise on the economy’s resurgence. As we move forward in the post-COVID era, we believe it is the right time for us to expand and grow more aggressively.”

Tanco had previously strengthened its balance sheet by trimming off some of its lacklustre assets in timeshare, resorts and leisure industries (including local and oversea resorts).

Such strategy has allowed the group to focus on its core property development and construction business as well as other businesses that have strong earnings visibility and recurring income.

In line with the stronger financial performance during the quarter, Tanco also managed to return to black in its 1H FY2023 ending Dec 31, 2023 with a net profit of RM10.5 mil from a net loss of RM5.31 mil during the same period a year ago. Revenue for its 1H FY2023 also jumped by multi-fold to RM51.03 mil from RM1.71 mil posted in 1H FY2022.

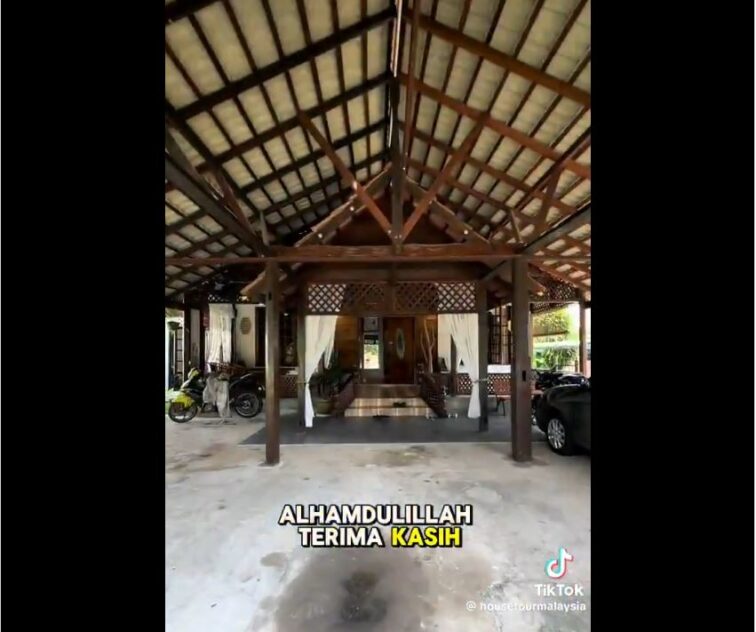

Currently, Tanco is in the midst of completing its property development project for the Block 2 Service suites in Splash Park, a development project in Dickson Bay that boasts a gross development value (GDV) of RM147 mil. To date, about 70% of the development has been sold, indicating a strong revival in the property market.

Aside from that, Tanco also owns tracts of landbank for development which will allow the group to expand aggressively. As the landbanks are without any borrowings, this will be a boost to Tanco’s profit margin from its upcoming property development project as the group does not need to service bank loans for all its development land.

Going forward, the recovery in the construction sector is also expected to continue with Tanco able to leverage its construction segment to gain access to building materials and credit lines from suppliers.

This synergy will boost the group’s profitability even as it takes on a more aggressive expansion strategy going forward, including diversification into other growth pillars.

At the close of today’s trading, Tanco was down 0.5 sen or 1.11% to 44.5 sen with 12.42 million shares traded, thus valuing the company at RM826 mil. – Feb 22, 2023