WHILE the construction sector is domestic oriented thus insulated from direct impact, the far reaching nature of the tariffs, if prolonged, elevates potential second order risks.

Not immune to this, the KLCON Index has fallen by – 4.3% since Liberation Day exacerbating year-to-date (YTD) performance following the Diffusion Rule sell down.

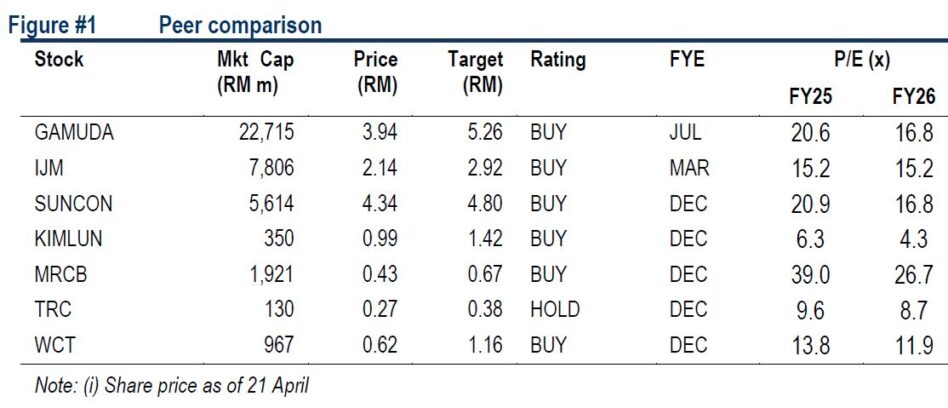

“On the whole, we think that elevated risk premium and negative wealth effects necessitate adjustment to our valuations,” said Hong Leong Investment Bank (HLIB) in the recent Sector Update report.

In HLIB’s view, the on/off nature of tariffs could result in deferment of investment decisions affecting the flow of industrial jobs.

Channel checks indicate that some investors might scale back investment or expansion during this period of uncertainty adopting a wait-and-see approach.

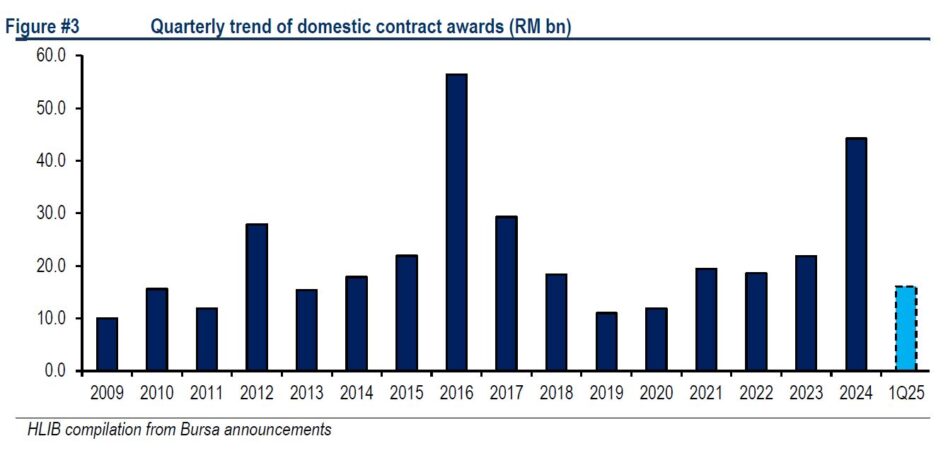

In recent years (2022-24), buoyed by ever increasing approved FDI, industrial jobs have consistently contributed 9-12% of annual contracts.

Several noteworthy contracts in the past include:

(i) factory construction for Texas Instruments – RM1.45 bil

(ii) semiconductor facility for SPIL – RM378 mil

(iii) logistics hub in Shah Alam – RM1.45 bil

Despite facing a bleaker picture in the near term, HLIB takes comfort in the sector’s low reliance on this segment for orderbook replenishment.

Tender opportunities have been coming thick and fast this year unimpeded by AI Diffusion rules, Deep Seek fears and global trade uncertainties.

HLIB anticipates that DC contracts could start trickling in from quarter two (2Q) onwards with awards for larger contract sizes possibly towards second half (2H), factoring for evaluation period. Encouragingly, a number of power infra contracts have materialised in this year.

“Overall the situation looks sunny now, however we do note that risks of DC capital expenditure pullback during periods of economic downturn remains,” said HLIB.

Heading towards an uncertain external environment, the government may bolster domestic oriented sectors like construction to offset external weakness.

The construction sector offers the highest “bang for the buck”, boasting the highest GDP multiplier of more than two times due to its array of economic linkages, manufacturing, logistics, labour, financing and others.

Already, the government has pivoted towards incorporating PFI elements into railway projects. Additionally, under Budget-25 projects worth RM9 bil is to be delivered under the PFI model.

“We reckon these projects could benefit from more rollout urgency,” said HLIB.

In this sustaining trend on private sector reliance for infra projects, we expect big caps with sizable balance sheets to thrive under such circumstances.

Construction companies with big balance sheet space stand to benefit under this regime.

On balance, HLIB retains their overweight sector call following the steep sell down as they still anticipate another year of healthy job flows, anchored by infra and DC projects leading to further order book growth opportunities. —Apr 22, 2025

Main image: Liga Asuransi