ACCORDING to various sources, India-based Tata Electronics, one of the world’s leading integrated semiconductor players, is eyeing a footprint in Malaysia by acquiring a fabrication or outsourced semiconductor assembly and test (OSAT) plant in the country.

Ongoing discussions are reportedly being held with potential targets, including Sarawak-based X-Fab, DNex’s SilTerra Malaysia, and Globetronics Technology.

“If successful, we believe this could potentially revitalise Malaysia’s technology sector by enhancing the country’s global market share in chip packaging, assembly, and testing services,” said Public Investment Bank (PIB) in the recent Sector Update Report.

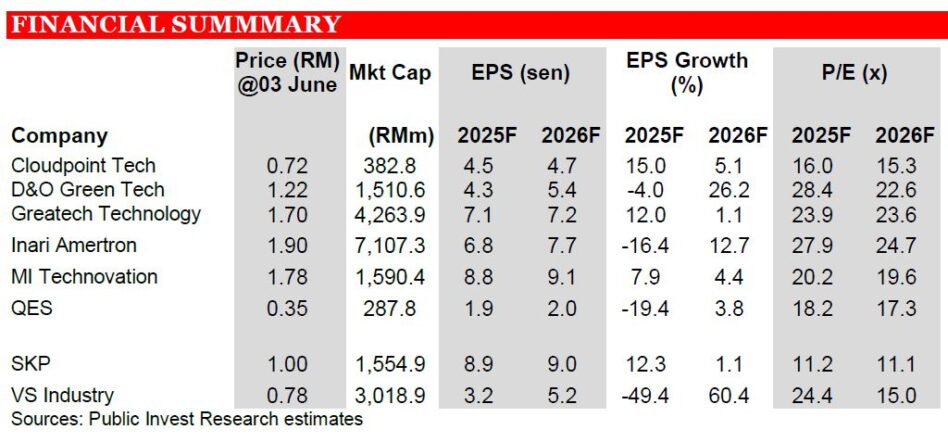

PIB maintains their Overweight rating on the sector, with Cloudpoint Technology and MI Technovation as our top picks.

Tata Electronics, a wholly-owned subsidiary of Tata Sons, has strong capabilities in:

i) Electronics manufacturing services.

ii) Semiconductor assembly and test.

iii) Semiconductor foundry.

iv) Design services.

Amid recent US tariff changes, the company plays an increasingly important role in Apple’s iPhone supply chain, as both a major assembler and component manufacturer, and is emerging as a key competitor to Taiwan’s Foxconn.

Apple is positioning India as an alternative manufacturing base to China, as tensions between the US and China escalate.

According to Counterpoint estimates, India now accounts for about 18% of global iPhone production, while China dominates with 75%.

KC Ang, who was appointed President of Tata Semiconductor Manufacturing in April this year, is leading the acquisition initiatives.

He previously spent around four years as Vice President of Operations at SilTerra Malaysia.

“Based on our understanding, discussions with various Malaysian players have been ongoing since April. The potential acquisitions would allow Tata to tap into Malaysia’s mature ecosystem and deep expertise in assembly, testing, and advanced packaging,” said PIB.

This move would also help Tata Electronics mitigate risks associated with current semiconductor tariffs and provide a diversified platform to serve a broader global customer base.

PIB believes companies like Globetronics Technology and DNeX’s 60%-owned SilTerra could present attractive acquisition targets due to their relatively low entry costs. —June 4, 2025

Main image: The Irish Independent