STEEL prices saw a brief uptick following the US tariff announcement, but the impact is limited as China, the world’s largest steel consumer continues to dictate global pricing.

Chinese exports to the US are small and largely consist of high-value processed goods that already command premium prices.

The pattern mirrors 2018, when prices spiked briefly post-tariff but slumped soon after as exemptions were granted.

Aluminium prices fluctuated between USD2,300/MT and USD2,500/MT over the past three months, despite expectations of sustained strength driven by unexpectedly strong consumption in China earlier in 2024.

That said, the US 25% additional tariff on aluminium imports globally introduces short-term market uncertainty.

The tariff will raise costs for US buyers and could prompt main exporters to the US, such as Canada and Mexico, to redirect shipments to other markets like the EU.

However, the impact on China is likely minimal, as 80%-90% of its aluminium production is consumed domestically.

In the medium-term, the market is expected to adjust through trade diversions or production cut to maintain demand-supply balance.

“As such, we maintain our view that China’s demand rebound remains the key driver of aluminium prices going forward,” said Kenanga.

We retain our average aluminium price assumptions at USD2,450/MT for 2025 and USD2,550/MT for 2026.

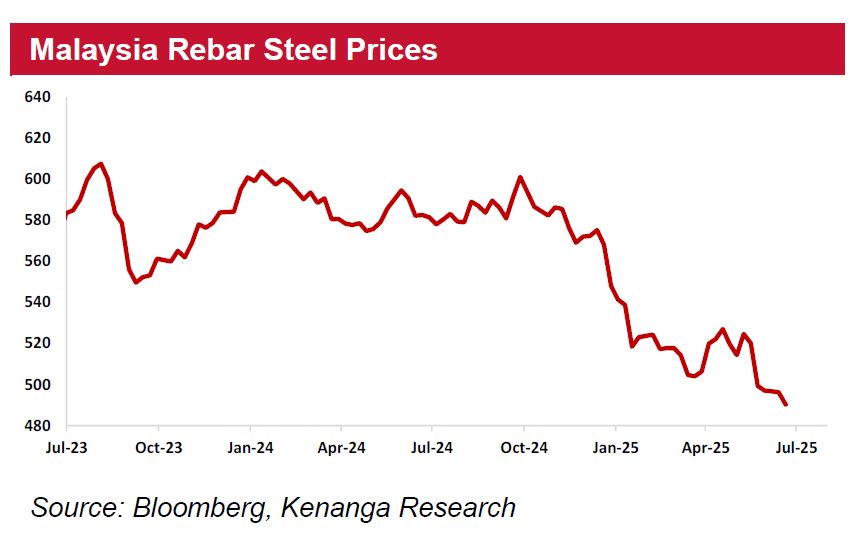

China’s steel demand is poised for modest growth in 2025 after years of stagnation, supported by a stabilising property market, government stimulus, and improving consumer sentiment.

A potential RMB4.4t in local government bond issuance could supercharge infrastructure spending, while property stabilisation is now a national priority.

Weak profitability has already triggered production cuts in China, pushing struggling steel producers toward consolidation.

If capacity limits are enforced, higher utilisation rates could lift steel prices. With current prices hovering near historical lows, the setup is in place for a potential rebound.

The silver lining is that more stable steel prices translate to steadier input costs for steel product players like ENGTEX and ULICORP (OP; TP: RM1.83), reducing earnings volatility.

A new water tariff sub-category for data centres may take effect soon with rates estimated at RM5.50/m3 according to SPAN.

The sentiment towards water-related stocks has significantly improved since last year backed by ongoing tariff adjustments and gradual progress in water infrastructure development.

Malaysia’s data centre boom is putting pressure on water supply, with reserve margins stuck at 15%—well below the 25% target.

The tariff hike is expected to inject fresh capital into water operators, accelerating capex and placing ENGTEX in a strong position to benefit from a likely ramp-up in pipe replacement orders starting next year.

Encouragingly, there have been several positive developments, including: (i) PBA (Not Rated) planning to complete three water pipeline projects worth RM189 mil over the next two years, (ii) PAAB building two new water treatment plants in Seberang Perai worth RM1 bil, and (iii) Sarawak’s allocation of RM1.08 bil for water pipe upgrades.

Several mega infrastructure projects are set to be rolled out in CY25, including: (i) Sungai Perak Raw Water Transfer Scheme to Penang (SPRWTS), (ii) Langat 2 water treatment plant, and (iii) Sungai Rasau phase 2.

Based on our estimates, the total value of the water pipe components for these projects is approximately RM1.1 bil. —July 4, 2025

Main image: Outbuild